Key Highlights:

- Super Micro Computer (SMCI, Financial) has issued $2 billion in convertible senior notes, maturing in 2030.

- The company's stock saw a premarket drop of 4.06%, landing at $43.48.

- Wall Street analysts provide mixed forecasts with a potential upside based on GuruFocus metrics.

Super Micro Computer (SMCI) has made a strategic financial move by issuing $2 billion in convertible senior notes that will mature by 2030. The proceeds are earmarked for capped call transactions, share repurchases, and various corporate initiatives. This decision comes amidst a drop in SMCI shares by 4.06% premarket, bringing the price to $43.48.

Analyst Price Targets: A Mixed Bag

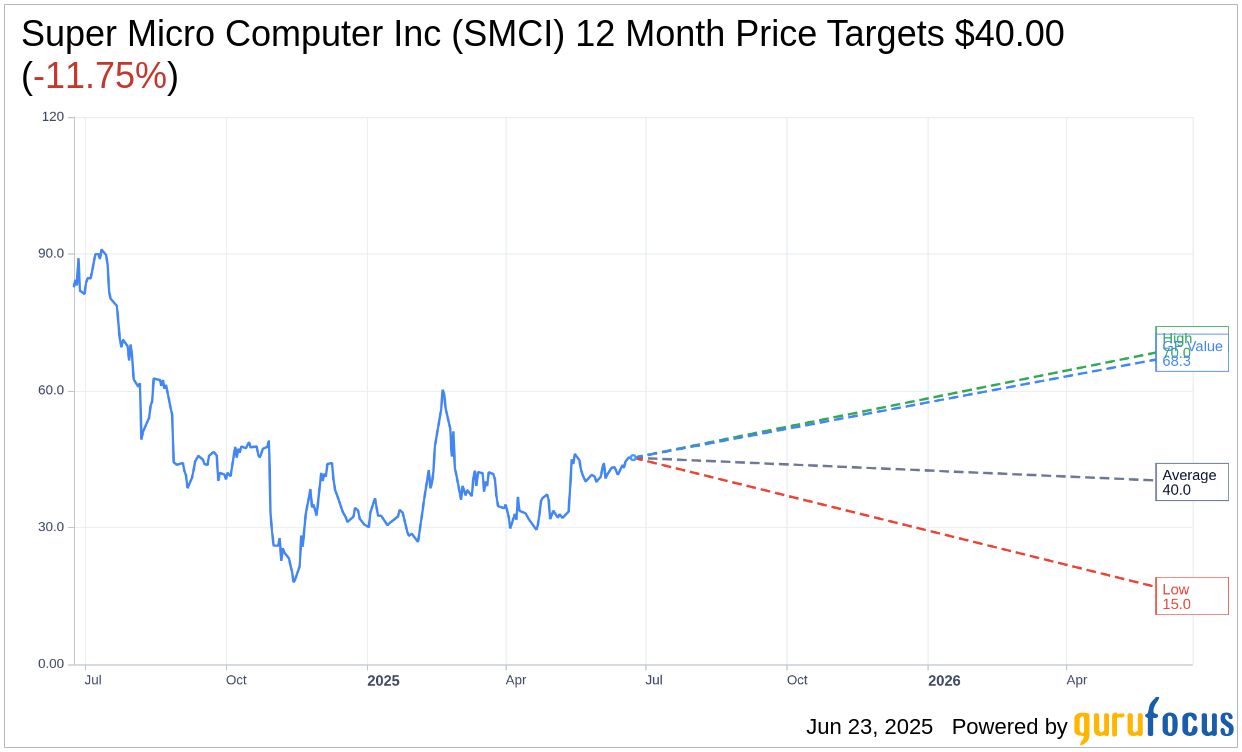

According to the one-year price targets set by 15 financial analysts, Super Micro Computer Inc (SMCI, Financial) currently holds an average target price of $40.00. This spans a wide spectrum with the highest estimate reaching $70.00 and the lowest at $15.00. These targets imply a potential downside of 11.75% compared to the present stock price of $45.32. For more detailed projections, you can visit the Super Micro Computer Inc (SMCI) Forecast page.

Brokerage Recommendations: Hold Steady

Consensus from 18 brokerage firms currently ranks Super Micro Computer Inc's (SMCI, Financial) stock with an average recommendation rating of 2.7, which suggests a "Hold" position. The ratings scale spans from 1 to 5, where 1 represents a Strong Buy and 5 indicates a Sell.

GF Value: An Optimistic Perspective

Leveraging GuruFocus estimates, the upcoming year's GF Value for Super Micro Computer Inc (SMCI, Financial) is projected at $68.35, pointing to a potential upside of 50.82% from the current stock price of $45.32. This GF Value is a comprehensive estimate of the fair value the stock should ideally trade at, derived from historical stock multiples, business growth trends, and future performance forecasts. More elaborate details can be found on the Super Micro Computer Inc (SMCI) Summary page.