On June 17, 2025, analyst Oliver Wintermantel from Evercore ISI Group provided an update on the stock of Williams-Sonoma (WSM, Financial). The firm's rating on Williams-Sonoma was maintained at "In-Line," indicating a steadiness in the company's market standing based on their evaluation.

However, the price target for Williams-Sonoma (WSM, Financial) was adjusted. The new price target has been set at USD 170.00, down from the previous target of USD 175.00. This adjustment reflects a percentage change of -2.86% from the prior price target.

The analyst actions highlight the firm's current market assessment and price expectations for Williams-Sonoma (WSM, Financial) as they navigate the retail landscape. Investors and stakeholders are advised to consider this updated price target in their decision-making processes.

Wall Street Analysts Forecast

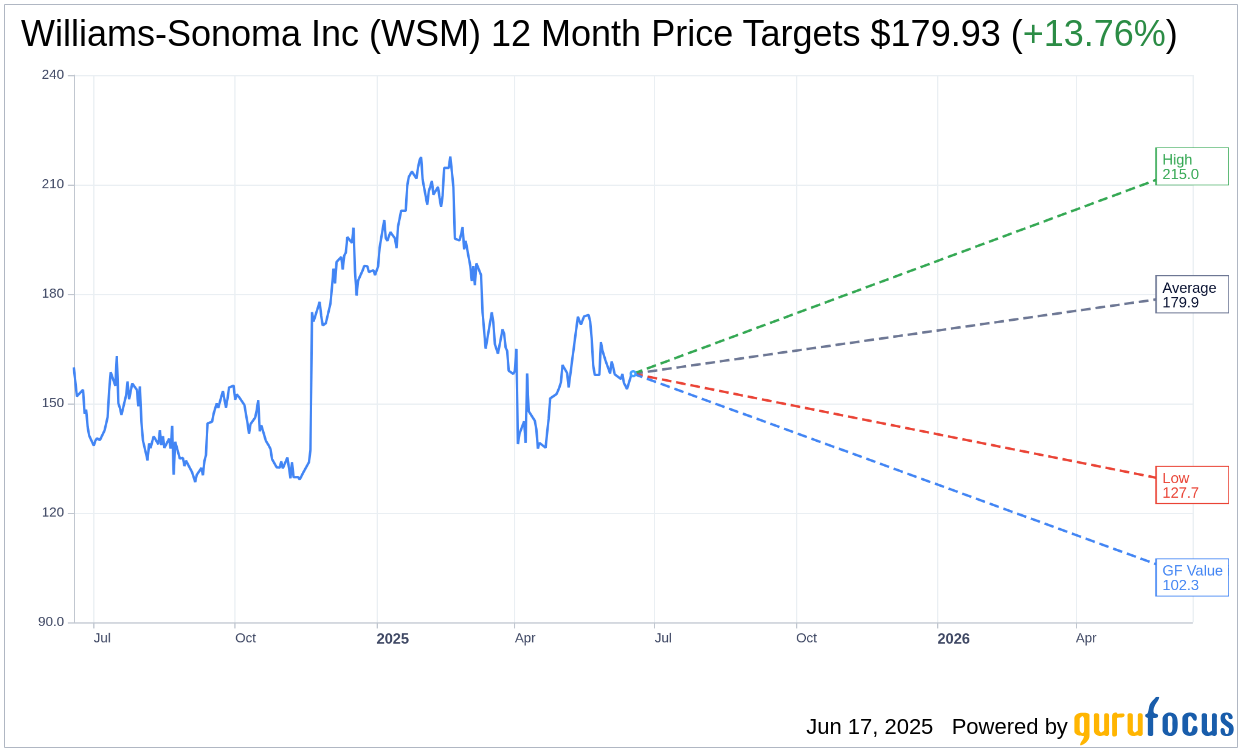

Based on the one-year price targets offered by 18 analysts, the average target price for Williams-Sonoma Inc (WSM, Financial) is $179.93 with a high estimate of $215.00 and a low estimate of $127.67. The average target implies an upside of 13.76% from the current price of $158.16. More detailed estimate data can be found on the Williams-Sonoma Inc (WSM) Forecast page.

Based on the consensus recommendation from 24 brokerage firms, Williams-Sonoma Inc's (WSM, Financial) average brokerage recommendation is currently 2.6, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Williams-Sonoma Inc (WSM, Financial) in one year is $102.31, suggesting a downside of 35.31% from the current price of $158.16. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Williams-Sonoma Inc (WSM) Summary page.