Morgan Stanley has revised its price target for One Gas (OGS, Financial), increasing it from $69 to $71, while maintaining an Equal Weight rating for the stock. This adjustment is part of a broader review of stocks within the Regulated & Diversified Utilities / IPPs North America sector. The update comes after utilities saw weaker performance compared to the S&P in May, according to an analyst's report.

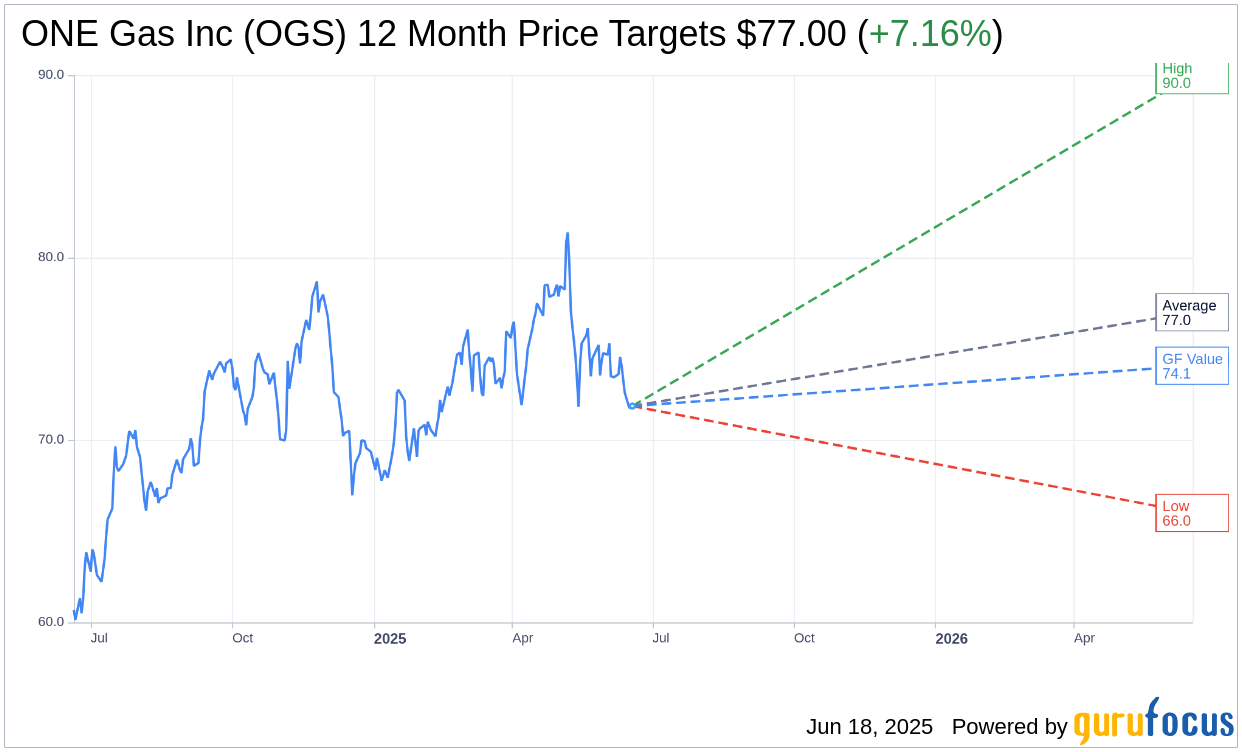

Wall Street Analysts Forecast

Based on the one-year price targets offered by 9 analysts, the average target price for ONE Gas Inc (OGS, Financial) is $77.00 with a high estimate of $90.00 and a low estimate of $66.00. The average target implies an upside of 7.16% from the current price of $71.86. More detailed estimate data can be found on the ONE Gas Inc (OGS) Forecast page.

Based on the consensus recommendation from 9 brokerage firms, ONE Gas Inc's (OGS, Financial) average brokerage recommendation is currently 2.6, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for ONE Gas Inc (OGS, Financial) in one year is $74.07, suggesting a upside of 3.08% from the current price of $71.855. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the ONE Gas Inc (OGS) Summary page.

OGS Key Business Developments

Release Date: May 06, 2025

- Net Income: $119 million or $1.98 per diluted share for the first quarter.

- Revenue Increase: Approximately $52 million from new rates and $2 million from customer growth.

- O&M Expenses: Approximately 2% higher than the first quarter last year.

- Interest Expense: $4.7 million higher than the same period in 2024.

- Dividend: $0.67 per share, unchanged from the previous quarter.

- Capital Projects: $178 million worth of capital projects completed in the quarter.

- New Meters Installed: Nearly 8,000 new meters through April.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- ONE Gas Inc (OGS, Financial) reported strong financial results with a net income of $119 million or $1.98 per diluted share, driven by effective regulatory execution and expense management.

- The company successfully managed O&M expenses, contributing to positive financial outcomes, and expects to achieve the upper half of its guidance ranges for the year.

- New rates implemented at the end of the previous year allowed ONE Gas Inc (OGS) to recover investments in its system, supporting customer growth and enhancing system reliability.

- The company demonstrated resilience during five named winter storms, maintaining system reliability without significant outages.

- ONE Gas Inc (OGS) received the American Gas Association Safety Award for the lowest rate of significant injuries among peers for the 8th consecutive year, highlighting its strong safety culture.

Negative Points

- O&M expenses increased by approximately 2% compared to the first quarter of the previous year, with a projected 4% CAGR in O&M expenses over the five-year plan.

- Interest expense in the first quarter was $4.7 million higher than the same period in 2024, due to the maturity of lower coupon notes and higher average commercial paper balances.

- Other income net decreased by just under $3 million compared to the same period last year, primarily due to decreases in the market value of investments associated with the non-qualified employee benefit plan.

- The company faces ongoing challenges in managing labor and benefits-related costs, which constitute about 60% of its O&M expenses.

- Despite strong financial performance, the company remains cautious about future opportunities for insourcing and efficiency improvements, indicating potential limitations in further cost reductions.