Curiosity (CURI, Financial) has unveiled its latest streaming service, Curiosity University, now available on Amazon Prime Video Channels in the United Kingdom. This move signifies a strategic enhancement of Curiosity's digital footprint in the region. Curiosity University will complement the company's main service, Curiosity Stream, as part of Amazon's add-on subscription options. The expansion aims to broaden Curiosity's reach and strengthen its presence in the UK digital streaming market.

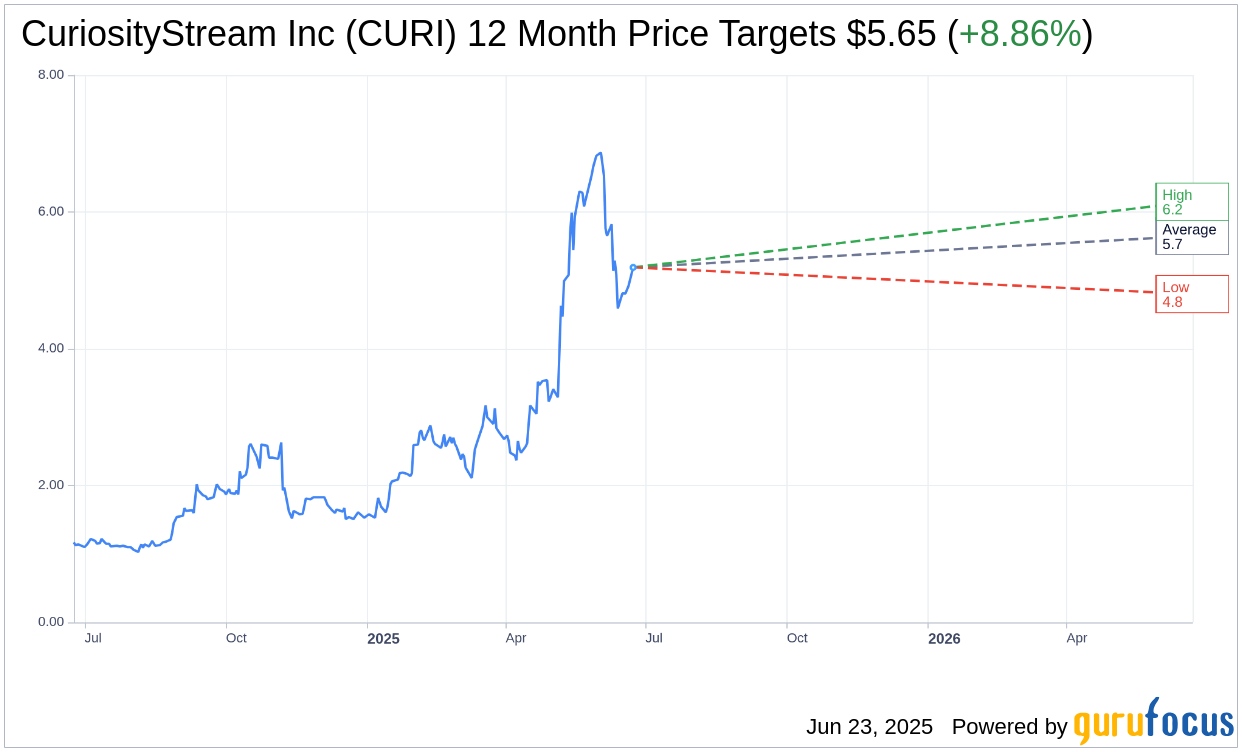

Wall Street Analysts Forecast

Based on the one-year price targets offered by 3 analysts, the average target price for CuriosityStream Inc (CURI, Financial) is $5.65 with a high estimate of $6.15 and a low estimate of $4.80. The average target implies an upside of 8.86% from the current price of $5.19. More detailed estimate data can be found on the CuriosityStream Inc (CURI) Forecast page.

Based on the consensus recommendation from 3 brokerage firms, CuriosityStream Inc's (CURI, Financial) average brokerage recommendation is currently 1.7, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for CuriosityStream Inc (CURI, Financial) in one year is $1.14, suggesting a downside of 78.03% from the current price of $5.19. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the CuriosityStream Inc (CURI) Summary page.

CURI Key Business Developments

Release Date: May 06, 2025

- Revenue: $15.1 million, up 26% year over year and 7% sequentially.

- Net Income: $0.3 million or $0.01 per share, first positive net income in company history.

- Adjusted EBITDA: $1.1 million, an improvement of $3.9 million from the previous year.

- Adjusted Free Cash Flow: $2 million, an increase of $0.8 million compared to last year.

- Gross Margin: 53%, improved from 44% a year ago.

- Operating Expenses: Declined by $1 million or 11% compared to last year.

- Cash and Securities: $39.1 million with no outstanding debt.

- Dividend: Increased to $0.08 per quarter or $0.32 annualized.

- Q2 Revenue Guidance: Expected in the range of $16 million to $17 million.

- Q2 Adjusted Free Cash Flow Guidance: Expected in the range of $2 million to $3 million.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- CuriosityStream Inc (CURI, Financial) reported a 26% year-over-year increase in Q1 revenue, reaching $15.1 million.

- The company achieved positive net income for the first time, with a $5.4 million improvement from the previous year.

- Adjusted EBITDA was positive at $1.1 million, marking a significant improvement from a loss of $2.8 million a year ago.

- CuriosityStream Inc (CURI) has maintained positive cash flow for five consecutive quarters.

- The company announced a doubling of its quarterly dividend to $0.08, reflecting confidence in future performance and commitment to shareholder returns.

Negative Points

- Direct subscription revenue was slightly down, attributed to fluctuations in marketing spend.

- The company faces challenges in maintaining consistent direct subscription growth due to marketing spend variability.

- Despite positive financial metrics, CuriosityStream Inc (CURI) did not provide specific year-end guidance, indicating potential uncertainty.

- The company relies heavily on licensing revenue, which may not be as stable as subscription revenue.

- Operating expenses, while reduced, could potentially increase in the future as marketing efforts ramp up.