Kroger (KR, Financial) reported its first-quarter revenue of $45.118 billion, slightly missing the anticipated $45.31 billion. Despite this, the company noted impressive sales performances, particularly in its pharmacy, eCommerce, and fresh food segments. Chairman and CEO Ron Sargent highlighted the progress in prioritizing efficiency, focusing on customer satisfaction, and enhancing the shopping experience. Sargent expressed confidence in Kroger’s strategy to sustain growth in its core business, emphasizing swift actions that are expected to benefit future operations. The company aims to continue delivering value for customers while investing in its workforce and generating robust returns for shareholders.

Wall Street Analysts Forecast

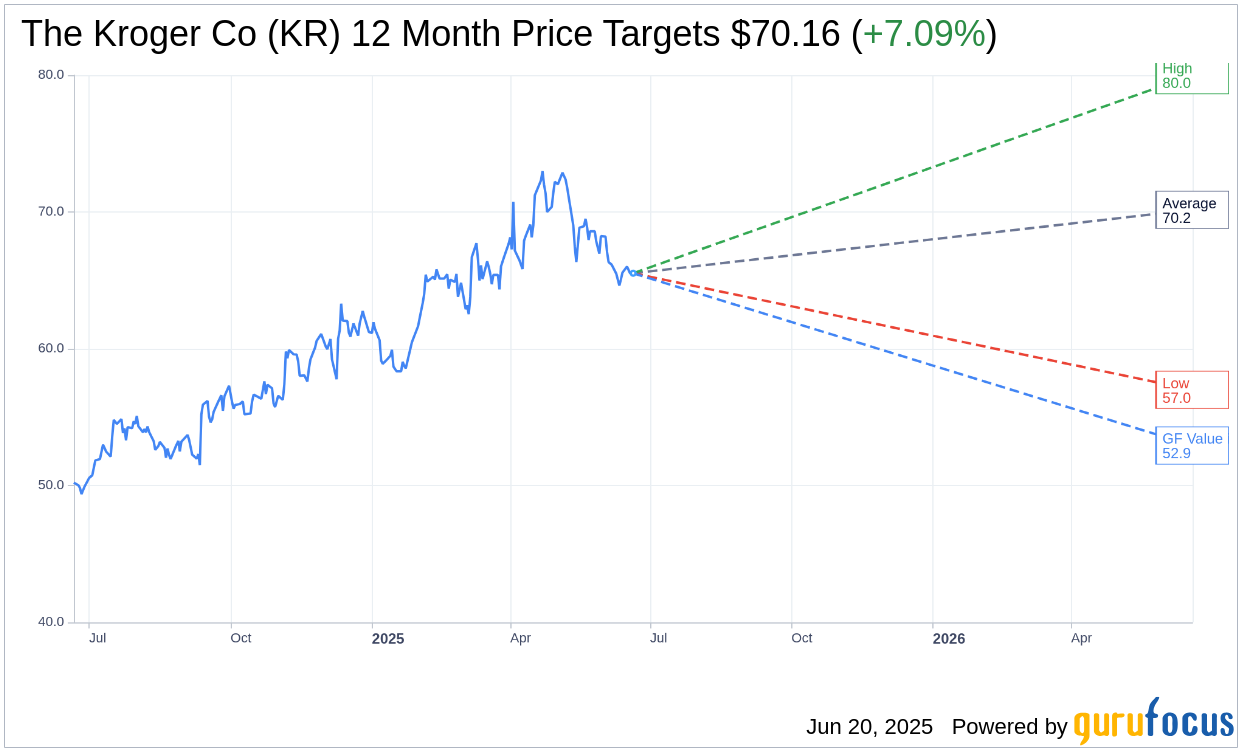

Based on the one-year price targets offered by 19 analysts, the average target price for The Kroger Co (KR, Financial) is $70.16 with a high estimate of $80.00 and a low estimate of $57.00. The average target implies an upside of 7.09% from the current price of $65.52. More detailed estimate data can be found on the The Kroger Co (KR) Forecast page.

Based on the consensus recommendation from 25 brokerage firms, The Kroger Co's (KR, Financial) average brokerage recommendation is currently 2.3, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for The Kroger Co (KR, Financial) in one year is $52.93, suggesting a downside of 19.22% from the current price of $65.52. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the The Kroger Co (KR) Summary page.