Builders FirstSource (BLDR, Financial) remains a focal point in the market today as Wedbush analyst Jay McCanless has updated his rating and price target for the company. The analyst has maintained an "Outperform" rating on Builders FirstSource, signaling continued confidence in the company's prospects despite a revision in the stock's price target.

Notably, the adjusted price target has been lowered from $190.00 to $145.00 USD. This adjustment reflects a decrease of 23.68% in the projected price, indicating a more conservative outlook on the company's future valuation amid broader market conditions.

The decision to uphold the "Outperform" rating suggests that while expectations have been tempered, there remains an anticipation of positive performance relative to other stocks. Stakeholders and investors in Builders FirstSource (BLDR, Financial) are advised to stay informed of any further updates or changes from analysts that may impact future strategies.

Builders FirstSource, ticker (BLDR, Financial), continues to trade on the NYSE, and investors will keenly watch its performance following this significant adjustment from Wedbush.

Wall Street Analysts Forecast

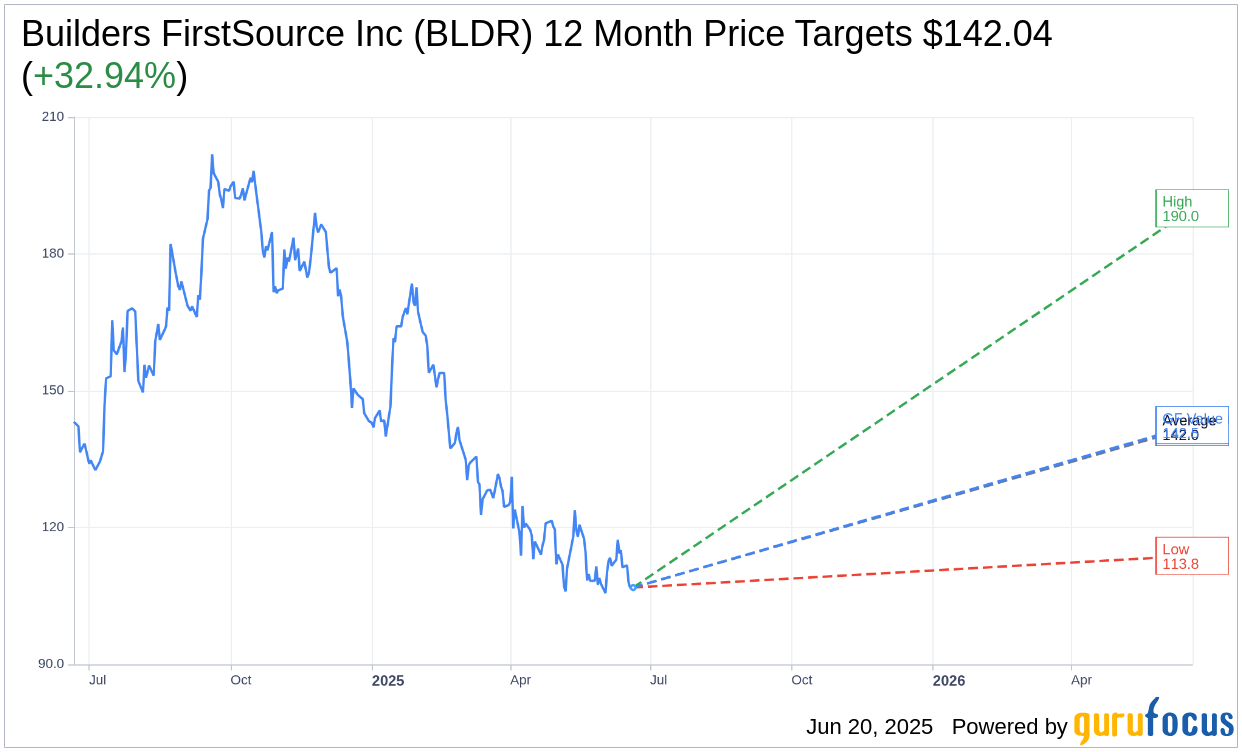

Based on the one-year price targets offered by 20 analysts, the average target price for Builders FirstSource Inc (BLDR, Financial) is $142.04 with a high estimate of $190.00 and a low estimate of $113.83. The average target implies an upside of 32.94% from the current price of $106.85. More detailed estimate data can be found on the Builders FirstSource Inc (BLDR) Forecast page.

Based on the consensus recommendation from 20 brokerage firms, Builders FirstSource Inc's (BLDR, Financial) average brokerage recommendation is currently 2.1, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Builders FirstSource Inc (BLDR, Financial) in one year is $142.49, suggesting a upside of 33.36% from the current price of $106.85. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Builders FirstSource Inc (BLDR) Summary page.