In a recent development, JP Morgan has initiated coverage on Red Rock Resorts (RRR, Financial). The financial institution's analyst, Daniel Politzer, has assigned an "Overweight" rating to the stock, suggesting a positive outlook.

As part of this coverage initiation, a price target of USD 62.00 has been announced for RRR. This price target indicates the analyst's expectation for the stock's performance and potential growth trajectory in the market.

This coverage initiation by JP Morgan marks a significant step for Red Rock Resorts (RRR, Financial), as it attracts attention from a leading financial firm. Investors and market watchers will be keenly observing the stock's performance in light of this development.

The announcement was made on June 23, 2025, signaling a potential opportunity for investors considering RRR as a strategic addition to their portfolios.

Wall Street Analysts Forecast

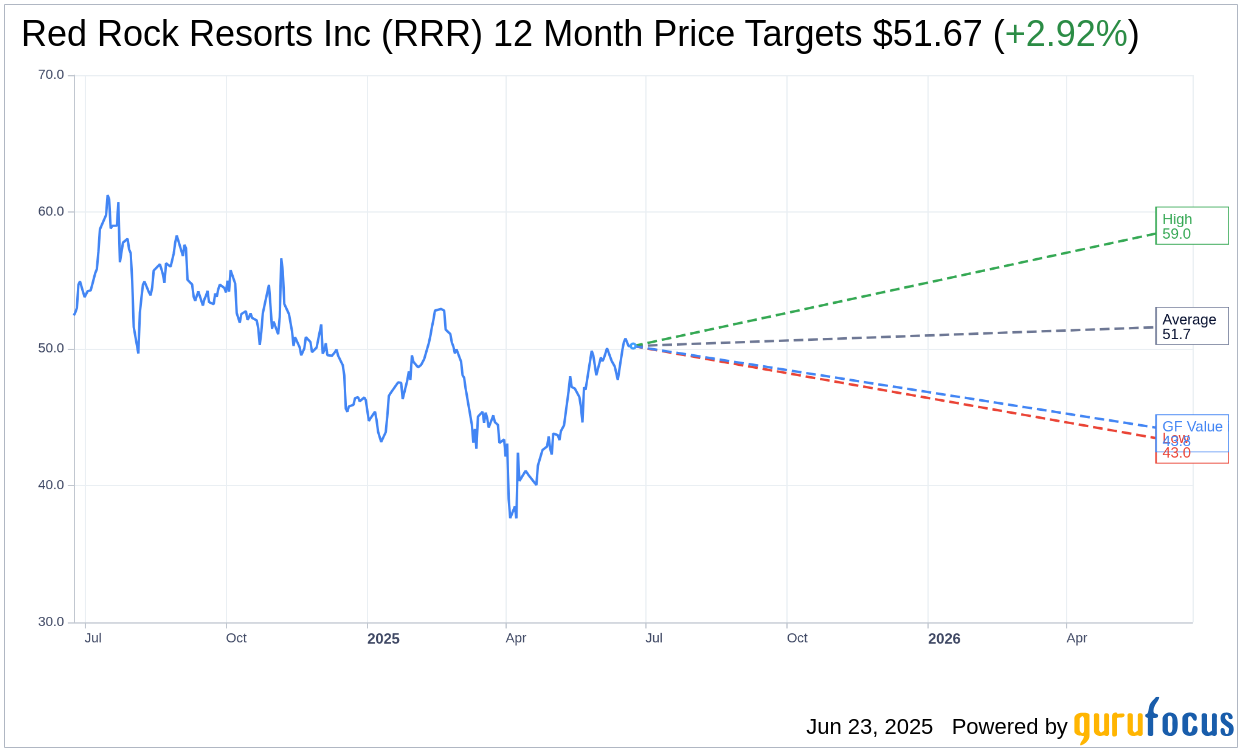

Based on the one-year price targets offered by 12 analysts, the average target price for Red Rock Resorts Inc (RRR, Financial) is $51.67 with a high estimate of $59.00 and a low estimate of $43.00. The average target implies an upside of 2.92% from the current price of $50.20. More detailed estimate data can be found on the Red Rock Resorts Inc (RRR) Forecast page.

Based on the consensus recommendation from 12 brokerage firms, Red Rock Resorts Inc's (RRR, Financial) average brokerage recommendation is currently 2.4, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Red Rock Resorts Inc (RRR, Financial) in one year is $43.82, suggesting a downside of 12.71% from the current price of $50.2. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Red Rock Resorts Inc (RRR) Summary page.