Craig-Hallum has commenced coverage on Adaptive Biotechnologies (ADPT, Financial), assigning a Buy rating to the stock. Analyst John Wilkin has set a target price of $15, signaling confidence in the company's future performance. This move suggests a positive outlook for ADPT, focusing on its potential growth and market position.

Wall Street Analysts Forecast

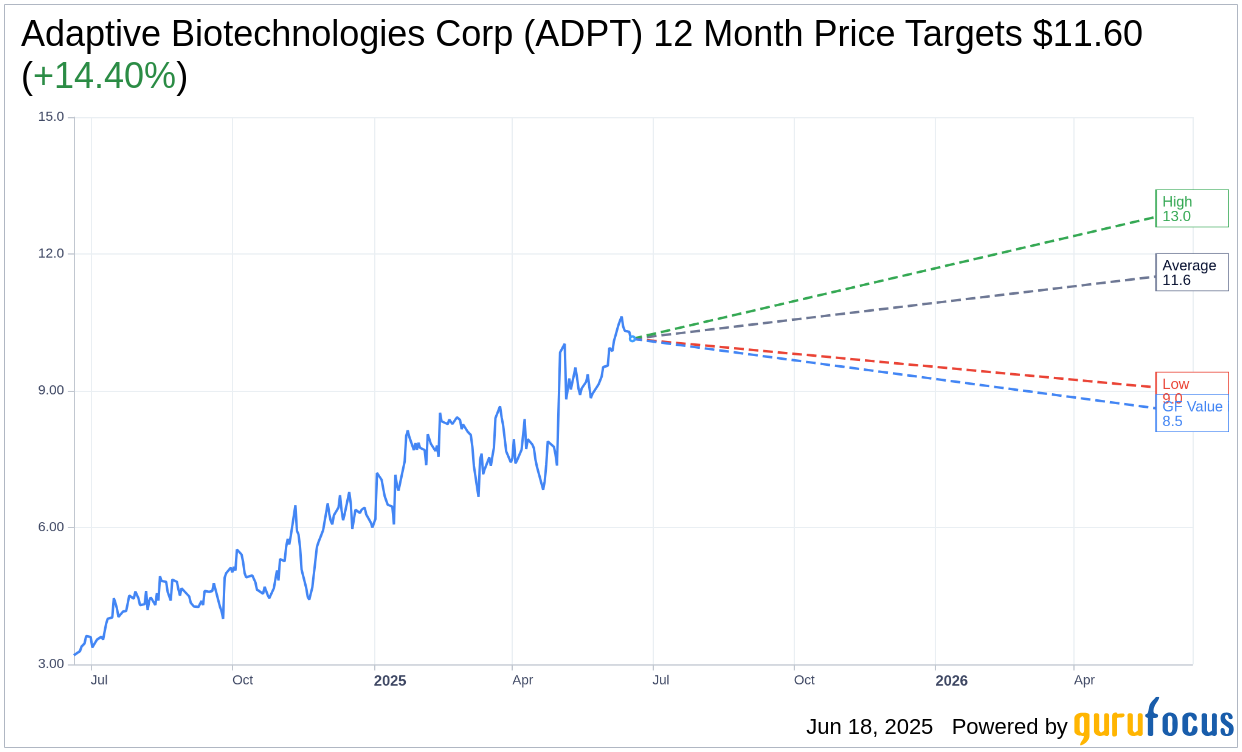

Based on the one-year price targets offered by 5 analysts, the average target price for Adaptive Biotechnologies Corp (ADPT, Financial) is $11.60 with a high estimate of $13.00 and a low estimate of $9.00. The average target implies an upside of 14.40% from the current price of $10.14. More detailed estimate data can be found on the Adaptive Biotechnologies Corp (ADPT) Forecast page.

Based on the consensus recommendation from 7 brokerage firms, Adaptive Biotechnologies Corp's (ADPT, Financial) average brokerage recommendation is currently 1.9, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Adaptive Biotechnologies Corp (ADPT, Financial) in one year is $8.51, suggesting a downside of 16.07% from the current price of $10.14. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Adaptive Biotechnologies Corp (ADPT) Summary page.

ADPT Key Business Developments

Release Date: May 01, 2025

- Total Revenue: $52.4 million, representing 25% growth from the same period last year.

- MRD Revenue: $43.7 million, a 34% increase versus prior year.

- Immune Medicine Revenue: $8.7 million, down 6% from a year ago.

- Sequencing Gross Margin: Improved by 17 percentage points year over year to 62%.

- Operating Expenses: Decreased by 9% from last year.

- Cash Burn: $23 million, a 38% improvement compared to the same period last year.

- Net Loss: $29.8 million for the quarter.

- clonoSEQ Test Volume: Increased 36% to 23,117 tests delivered versus last year.

- ASP for clonoSEQ: Increased approximately 14% year over year.

- MRD Pharma Revenue: Grew 7% versus prior year to $15.2 million.

- Cash Position: $233 million.

- Updated Full-Year MRD Revenue Guidance: Raised to $180 million to $190 million.

- Updated Full-Year Operating Expense Guidance: Lowered to $335 million to $345 million.

- Updated Full-Year Cash Burn Guidance: Lowered to $50 million to $60 million.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Adaptive Biotechnologies Corp (ADPT, Financial) reported a 34% increase in MRD revenue year-over-year, demonstrating strong growth in clinical volumes, ASP, and pharma sequencing.

- The company achieved a significant improvement in sequencing gross margin, which increased by 17 percentage points to 62% year-over-year.

- Operating expenses decreased by 9%, highlighting disciplined cost management while maintaining growth.

- Adaptive Biotechnologies Corp (ADPT) raised its full-year guidance for MRD revenue, operating expenses, and cash burn, reflecting strong performance and sustained momentum.

- The company has a solid cash position of $233 million, providing ample runway to achieve strategic objectives without needing additional capital.

Negative Points

- Immune Medicine revenue decreased by 6% year-over-year, driven by a 23% decrease in Genentech amortization.

- Despite improvements, the MRD adjusted EBITDA remains at a loss of $4.1 million, although this is an improvement from the previous year.

- The Immune Medicine business continues to operate at a loss, with adjusted EBITDA showing a 21% improvement but still negative.

- The company faces challenges in achieving operational efficiencies from EMR integrations, with potential savings not yet factored into the 2025 guidance.

- There is uncertainty regarding the timing and magnitude of sequential growth in test volumes, as several strategic initiatives are still in early stages.