- Trinity Capital (TRIN, Financial) maintains a quarterly dividend of $0.51, offering a robust yield of 14.28%.

- Analysts project a potential 12.33% upside, with a 1.9 "Outperform" rating on the stock.

- GuruFocus estimates suggest a substantial 70.35% upside, forecasting a future GF Value of $24.36.

Trinity Capital (TRIN) has reaffirmed its commitment to shareholders by announcing the continuation of its quarterly dividend at $0.51 per share, offering an impressive forward dividend yield of 14.28%. This payout will be distributed on July 15 to investors registered by June 30, with the ex-dividend date also on June 30.

Wall Street Analysts' Price Targets and Recommendations

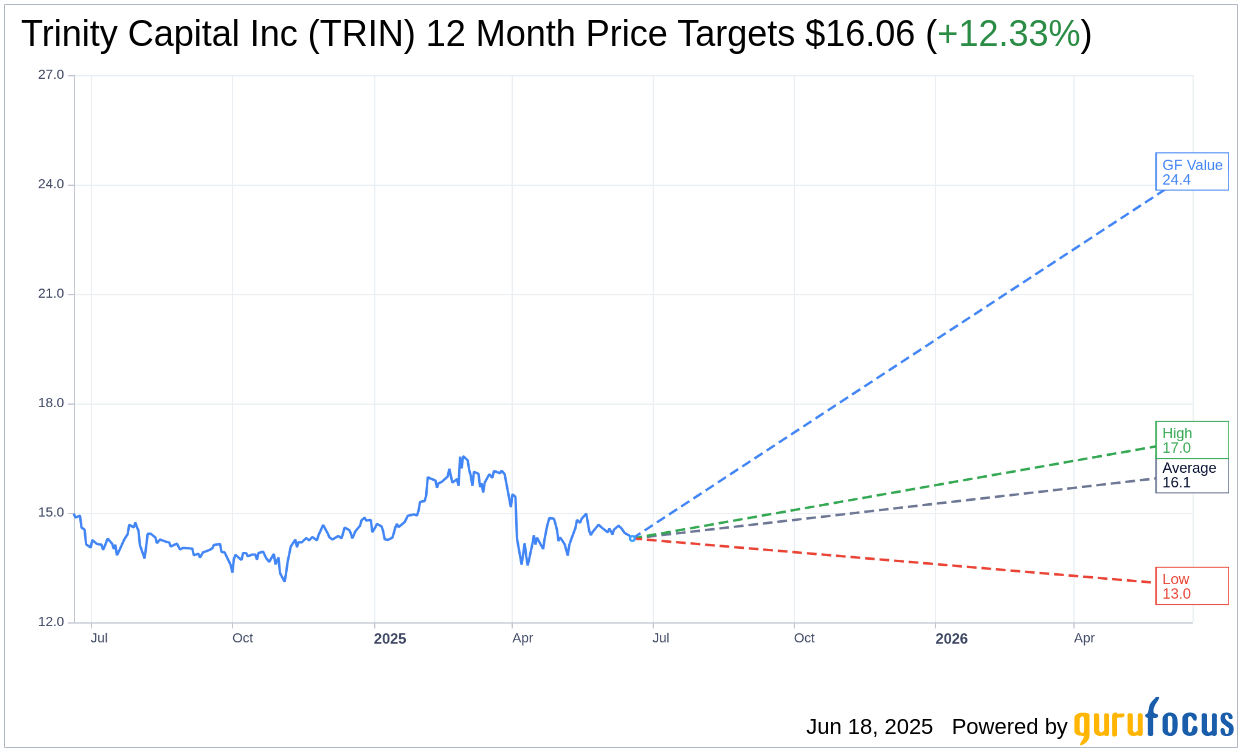

Wall Street analysts remain optimistic about Trinity Capital Inc (TRIN, Financial) with a mean one-year price target of $16.06. This forecast, gathered from 8 analysts, presents a high of $17.00 and a low of $13.00, reflecting a potential upside of 12.33% from the recent price of $14.30. For a deeper dive into these estimations, visit the Trinity Capital Inc (TRIN) Forecast page.

The consensus recommendation from 8 brokerage firms rates Trinity Capital Inc (TRIN, Financial) at 1.9, categorizing the stock as "Outperform". This rating places it on a scale where 1 represents a Strong Buy and 5 suggests Sell.

GuruFocus GF Value Analysis

According to GuruFocus estimates, the projected GF Value for Trinity Capital Inc (TRIN, Financial) in the coming year stands at $24.36, indicating a remarkable upside potential of 70.35% from the present price of $14.30. The GF Value is determined through an evaluation of the historical trading multiples, previous business growth, and anticipated future business performance. For comprehensive insights, explore the Trinity Capital Inc (TRIN) Summary page.

Also check out: (Free Trial)