On June 12, 2025, Solus Alternative Asset Management LP (Trades, Portfolio) executed a strategic reduction in its holdings of Bristow Group Inc. The transaction involved a decrease of 45,857 shares, which impacted the firm's portfolio by -0.61%. This move reflects a calculated adjustment in the firm's investment strategy, potentially aligning with broader market conditions or internal portfolio rebalancing efforts. The shares were traded at a price of $33.71, and following this transaction, Solus Alternative Asset Management LP (Trades, Portfolio) now holds a total of 3,076,796 shares in Bristow Group Inc, representing 10.69% of its portfolio.

Profile of Solus Alternative Asset Management LP (Trades, Portfolio)

Solus Alternative Asset Management LP (Trades, Portfolio) is a well-regarded firm known for its focus on value investing. Headquartered at 25 Maple Street, 2nd Floor, Summit, NJ, the firm manages an equity portfolio valued at $253 million. Its top holdings are concentrated in the energy and communication services sectors, with significant investments in companies such as VEON Ltd (VEON, Financial), Chevron Corp (CVX, Financial), Valero Energy Corp (VLO, Financial), Exxon Mobil Corp (XOM, Financial), and Bristow Group Inc (VTOL, Financial). This diversified approach underscores the firm's strategic emphasis on sectors with robust growth potential and stable returns.

Overview of Bristow Group Inc

Bristow Group Inc, trading under the symbol VTOL, is a prominent provider of vertical flight solutions, primarily serving offshore energy companies and government entities. The company operates across various segments, including Offshore Energy Services and Government Services, with a market capitalization of $981.237 million. Bristow Group's services are utilized by customers in numerous countries, including Australia, Brazil, Canada, and the UK, among others. The company's strategic positioning in the oil and gas industry highlights its critical role in facilitating transportation to and from offshore energy installations.

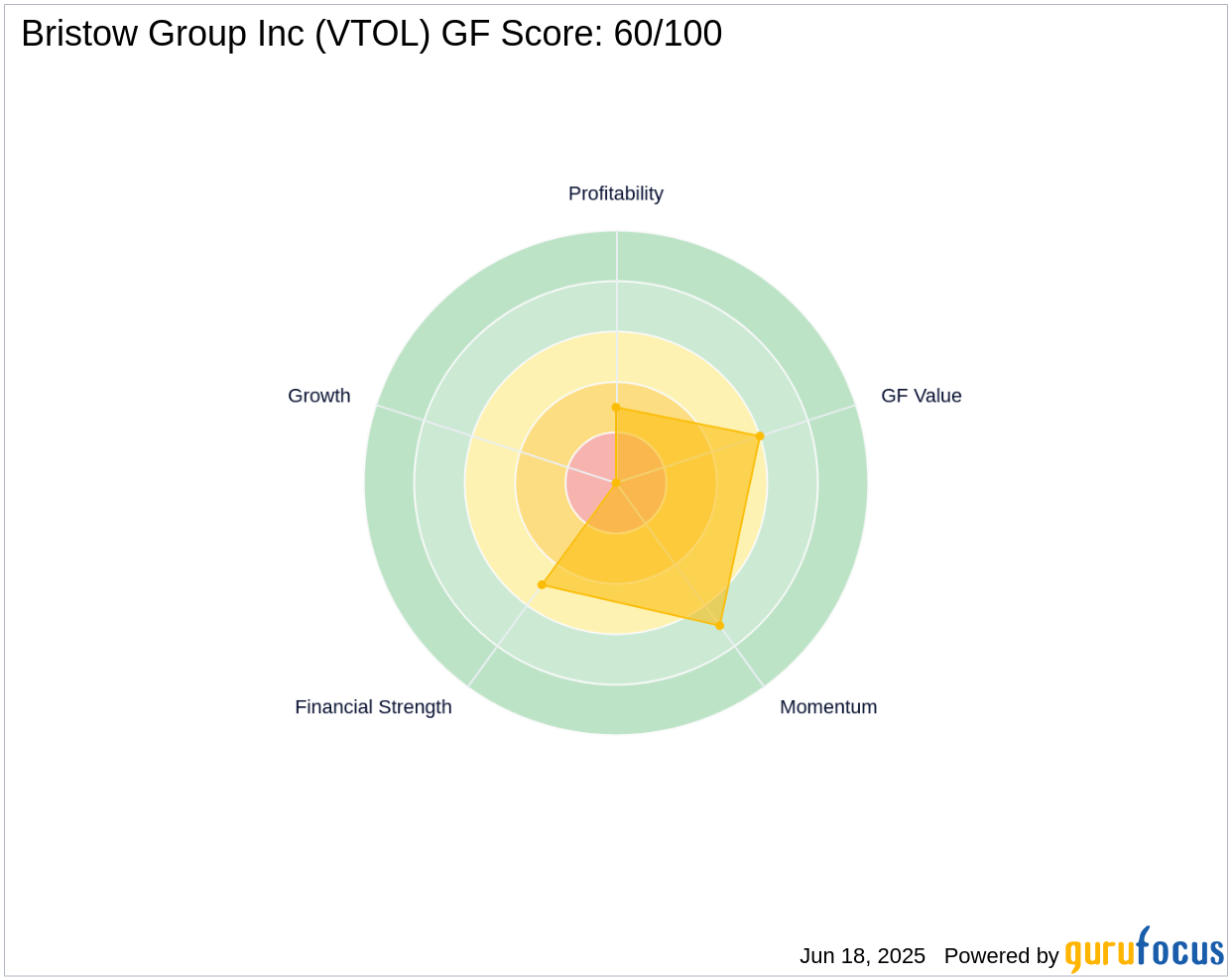

Financial Metrics and Valuation of Bristow Group Inc

Bristow Group Inc is currently considered fairly valued with a GF Value of $31.56 and a Price to GF Value ratio of 1.08. The company has a GF Score of 60/100, indicating poor future performance potential. Its balance sheet is ranked at 5/10, while the profitability rank stands at 3/10. Despite these challenges, the company has demonstrated a 41.10% EBITDA growth over three years, although it has faced a decline in earnings growth by -15.30%. These metrics suggest a mixed outlook, with potential for improvement in certain areas.

Market Performance and Growth Indicators

Since its IPO in 2020, Bristow Group Inc has experienced a significant price increase of 108.95%. However, the stock has seen a year-to-date price change of -3.4%. The company's growth rank is currently 0/10, reflecting challenges in sustaining consistent growth. Despite these fluctuations, the company's strategic focus on the oil and gas sector positions it well for potential future gains, particularly as global energy demands evolve.

Other Notable Investors in Bristow Group Inc

Donald Smith & Co. holds the largest share percentage of Bristow Group Inc among notable investors. Additionally, Arnold Van Den Berg (Trades, Portfolio) is also a significant investor in the company. The presence of these value-focused investors underscores the potential they see in Bristow Group Inc, despite the current challenges it faces. Their involvement may provide confidence to other investors considering positions in the company.

Transaction Analysis

The recent reduction in shares by Solus Alternative Asset Management LP (Trades, Portfolio) reflects a strategic decision to adjust its holdings in Bristow Group Inc. This transaction, while reducing the firm's stake, still leaves a substantial investment in the company, indicating continued confidence in its long-term potential. The current stock price of $34.1 represents a gain of 1.16% since the transaction, suggesting a positive market response. As the firm continues to monitor its portfolio, this adjustment may align with broader investment strategies aimed at optimizing returns and managing risk.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

Also check out: