Key Highlights:

- Keysight Technologies (KEYS, Financial) boosts engagement by partnering with AMD on server CPU testing.

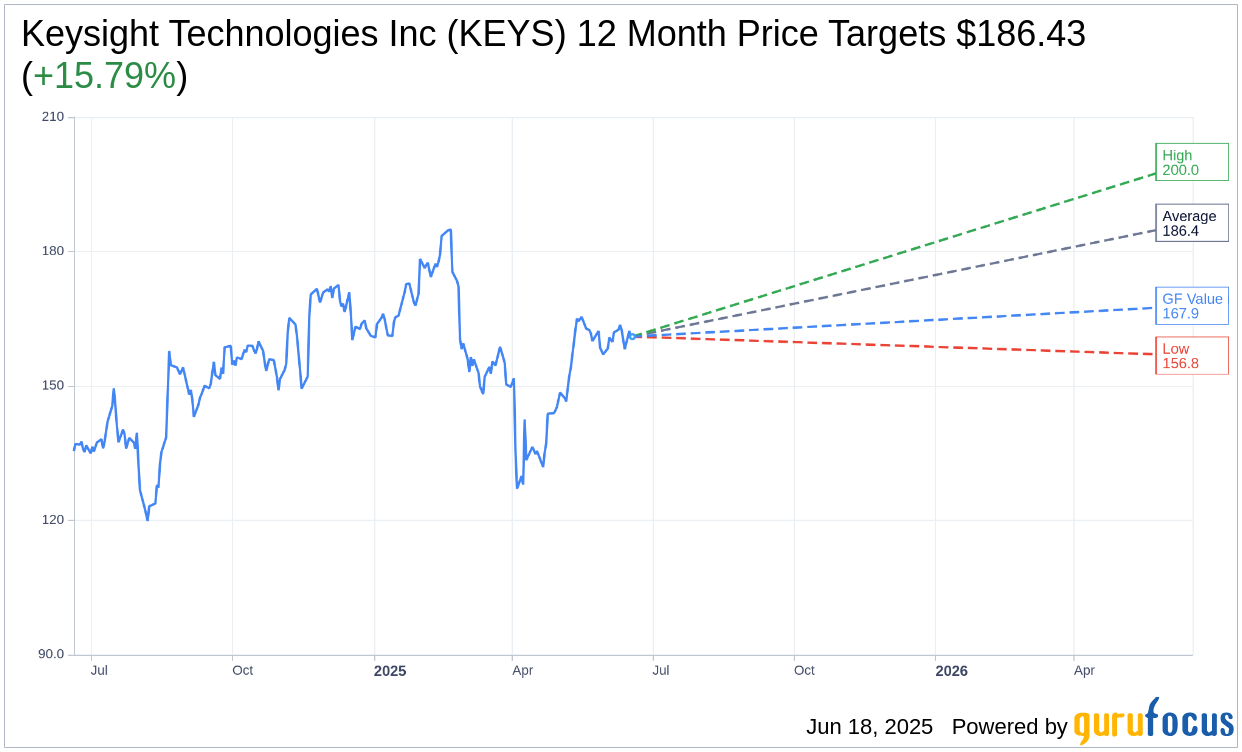

- Analysts anticipate a potential 15.79% increase in Keysight's stock price within a year.

- Keysight is rated as "Outperform" by major brokerage firms.

Shares of Keysight Technologies (NYSE: KEYS) experienced a modest increase of 1.2% as the company played a pivotal role in assisting AMD (NASDAQ: AMD) with the testing of its server CPUs. By providing early access to its beta software, Keysight facilitated AMD's compliance testing for PCI Express technology, highlighting its advanced testing capabilities at a recent industry conference.

Analyst Projections for Keysight

Wall Street remains optimistic about Keysight Technologies with 11 analysts setting a one-year average price target of $186.43. This projection includes a high estimate of $200.00 and a low of $156.78. If realized, the average target price would represent an upside of 15.79% from its current trading price of $161.01. For a more thorough breakdown of these projections, investors are encouraged to visit the Keysight Technologies Inc (KEYS, Financial) Forecast page.

The consensus from 13 brokerage firms gives Keysight Technologies an average brokerage recommendation of 2.1, indicative of an "Outperform" status. This rating is based on a scale where 1 signifies a Strong Buy and 5 points to a Sell.

GF Value Insight

According to GuruFocus' estimates, the projected GF Value for Keysight Technologies in one year stands at $167.90. This suggests a potential upside of 4.28% from the current market price of $161.01. The GF Value represents GuruFocus' fair value estimate, derived from the stock's historical trading multiples, past business growth, and future performance forecasts. For more detailed insights, please visit the Keysight Technologies Inc (KEYS, Financial) Summary page.