Quick Summary:

- Apple (AAPL, Financial) must comply with the European Commission's Digital Markets Act to avoid substantial fines.

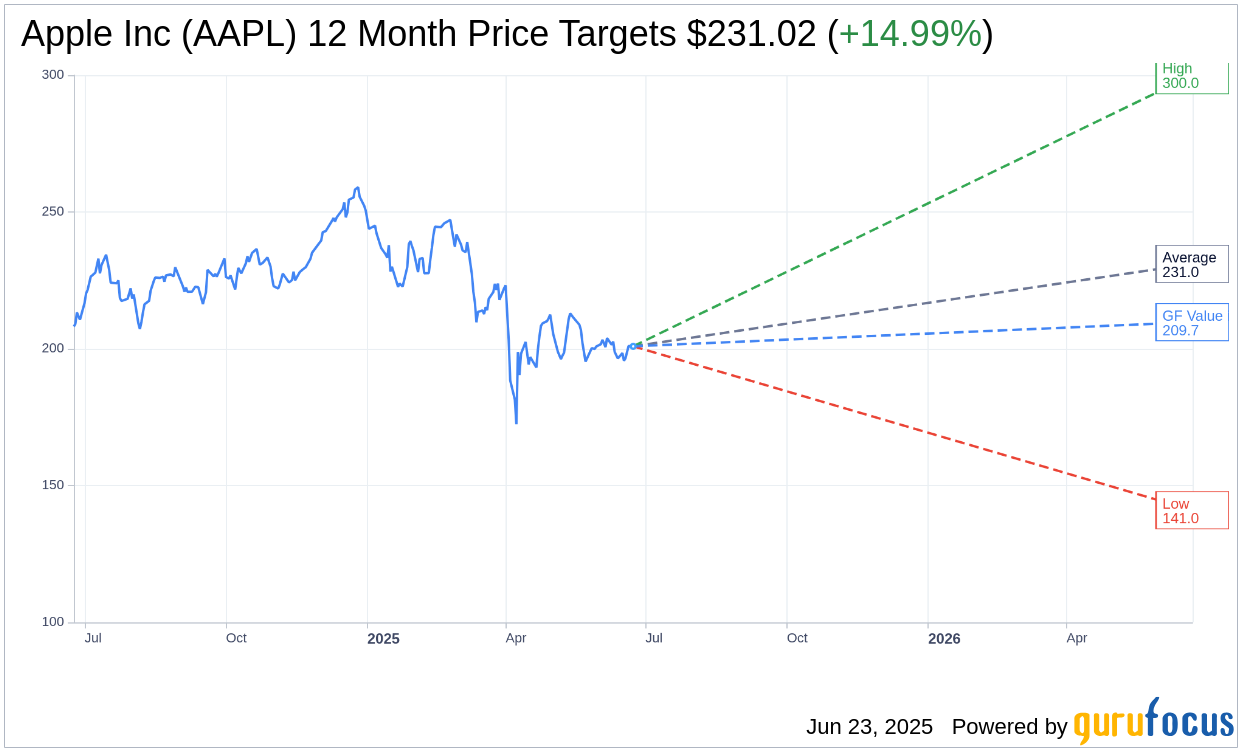

- Analysts project an average price target for Apple at $231.02, suggesting a potential upside of nearly 15%.

- The current brokerage consensus rates Apple as "Outperform," with a GF Value estimate showing a moderate upside.

Apple Inc. (AAPL) is fast approaching a critical deadline imposed by the European Commission's Digital Markets Act. The tech giant is in the midst of negotiations, aiming to adjust its App Store practices and its Core Technology Fee to sidestep punitive fines that could be as steep as 5% of its global revenue. This development is pivotal for investors monitoring Apple's regulatory challenges in Europe.

Wall Street Analysts Forecast

In light of current market evaluations, 41 analysts have set a one-year price target for Apple Inc. (AAPL, Financial), with an average target price of $231.02. Price estimates range from a high of $300.00 to a low of $141.00. This average target reveals a potential upside of 14.99% from Apple's present trading price of $200.91. For more extensive data on these projections, visit the Apple Inc (AAPL) Forecast page.

Brokerage Firm Insights

Currently, 50 brokerage firms contribute to a consensus recommendation for Apple Inc. (AAPL, Financial), averaging a 2.2 rating. This translates to an "Outperform" status on the rating scale, where 1 represents a Strong Buy, and 5 indicates a Sell. Such a consensus reflects analysts' confidence in Apple's market trajectory.

GuruFocus Valuation Perspective

According to GuruFocus metrics, the estimated GF Value for Apple Inc. (AAPL, Financial) within the next year is projected at $209.73. This suggests a modest upside of 4.39% from the current share price of $200.91. The GF Value is GuruFocus' calculated fair value, informed by the stock's historical trading multiples, past business growth, and anticipated future performance. For further insights, explore the Apple Inc (AAPL) Summary page.