Silicon Motion (SIMO, Financial) saw its rating boosted to Buy from Neutral by BofA analyst Simon Woo. In addition, the price target for the stock was significantly increased from $55 to $90. This change reflects a more optimistic outlook on the company's performance and potential.

Wall Street Analysts Forecast

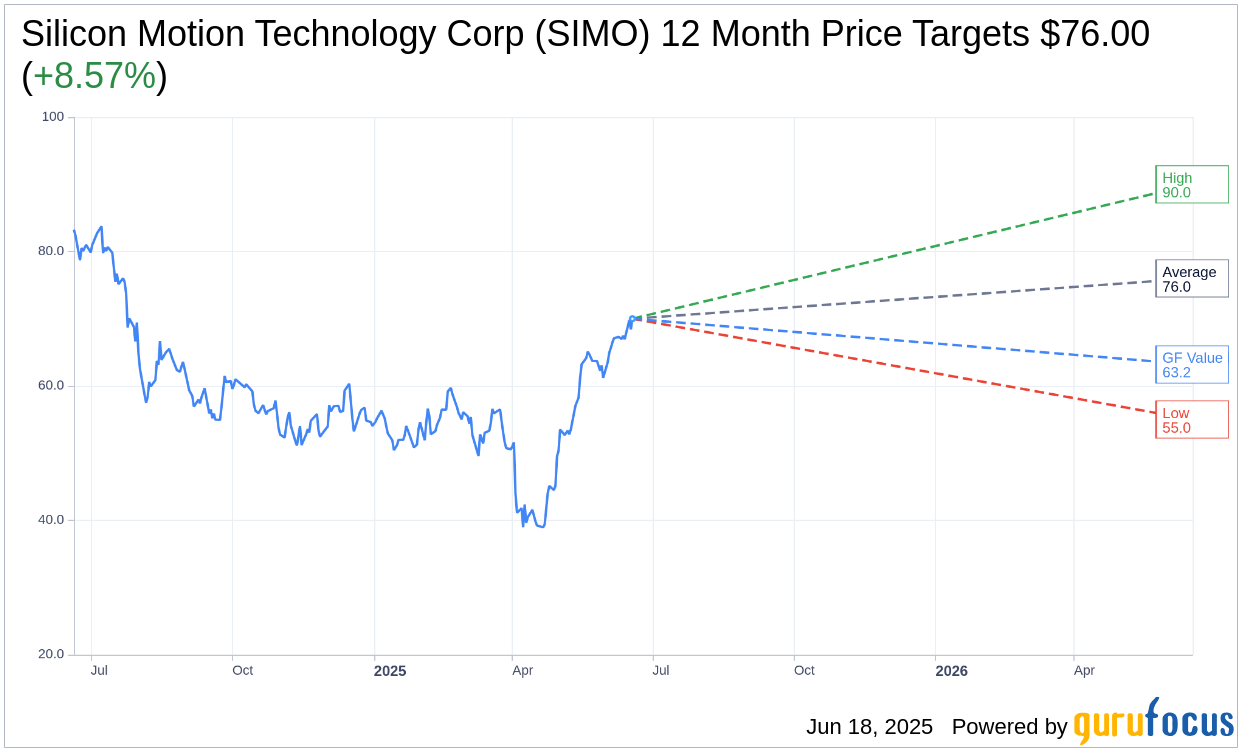

Based on the one-year price targets offered by 8 analysts, the average target price for Silicon Motion Technology Corp (SIMO, Financial) is $76.00 with a high estimate of $90.00 and a low estimate of $55.00. The average target implies an upside of 8.57% from the current price of $70.00. More detailed estimate data can be found on the Silicon Motion Technology Corp (SIMO) Forecast page.

Based on the consensus recommendation from 10 brokerage firms, Silicon Motion Technology Corp's (SIMO, Financial) average brokerage recommendation is currently 2.1, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Silicon Motion Technology Corp (SIMO, Financial) in one year is $63.19, suggesting a downside of 9.73% from the current price of $70. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Silicon Motion Technology Corp (SIMO) Summary page.

SIMO Key Business Developments

Release Date: April 30, 2025

- Revenue: $166.5 million, a decrease of 12.9% sequentially.

- Gross Margin: Increased to 47.1%.

- Operating Expenses: Increased to $63.6 million.

- Operating Margin: Decreased to 8.9%.

- Earnings per ADS: $0.60.

- Cash and Cash Equivalents: $331.7 million at the end of the first quarter.

- Stock Repurchases: $24.3 million repurchased in the first quarter.

- Second Quarter Revenue Outlook: Expected to increase 5% to 10% to $175 million to $183 million.

- Second Quarter Gross Margin Outlook: Expected to expand to 47% to 48%.

- Second Quarter Operating Margin Outlook: Expected to be in the range of 8.9% to 10.9%.

- Full Year Revenue Growth Target: Aiming for a run rate of approximately $1 billion by year-end.

- Full Year Gross Margin Target: Expected to reach the higher end of 48% to 50% by year-end.

- Full Year Tax Rate: Expected to be approximately 15%.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Silicon Motion Technology Corp (SIMO, Financial) delivered revenue at the high end of their range for the first quarter, indicating strong financial performance.

- The company experienced gross margin expansion due to the successful introduction of new products and a shift towards higher-end PCIe and UFS products.

- Silicon Motion is benefiting from increased controller outsourcing by NAND flash maker customers, which is expected to continue as controller capacity increases.

- The company secured significant design wins, including with NVIDIA's BlueField-3 DPU platform, enhancing their market position.

- Silicon Motion is well-positioned for long-term growth with investments in next-generation technologies and expansion into new markets such as enterprise, AI storage, and automotive.

Negative Points

- Sales decreased by 12.9% sequentially in the first quarter, reflecting weak end-user demand for PCs and smartphones.

- Operating expenses increased due to investments in new enterprise storage products and new product tape-outs, impacting profitability.

- The company faces macroeconomic uncertainties, including geopolitical challenges and tariffs, which could affect demand.

- Silicon Motion's exposure to the US market is limited, which may restrict growth opportunities in the PC and smartphone sectors.

- The company is cautious about the potential negative impact of tariffs on demand, which could affect their ability to achieve revenue targets.