Summary:

- Texas Instruments (TXN, Financial) announces a historic $60 billion investment in U.S. semiconductor facilities.

- The expansion is projected to generate over 60,000 jobs across Texas and Utah.

- Analysts provide a mixed outlook, with price targets indicating potential downside from current levels.

Texas Instruments (TXN) has unveiled its ambitious plan to inject more than $60 billion into the development of seven semiconductor facilities in the United States. This unprecedented investment aims to bolster U.S. chip manufacturing capabilities and is expected to create over 60,000 new jobs. Following this announcement, Texas Instruments' stock experienced a 1% uptick.

Analyst Insights and Forecasts

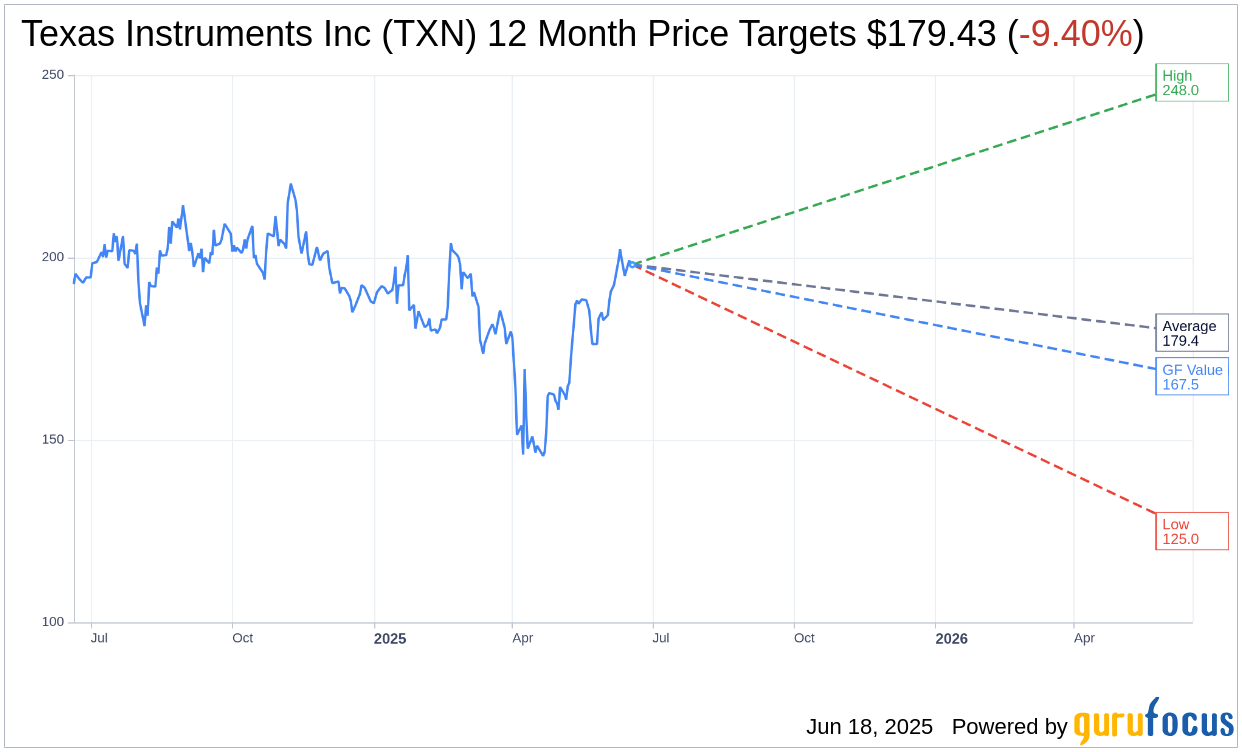

According to the latest one-year price target projections from 29 analysts, Texas Instruments Inc (TXN, Financial) has a mean target price of $179.43. The highest forecasted price is $248.00, while the lowest stands at $125.00. At the current share price of $198.06, these projections suggest a potential downside of 9.40%. For more comprehensive forecast data, visit the Texas Instruments Inc (TXN) Forecast page.

When considering the consensus from 38 brokerage firms, Texas Instruments Inc (TXN, Financial) garners an average brokerage recommendation of 2.7. This rating aligns with a "Hold" status, based on a scale where 1 suggests a Strong Buy and 5 signals a Sell.

Evaluating GF Value Estimates

GuruFocus presents an estimated GF Value for Texas Instruments Inc (TXN, Financial) at $167.46 in one year. This forecast points to a potential downside of 15.45% from the current market price of $198.055. The GF Value metric by GuruFocus reflects an estimation of what the stock should be valued at, derived from historical trading multiples, past growth trends, and prognostications of the business's future performance. More detailed insights can be accessed on the Texas Instruments Inc (TXN) Summary page.