Descartes Systems Group (DSGX, Financial) has strengthened its portfolio by acquiring PackageRoute, a final-mile carrier solutions provider. This acquisition enhances Descartes' offerings with PackageRoute's mobile and web-based technology, which delivers real-time visibility into package deliveries and supports route optimization and fleet management. PackageRoute mainly serves subcontracted delivery service providers affiliated with larger carriers.

According to Descartes, PackageRoute's customers are expected to benefit significantly from the integration with Descartes' own GroundCloud routing, safety, and compliance solutions. Based in Sammamish, Washington, PackageRoute was acquired for approximately $2 million, an investment completed using Descartes' existing cash reserves.

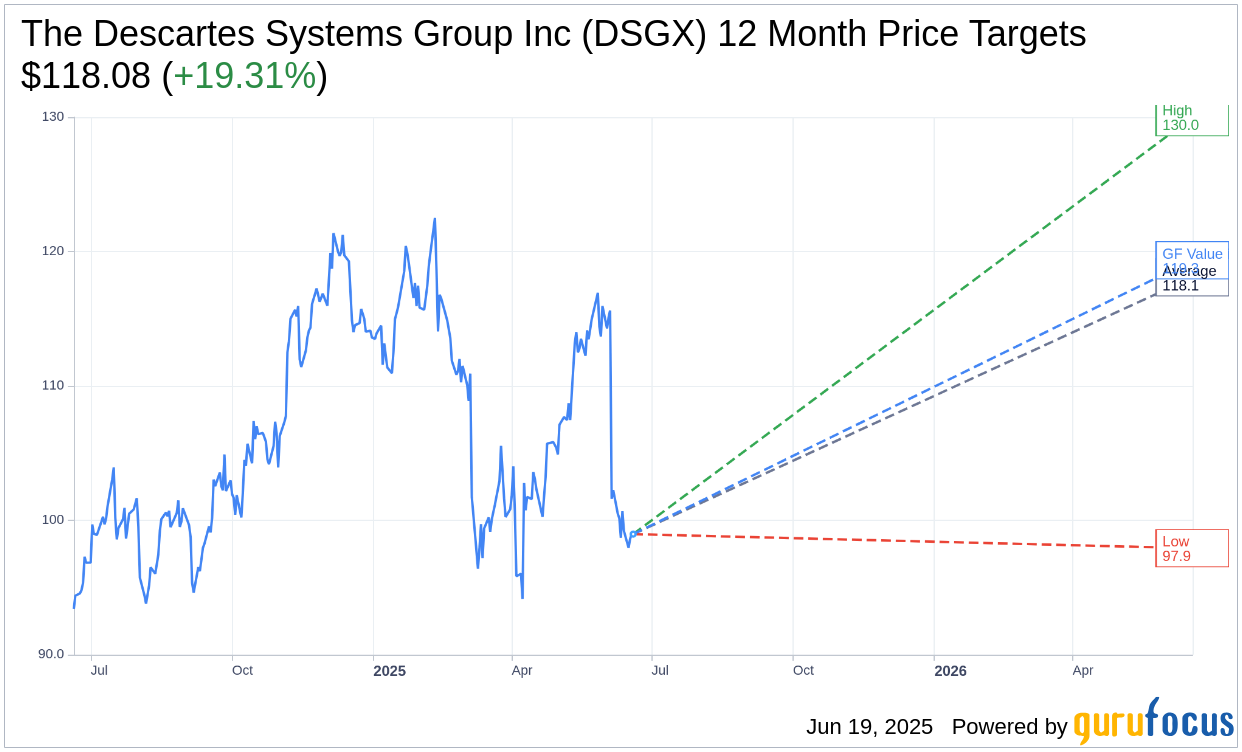

Wall Street Analysts Forecast

Based on the one-year price targets offered by 12 analysts, the average target price for The Descartes Systems Group Inc (DSGX, Financial) is $118.08 with a high estimate of $130.00 and a low estimate of $97.92. The average target implies an upside of 19.31% from the current price of $98.97. More detailed estimate data can be found on the The Descartes Systems Group Inc (DSGX) Forecast page.

Based on the consensus recommendation from 12 brokerage firms, The Descartes Systems Group Inc's (DSGX, Financial) average brokerage recommendation is currently 2.2, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for The Descartes Systems Group Inc (DSGX, Financial) in one year is $119.35, suggesting a upside of 20.6% from the current price of $98.965. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the The Descartes Systems Group Inc (DSGX) Summary page.

DSGX Key Business Developments

Release Date: June 04, 2025

- Total Revenue: $168.7 million, up 11.5% from $151.3 million in Q1 last year.

- Services Revenue: $156.6 million, representing 93% of total revenue, up 13.6% year-over-year.

- Adjusted EBITDA: $75.1 million, 44.5% of revenue, up 12.1% from $67.0 million in Q1 last year.

- Net Income: $36.2 million, up 4% from $34.7 million in Q1 last year.

- Cash Flow from Operations: $53.6 million, 71% of adjusted EBITDA, down from $63.7 million in Q1 last year.

- Cash Balance: $176 million at the end of April, down from $236 million at the end of January.

- Gross Margin: 76.4% of revenue, slightly down from 76.6% in Q1 last year.

- Operating Expenses: Increased by 10.4% year-over-year, primarily due to acquisitions.

- Acquisition Cost: $115 million plus restructuring costs for 3GTMS.

- Restructuring Charge: $4 million in Q2, with expected annual cost savings of $15 million.

- Debt Status: Debt-free with an undrawn $350 million line of credit.

- Tax Rate: 24.4% of pretax income, expected to trend between 24% and 28% for the year.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- The Descartes Systems Group Inc (DSGX, Financial) reported a 12% increase in total revenues from the previous year, with services revenues up 14%.

- The company achieved a 9% increase in income from operations and a 12% rise in adjusted EBITDA, with an adjusted EBITDA margin improvement to 45%.

- The acquisition of 3GTMS, despite requiring restructuring, is expected to enhance the transportation management portfolio and provide additional functionality to existing customers.

- The MacroPoint real-time visibility business experienced strong demand, contributing to growth despite a challenging domestic truck market in the US.

- The Global Trade Intelligence business saw significant growth due to increased demand for tariff and duty information amid changing trade environments.

Negative Points

- The broader macro environment remains challenging, with shipment volumes down in various transportation modes, particularly in US-China trade.

- The company had to undertake a restructuring, impacting about 7% of its workforce, to prepare for potential future economic challenges.

- Cash flow from operations decreased to $53.6 million, down from $63.7 million in the same quarter last year, partly due to acquisition-related charges.

- The US's removal of the de minimis tariff exemption for Chinese imports led to temporary disruptions in the company's small package import business.

- Uncertainty in global trade and economic conditions is causing decision-making paralysis among customers, impacting transaction volumes and growth.