A virtual meeting is set to take place on June 24, organized by Craig-Hallum, focusing on discussions around NOTE. The event is expected to provide insights into the company's performance and potential investment opportunities. This gathering presents a chance for investors to gain valuable information that can aid in making informed investment decisions regarding the stock (NOTE, Financial).

Wall Street Analysts Forecast

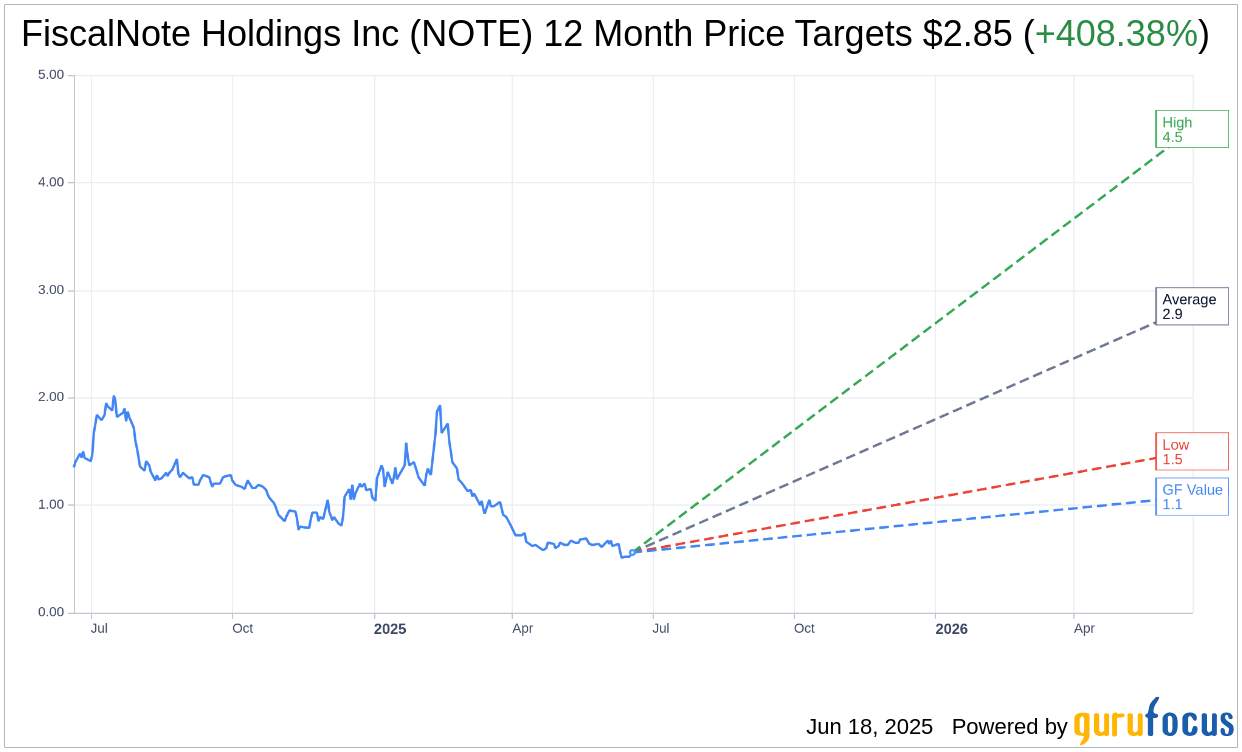

Based on the one-year price targets offered by 5 analysts, the average target price for FiscalNote Holdings Inc (NOTE, Financial) is $2.85 with a high estimate of $4.50 and a low estimate of $1.50. The average target implies an upside of 408.38% from the current price of $0.56. More detailed estimate data can be found on the FiscalNote Holdings Inc (NOTE) Forecast page.

Based on the consensus recommendation from 5 brokerage firms, FiscalNote Holdings Inc's (NOTE, Financial) average brokerage recommendation is currently 1.8, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for FiscalNote Holdings Inc (NOTE, Financial) in one year is $1.08, suggesting a upside of 92.65% from the current price of $0.5606. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the FiscalNote Holdings Inc (NOTE) Summary page.

NOTE Key Business Developments

Release Date: May 12, 2025

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- FiscalNote Holdings Inc (NOTE, Financial) exceeded both revenue and adjusted EBITDA guidance for Q1 2025, with total revenue reaching $27.5 million.

- The company reported a significant improvement in adjusted EBITDA, achieving $2.8 million, which is higher than the prior year and above guidance.

- FiscalNote Holdings Inc (NOTE) has successfully reduced its senior term loans by $96 million since December 2023, leading to a decrease in cash interest expense.

- The launch of the PolicyNote platform has been well-received, with increased customer engagement and a positive impact on user experience.

- The company is seeing strong pipeline growth, particularly in Europe, and has doubled pipeline creation compared to the same period in 2024.

Negative Points

- Annual recurring revenue (ARR) has not yet resumed growth, with Q1 2025 ARR at $88 million, down from $94 million in 2024.

- Net revenue retention decreased to 93% in Q1 2025 from 96% in the prior year, reflecting underperformance at the end of 2024.

- The company experienced a $4 million decrease in revenue compared to the prior year, primarily due to divestitures.

- Gross margins on a GAAP basis decreased by 200 basis points due to sunset products and higher amortization expenses.

- The revenue guidance for Q2 2025 is projected to be lower than Q1 levels, primarily due to recent divestitures.