On a recent trading day, Target (TGT, Financial) observed its shares gaining 44 cents, or 0.46%, closing near $95.46. The options market activity was close to the average, with a total of 104,000 contracts exchanged. Notably, puts were more active than calls, resulting in a put/call ratio of 2.04, slightly below the typical ratio of 2.07.

The implied volatility for Target, identified at 33.73, saw a decline of 0.93, remaining above the median for the past year. This suggests an anticipated daily price fluctuation of approximately $2.03. Additionally, the put-call skew has intensified, indicating a heightened demand for protective options strategies on the downside. These metrics provide insight into investor sentiment and expectations regarding Target's stock movements.

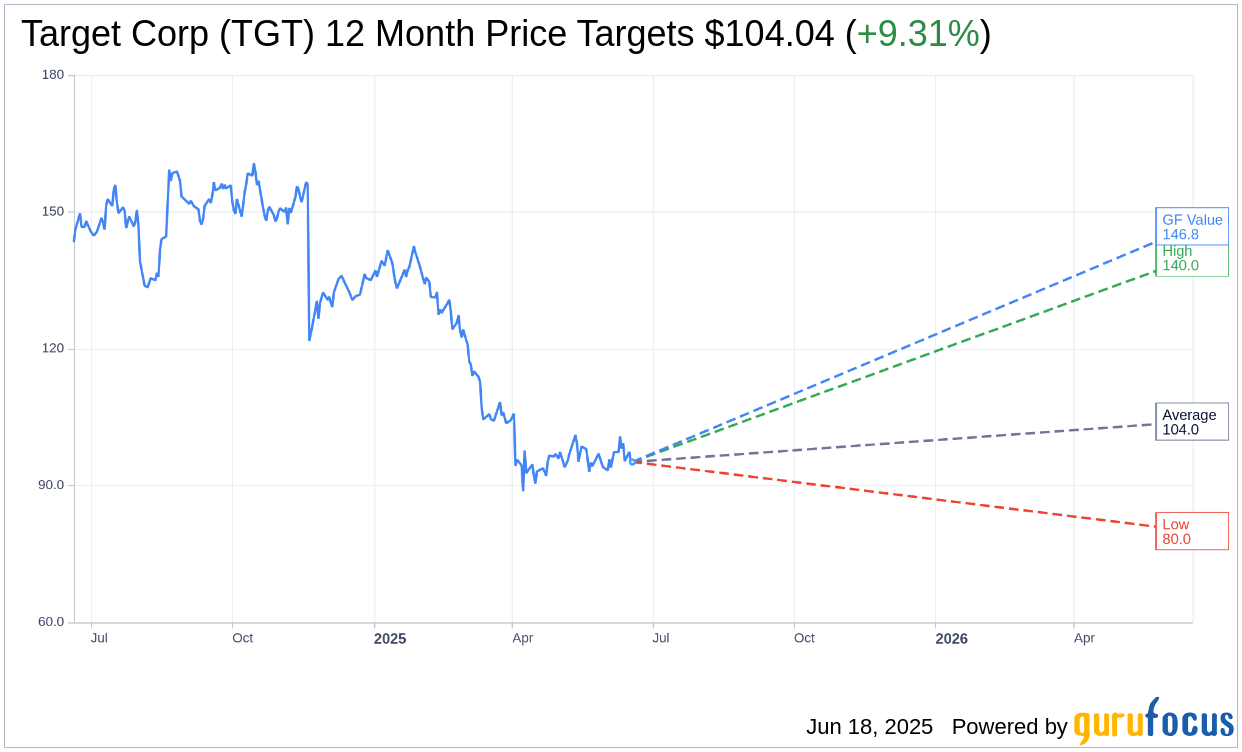

Wall Street Analysts Forecast

Based on the one-year price targets offered by 31 analysts, the average target price for Target Corp (TGT, Financial) is $104.04 with a high estimate of $140.00 and a low estimate of $80.00. The average target implies an upside of 9.31% from the current price of $95.18. More detailed estimate data can be found on the Target Corp (TGT) Forecast page.

Based on the consensus recommendation from 39 brokerage firms, Target Corp's (TGT, Financial) average brokerage recommendation is currently 2.7, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Target Corp (TGT, Financial) in one year is $146.85, suggesting a upside of 54.29% from the current price of $95.18. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Target Corp (TGT) Summary page.

TGT Key Business Developments

Release Date: May 21, 2025

- Net Sales: Declined 2.8% in Q1.

- Comparable Sales: Decreased by 3.8%.

- Traffic: Declined 2.4%.

- Average Ticket: Down 1.4%.

- GAAP EPS: $2.27, including $0.97 benefit from litigation resolution.

- Adjusted EPS: $1.30, compared to $2.03 last year.

- Gross Margin: 28.2%, about 60 basis points lower than last year.

- SG&A Rate: Reported at 19.3%, underlying rate at 21.7%.

- Operating Margin: 6.2%, including 250 basis points benefit from legal settlements.

- Inventory: Up 11% year-over-year.

- Digital Sales Growth: Mid-single-digit growth, with 36% growth in same-day delivery.

- CapEx: $790 million in Q1, full-year expected near lower end of $4 billion to $5 billion range.

- Store Openings: Added three new locations, on track to open around 20 for the year.

- Store Remodels: Strong comp lifts of 2% to 4% following remodels.

- Full-Year Adjusted EPS Guidance: Updated to $7 to $9.

- Full-Year GAAP EPS Guidance: Updated to $8 to $10.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Target Corp (TGT, Financial) reported mid-single-digit growth in its first-party digital business, with a notable 36% increase in same-day delivery powered by Target Circle 360.

- The company saw strong performance in its limited-time design partnership with Kate Spade, marking the most successful collaboration in over a decade.

- Target Corp (TGT) experienced progress in inventory shrink, with rates moderating from extreme levels encountered in previous years.

- The company is investing in new stores, ongoing remodels, and technology, which are expected to support long-term growth.

- Target Corp (TGT) is expanding its Target Plus marketplace, with a 20% growth in GMV this quarter, adding hundreds of new partners to the platform.

Negative Points

- Target Corp (TGT) faced a 2.8% decline in net sales for the first quarter, driven by a decrease in traffic and lower average basket size.

- The company experienced pressure from higher markdowns and digital fulfillment costs, impacting its gross margin.

- Target Corp (TGT) is dealing with ongoing challenges in discretionary categories due to declining consumer confidence and high inflation.

- The company anticipates continued sales pressure and tariff impacts, which could affect profitability in the near term.

- Target Corp (TGT) is taking actions to right-size inventory, which may lead to incremental markdowns and receipt adjustment costs in the second quarter.