Lake Street has adjusted its price target for Smith & Wesson Brands (SWBI, Financial) to $11 from a previous $12.50, while maintaining a Buy rating on the stock. This revision follows the company's fourth-quarter results, which fell short of the firm’s expectations in both sales and earnings. The analyst expressed disappointment with the Q4 performance and the initial outlook for Q1, attributing the reduced forecast to broader economic trends influencing consumer spending, sales, and profit margins.

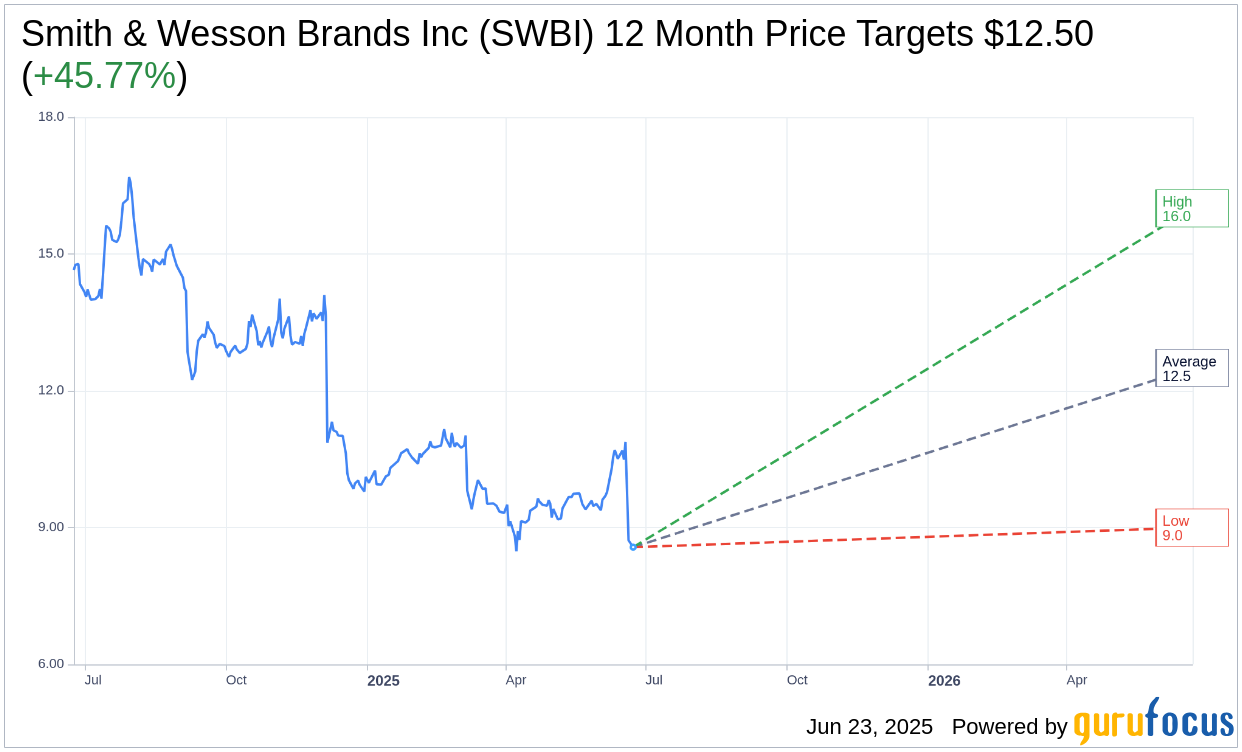

Wall Street Analysts Forecast

Based on the one-year price targets offered by 3 analysts, the average target price for Smith & Wesson Brands Inc (SWBI, Financial) is $12.50 with a high estimate of $16.00 and a low estimate of $9.00. The average target implies an upside of 45.77% from the current price of $8.58. More detailed estimate data can be found on the Smith & Wesson Brands Inc (SWBI) Forecast page.

Based on the consensus recommendation from 3 brokerage firms, Smith & Wesson Brands Inc's (SWBI, Financial) average brokerage recommendation is currently 2.3, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

SWBI Key Business Developments

Release Date: June 18, 2025

- Net Sales: $140.8 million, down 11.6% from the prior year comparable quarter.

- New Products Revenue: Accounted for 43.9% of total revenue in the fourth quarter.

- Gross Margin: 28.8%, a decrease of 6.7 percentage points from the prior year comparable quarter.

- Operating Expenses: $27.4 million, $2.1 million lower than the prior year comparable quarter.

- Net Income: $8.6 million, $18.7 million less than the prior year comparable quarter.

- GAAP Earnings Per Share (EPS): $0.19, down from $0.59 in the prior year comparable quarter.

- Non-GAAP Earnings Per Share (EPS): $0.20, down from $0.48 in Q4 fiscal 2024.

- Cash from Operations: $40.8 million generated during the quarter.

- Capital Expenditures: $7.3 million spent on capital projects.

- Net Free Cash: $33.5 million.

- Dividends Paid: $5.7 million.

- Revolving Line of Credit Repayment: $30 million repaid.

- Cash on Hand: $25.2 million at the end of the quarter.

- Borrowings: $80 million on the line of credit.

- Loan Availability: $92.3 million at the end of fiscal 2025.

- Quarterly Dividend: $0.13 per share, payable on July 21.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- New products accounted for 44% of sales in the fourth quarter, highlighting strong innovation and competitive differentiation.

- Smith & Wesson Brands Inc (SWBI, Financial) gained market share in handguns, with shipments declining less than the overall market.

- The company maintained a strong balance sheet and is comfortable with internal inventory levels.

- Smith & Wesson Brands Inc (SWBI) plans to continue investing in innovation to maintain market share leadership.

- The company generated $40.8 million in cash from operations during the quarter, demonstrating strong cash flow management.

Negative Points

- Net sales for the fourth quarter were $140.8 million, down 11.6% from the prior year, reflecting challenging market conditions.

- Gross margin decreased by 6.7 percentage points compared to the prior year, due to lower production volumes and pricing pressures.

- Net income for the fourth quarter was $8.6 million, significantly lower than the prior year's $27.3 million.

- Average selling prices trended lower year-over-year, with a 4.5% decline in Q4, impacting profitability.

- The company anticipates continued economic headwinds, such as inflation and tariffs, which may pressure demand and margins in fiscal 2026.