- Meta Platforms opts for a $14.3 billion stake in Scale AI, aiming to enhance its presence in artificial general intelligence.

- Analysts provide a varied forecast for Meta's stock price, with an average price target of $714.93.

- Despite a strong "Outperform" rating, GuruFocus projects a possible downside based on current valuations.

Meta Platforms' Strategic Investment in AI

Meta Platforms (META, Financial) recently concluded discussions with the AI firm Perplexity AI and decided instead to make a substantial investment in Scale AI. This move is part of Meta's strategic commitment to pushing boundaries in artificial general intelligence. Investing $14.3 billion for a 49% stake, Meta values Scale AI at over $29 billion.

Analyst Forecast for Meta Platforms' Stock

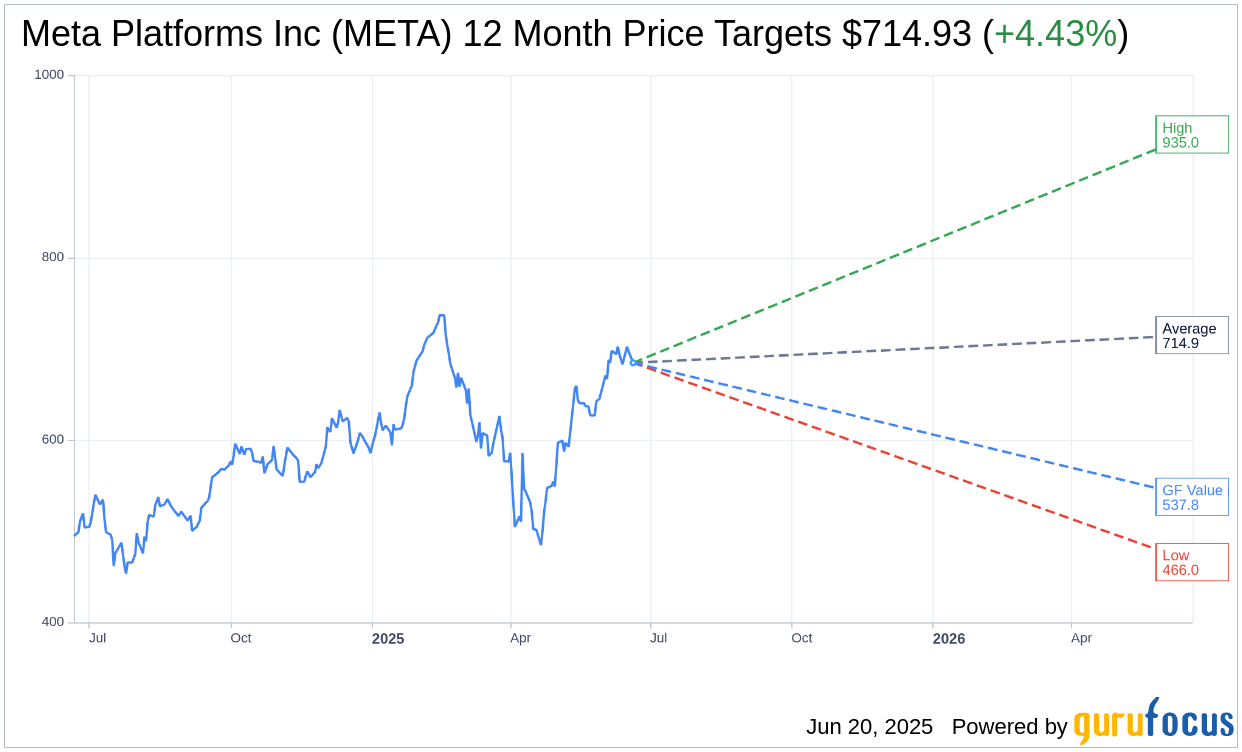

Meta's financial outlook garners attention with one-year price targets from 61 analysts. The forecasts reveal an average target price of $714.93, stretching from a high of $935.00 to a low of $466.00. This presents a potential upside of 4.43% from its present trading price of $684.63. For a more comprehensive view, visit the Meta Platforms Inc (META, Financial) Forecast page.

Brokerage Recommendations and GF Value Insights

The consensus among 71 brokerage firms offers an "Outperform" rating for Meta Platforms Inc (META, Financial), with an average recommendation of 1.8. The rating system ranges from 1, indicating a Strong Buy, to 5, signifying a Sell. This positive sentiment underscores Meta's promising market position.

Contrasting this optimism, GuruFocus estimates Meta's GF Value at $537.79 over the next year, implying a downside of 21.45% from the current stock price of $684.63. The GF Value metric considers historical trading multiples, past business growth, and future performance projections. Further details are available on the Meta Platforms Inc (META, Financial) Summary page.