IPG Photonics (IPGP, Financial) has introduced a new series of high-power lasers based on an innovative rack-integrated design. Showcased at the Laser World of Photonics event in Munich, Germany, this product line offers significant cost savings and operational improvements for manufacturers. Key benefits include a 60% reduction in floor space usage, which translates to lower facility expenses and provides more flexible factory configurations.

The newly designed RI lasers leverage advanced IPG laser pump diodes that deliver higher power densities in a compact form, thereby decreasing the total cost of ownership. This new platform not only reduces size and weight but also ensures more uniform processing outcomes, cutting down on waste and setup time.

Additionally, the RI laser platform facilitates easier integration for OEMs and significantly reduces risks of laser damage or operational shutdowns. With a built-in protection feature against condensation, these lasers can be water-cooled up to 25 degrees C, allowing for increased maximum operating temperatures and safer functionality in humid conditions.

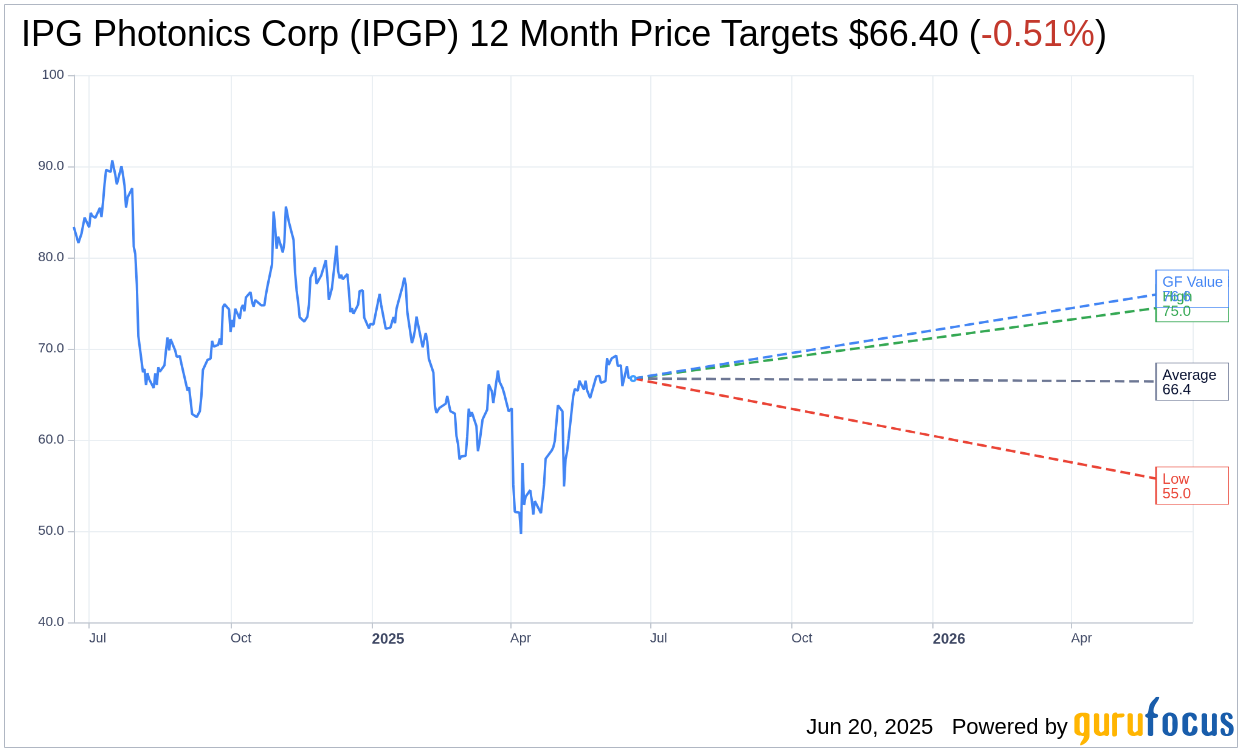

Wall Street Analysts Forecast

Based on the one-year price targets offered by 5 analysts, the average target price for IPG Photonics Corp (IPGP, Financial) is $66.40 with a high estimate of $75.00 and a low estimate of $55.00. The average target implies an downside of 0.51% from the current price of $66.74. More detailed estimate data can be found on the IPG Photonics Corp (IPGP) Forecast page.

Based on the consensus recommendation from 10 brokerage firms, IPG Photonics Corp's (IPGP, Financial) average brokerage recommendation is currently 2.9, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for IPG Photonics Corp (IPGP, Financial) in one year is $76.59, suggesting a upside of 14.76% from the current price of $66.74. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the IPG Photonics Corp (IPGP) Summary page.

IPGP Key Business Developments

Release Date: May 06, 2025

- Revenue: $228 million, above the midpoint of guidance, down 10% year over year.

- Gross Margin: GAAP gross margin at 39.4%, adjusted gross margin at 40%.

- Operating Income: GAAP operating income of $2 million.

- Net Income: GAAP net income of $4 million or $0.09 per diluted share.

- Adjusted Earnings Per Share: $0.31 per diluted share.

- Cash and Investments: $927 million in cash equivalents and short-term investments, no debt.

- Cash Flow from Operations: $13 million.

- Capital Expenditures: $25 million.

- Revenue Guidance for Q2 2025: $210 million to $240 million.

- Adjusted Gross Margin Guidance for Q2 2025: 36% to 38%.

- Operating Expenses Guidance for Q2 2025: $86 million to $88 million.

- Adjusted Earnings Per Share Guidance for Q2 2025: $0.05 to $0.25.

- Adjusted EBITDA Guidance for Q2 2025: $16 million to $31 million.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- IPG Photonics Corp (IPGP, Financial) reported revenue above the midpoint of their guidance, indicating a solid start to the year.

- The company experienced strong bookings growth, with a book-to-bill ratio solidly above 1, the strongest in more than two years.

- IPG Photonics Corp (IPGP) is gaining traction in medical micro-machining and advanced applications, contributing positively to revenue.

- The company has a strong balance sheet with over $900 million in cash and no debt, providing financial flexibility.

- IPG Photonics Corp (IPGP) is actively pursuing strategic acquisitions, such as the clean laser acquisition, which is already contributing to growth.

Negative Points

- Revenue from materials processing decreased 14% year over year, primarily due to lower sales in cutting and welding.

- The company is facing challenges from recently imposed tariffs, impacting revenue guidance by approximately $15 million due to potential shipment delays.

- Operating expenses increased due to investments in key strategic areas, impacting profitability.

- Foreign currency fluctuations reduced revenue by approximately $5 million or 2% in the quarter.

- The cutting revenue remained weak both year over year and sequentially across most regions.