Jefferies has revised its price target for Kroger (KR, Financial), lifting it from $75 to $83, while maintaining a Buy rating on the stock. The decision follows Kroger's strong performance in the first quarter, with the analyst optimistic about the company's future given recent management strategies. These strategies include accelerating the opening of new stores, closing less efficient ones, evaluating non-core assets, reassessing capital allocation, and restructuring e-commerce operations. The focus on enhancing consumer value and competitive pricing indicates a strong commitment to advancing Kroger's market position.

Wall Street Analysts Forecast

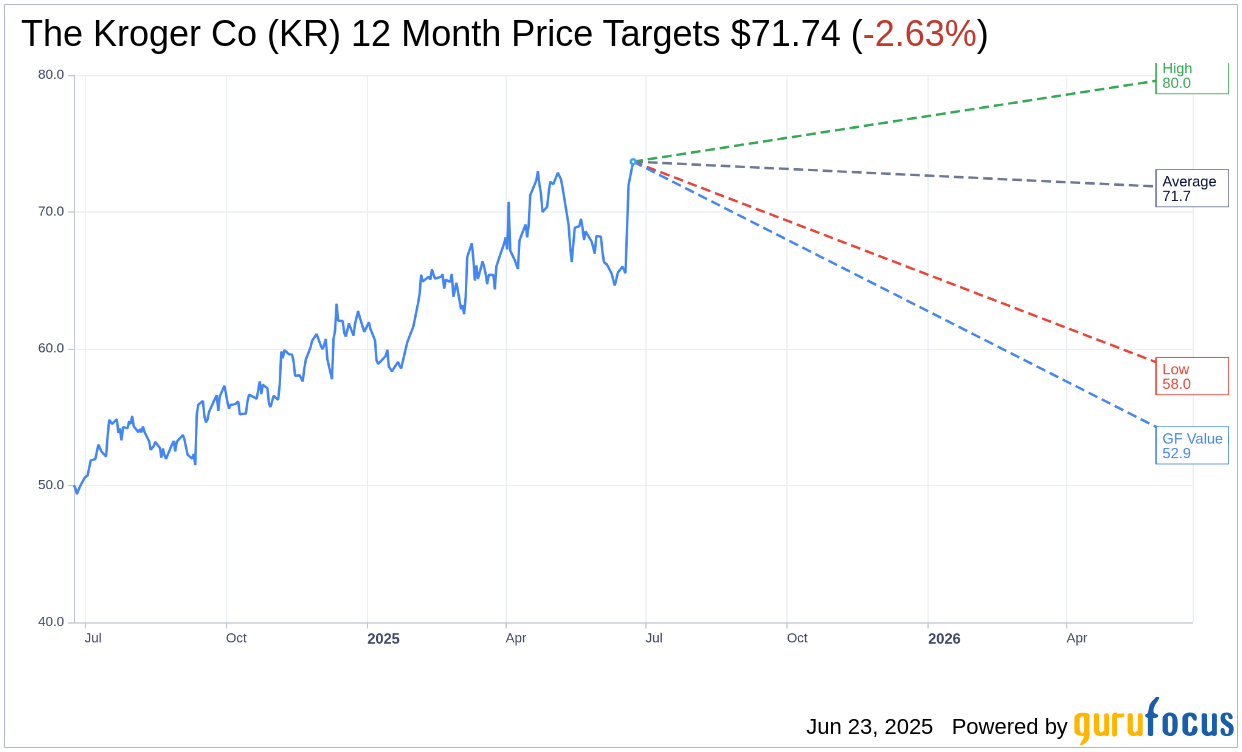

Based on the one-year price targets offered by 19 analysts, the average target price for The Kroger Co (KR, Financial) is $71.74 with a high estimate of $80.00 and a low estimate of $58.00. The average target implies an downside of 2.60% from the current price of $73.66. More detailed estimate data can be found on the The Kroger Co (KR) Forecast page.

Based on the consensus recommendation from 25 brokerage firms, The Kroger Co's (KR, Financial) average brokerage recommendation is currently 2.3, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for The Kroger Co (KR, Financial) in one year is $52.94, suggesting a downside of 28.12% from the current price of $73.655. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the The Kroger Co (KR) Summary page.

KR Key Business Developments

Release Date: June 20, 2025

- Identical Sales Growth (Excluding Fuel): Increased by 3.2%.

- Adjusted Net Earnings Per Diluted Share: $1.49, an increase of 4%.

- E-commerce Sales Growth: 15% increase in the first quarter.

- Fresh Sales Performance: Strong performance, better than center store sales.

- Our Brands Sales Growth: Grew faster than national brands for the seventh consecutive quarter.

- Store Closures: Plans to close approximately 60 stores over the next 18 months.

- New Store Projects: On track to complete 30 major store projects in 2025.

- Adjusted FIFO Operating Profit: $1.5 billion.

- Fuel Sales: Lower than last year, with fewer gallons sold.

- Net Total Debt to Adjusted EBITDA: 1.69.

- Capital Allocation: $5 billion ASR program expected to complete by the third fiscal quarter of 2025.

- Full Year Guidance for Identical Sales Without Fuel: Raised to a range of 2.25% to 3.25%.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- The Kroger Co (KR, Financial) reported a solid first quarter with strong sales in pharmacy, e-commerce, and fresh categories, leading to a 3.2% increase in identical sales, excluding fuel.

- The company's Our Brands segment continues to outperform national brands for the seventh consecutive quarter, driven by high-quality products and innovation such as the introduction of 80 new protein products.

- E-commerce sales grew by 15% in the first quarter, with improvements in order accuracy and reduced pickup wait times, contributing to increased customer engagement.

- The Kroger Co (KR) is focusing on cost optimization and efficiency, which includes modernizing operations and reviewing non-core assets to reinvest savings into lower prices and additional store hours.

- The company is committed to improving associate wages and benefits, which has resulted in record retention rates and a better customer experience.

Negative Points

- The Kroger Co (KR) plans to close approximately 60 underperforming stores over the next 18 months, which could impact local employment and community presence.

- Fuel sales were lower than expected, with a decline in gallons sold and profitability, posing a headwind for the company's results for the remainder of the year.

- Despite growth in e-commerce, the segment is not yet profitable, and the company acknowledges the need for further improvements to achieve profitability.

- The macroeconomic environment remains uncertain, with customers spending cautiously and seeking more value, which could impact sales growth.

- The company faces challenges with ongoing labor negotiations, including a recent strike by associates at King Super store locations, which could affect operations and labor relations.