Key Takeaways:

- Smith & Wesson (SWBI, Financial) experienced a challenging fiscal fourth quarter, with a notable 12% decline in revenue.

- The stock dipped 14% in after-hours trading, influenced by inflationary pressures and trade policy challenges.

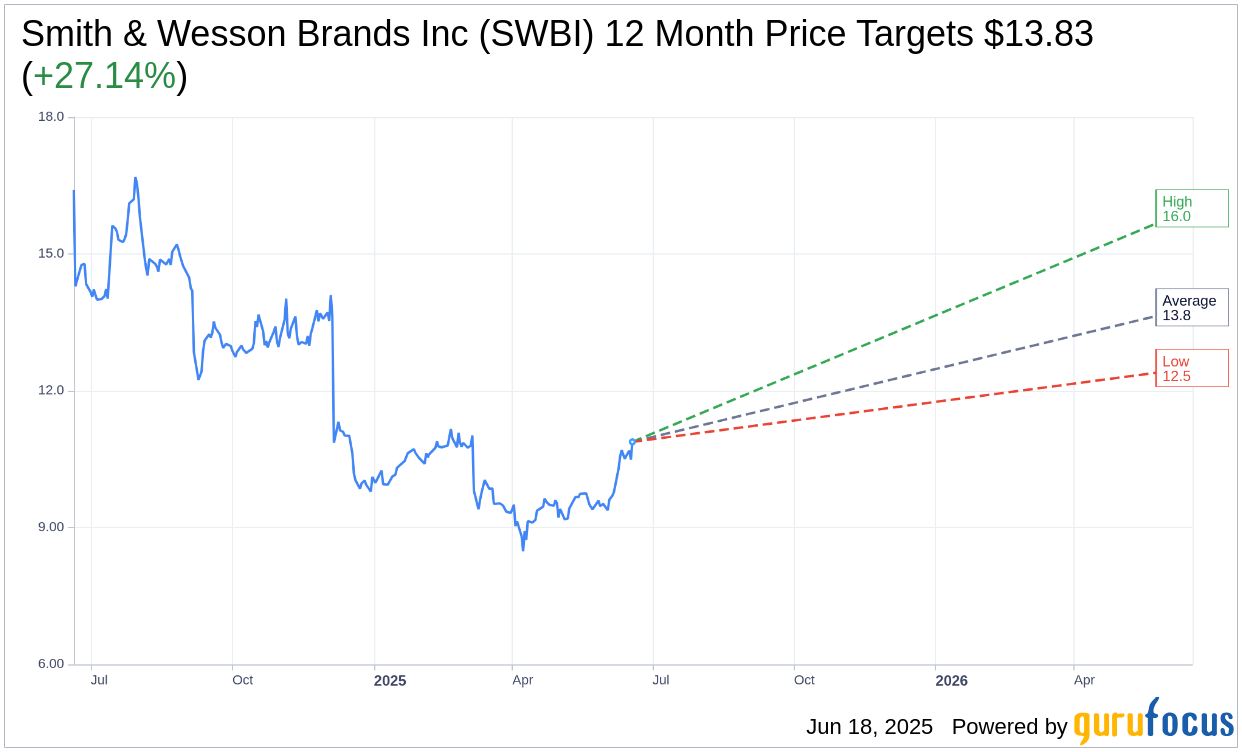

- Analysts have set an average stock price target of $13.83, suggesting potential upside for investors.

Smith & Wesson's Financial Performance: A Closer Look

Smith & Wesson (SWBI) recently reported a substantial 12% drop in revenue for the fiscal fourth quarter, falling short of Wall Street's expectations by approximately $12 million. This disappointing performance comes amid rising inflation and ongoing trade policy issues, which have significantly impacted the company's operations. Consequently, the stock experienced a 14% decline in after-hours trading, primarily due to a dip in firearm sales and diminished profitability.

Wall Street Analysts' Forecast on Smith & Wesson

According to the one-year price targets provided by three analysts, the average target price for Smith & Wesson Brands Inc (SWBI, Financial) is set at $13.83. The projections range from a high estimate of $16.00 to a low estimate of $12.50, reflecting a potential upside of 27.14% from the current price of $10.88. Investors seeking more comprehensive estimate data can explore the Smith & Wesson Brands Inc (SWBI) Forecast page.

Furthermore, based on the consensus recommendation from three brokerage firms, Smith & Wesson Brands Inc's (SWBI, Financial) average brokerage recommendation stands at 2.3, indicating an "Outperform" status. This rating is part of a scale where 1 represents a Strong Buy and 5 signifies a Sell, suggesting a relatively positive outlook from the analyst community.

Conclusion: Navigating the Investment Landscape

Despite the challenges faced in the recent quarter, Smith & Wesson's stock has a promising outlook according to analyst predictions. With a potential upside and an "Outperform" rating, investors may find opportunities in SWBI as market conditions stabilize. However, it's crucial to stay informed and consider macroeconomic factors that may continue to affect the company's performance.