Summary:

- State Street (STT, Financial) filed for a mixed securities shelf to efficiently raise capital.

- Analysts expect an 8.03% upside with an average price target of $107.62.

- Current "Outperform" rating with a GF Value estimate suggesting slight downside.

State Street Corporation (STT) recently took a strategic step by filing for an automatic mixed securities shelf. This initiative allows the company to issue a range of securities, providing it with the crucial ability to adapt swiftly to changing market landscapes. This flexibility is essential for effectively managing capital and seizing opportunities as they arise.

Wall Street Analysts Forecast

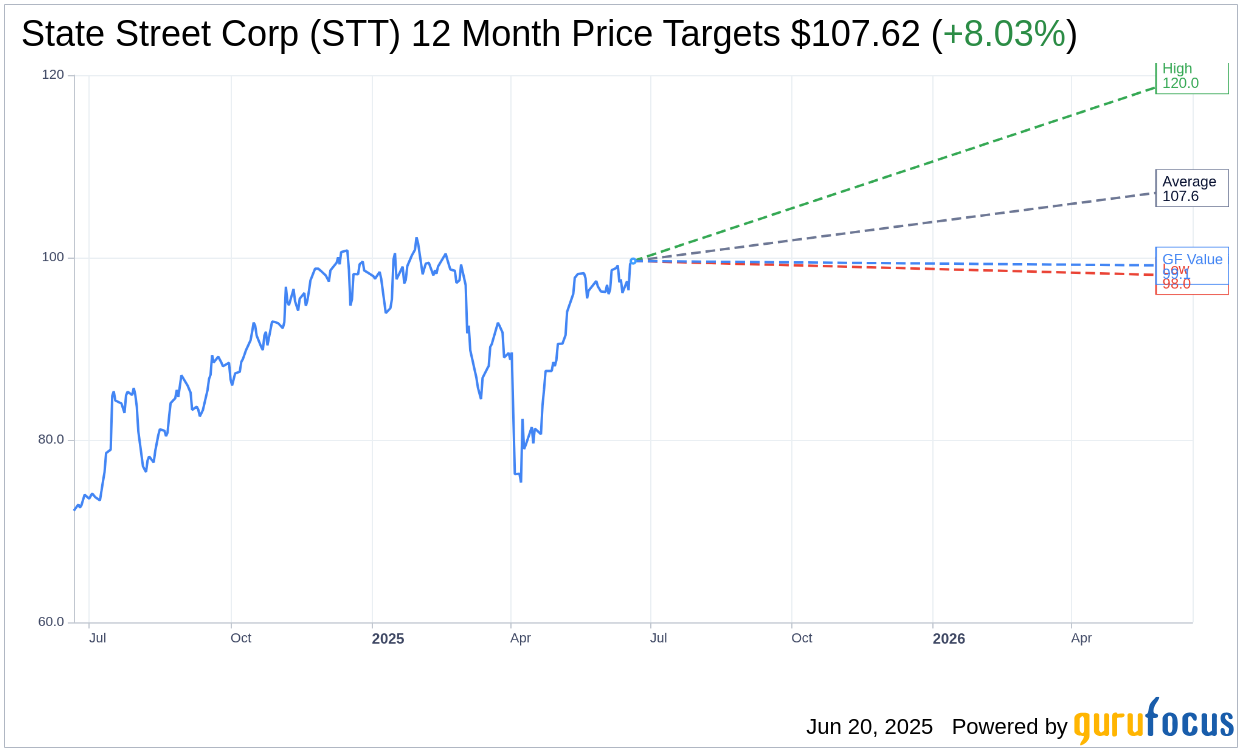

According to data gathered from 13 financial analysts, the average 12-month price target for State Street Corp (STT, Financial) stands at $107.62. The forecasts range with a high of $120.00 and a low of $98.00. This average target reflects an 8.03% potential upside from the current trading price of $99.62. Investors seeking more detailed price projections can explore the State Street Corp (STT) Forecast page.

In terms of analyst recommendations, 17 brokerage firms collectively assign State Street Corp (STT, Financial) an average rating of 2.5. This places the stock in the "Outperform" category. On the scale used, a rating of 1 indicates a Strong Buy, while a rating of 5 suggests a Sell recommendation, highlighting the stock's favorable outlook among industry experts.

Delving into GuruFocus metrics, the estimated GF Value for State Street Corp (STT, Financial) over the next year is calculated to be $99.11. This suggests a marginal downside of 0.51% from its current price of $99.62. The GF Value represents GuruFocus' assessment of the stock's intrinsic value, derived from historical trading multiples, past growth trends, and future performance projections. For a more comprehensive analysis, visit the State Street Corp (STT) Summary page.