Summary

- L3Harris Technologies (LHX, Financial) has been awarded a $487.3 million contract for terminal modernization and support services.

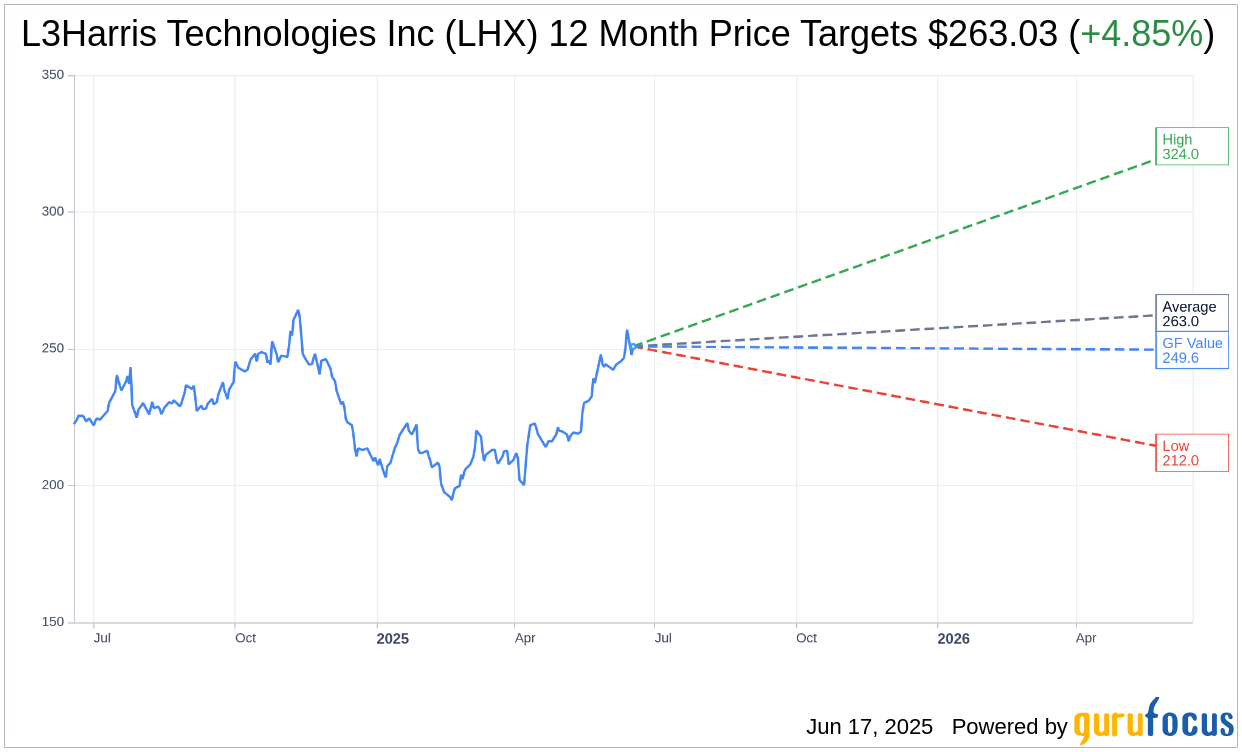

- Wall Street analysts offer an average price target of $263.03 for LHX, signaling a potential upside of 4.85%.

- The company's stock holds an "Outperform" recommendation from 24 brokerage firms.

L3Harris Technologies (LHX) has successfully landed a robust contract, valued at $487.3 million, aimed at modernizing enterprise terminals while providing essential depot and engineering services. This significant project, associated with the Army Contracting Command at Aberdeen Proving Ground in Maryland, is set to reach completion by June 2030.

Wall Street Analysts' Outlook

According to insights from 18 analysts, L3Harris Technologies Inc (LHX, Financial) is forecasted to have an average target price of $263.03. This figure encompasses a high estimate of $324.00 and a low estimate of $212.00. The average target indicates a possible upside of 4.85% from its current trading price of $250.86. For a more comprehensive analysis of these projections, visit the L3Harris Technologies Inc (LHX) Forecast page.

From the perspective of 24 brokerage firms, L3Harris Technologies Inc's (LHX, Financial) stock is recommended at an average rating of 2.0, denoting an "Outperform" status. The rating system spans from 1 to 5, where 1 equates to a Strong Buy and 5 indicates a Sell.

Market Valuation Insights

Considering GuruFocus estimates, the GF Value for L3Harris Technologies Inc (LHX, Financial) in the coming year is anticipated to be $249.58. This valuation suggests a minor downside of 0.51% from its current market price of $250.86. The GF Value is determined by analyzing historical multiples at which the stock has traded, alongside its historical and projected business growth. For further information, please check the L3Harris Technologies Inc (LHX) Summary page.