Welcome investors! Here's a quick summary of the latest insights on International Business Machines Corp (IBM, Financial):

- Wedbush reaffirms its "Outperform" rating for IBM, increasing the price target to $325.

- IBM's robust AI and cloud computing initiatives present substantial growth opportunities.

- Despite the optimism, current forecasts suggest potential downside risks from its present stock price.

Wedbush's Optimistic Stance on IBM

Wedbush has once again endorsed International Business Machines (IBM, Financial) with an "Outperform" rating, raising its price target significantly to $325 from the previous $300. This upward revision underscores IBM’s strategic positioning in the burgeoning fields of AI and cloud computing. Wedbush highlights IBM's diversified portfolio, which includes powerful assets like WatsonX and Red Hat, as pivotal to unlocking meaningful growth prospects for the company.

Wall Street Analysts' Price Targets for IBM

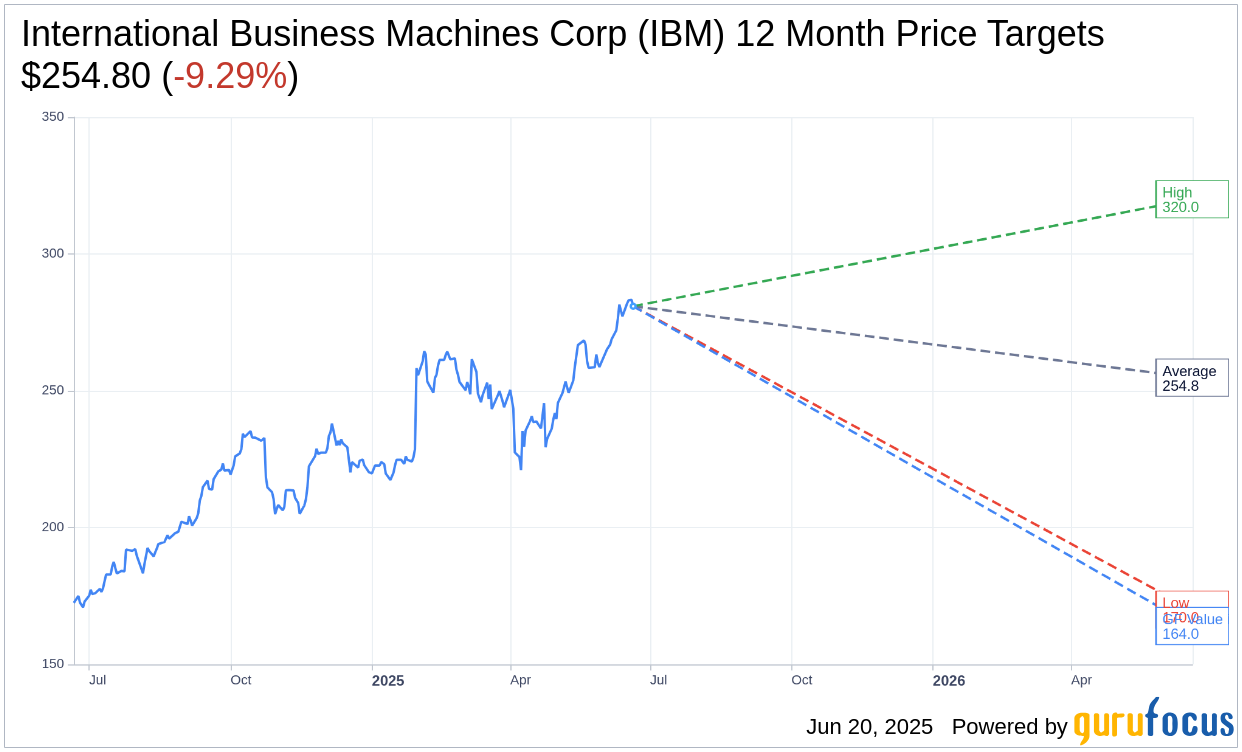

Current market analysis from 18 seasoned analysts projects an average one-year target price for IBM at $254.80. This includes a high estimate of $320.00 and a low estimate of $170.00. These figures suggest a potential downside of 9.29% from the current trading price of $280.91. For investors looking for more comprehensive estimate data, it is available on the International Business Machines Corp (IBM, Financial) Forecast page.

Consensus Recommendations from Brokerage Firms

The consensus recommendation from 23 brokerage firms presently rates IBM at an average of 2.4, indicating an "Outperform" status. This rating is part of a scale where 1 equates to a "Strong Buy" and 5 represents a "Sell." Such a positioning reflects a generally favorable outlook from financial experts.

GuruFocus Fair Value Estimate Analysis

According to GuruFocus estimates, the GF Value for IBM in the forthcoming year is calculated at $164.03, which indicates a potential downside of 41.61% from its current market price of $280.91. The GF Value is a calculated assessment based on IBM’s historical trading multiples, past business growth, and anticipated future performance metrics. More analytics and data can be accessed on the International Business Machines Corp (IBM, Financial) Summary page. This robust valuation tool can serve as a significant measure for long-term investment strategies.