Truist has revised its price target for CarMax (KMX, Financial), moving it from $72 to $74, while maintaining a Hold recommendation on the stock. The adjustment follows a robust first-quarter performance, highlighted by used unit comparable sales growth of 8.1%. This increase may have been fueled by consumers hastening purchases in anticipation of potential tariffs. Looking ahead, CarMax faces more challenging comparisons in the second quarter, with sustainability of growth being a critical issue. The company is advised to enhance its core run rate to ensure continued success.

Wall Street Analysts Forecast

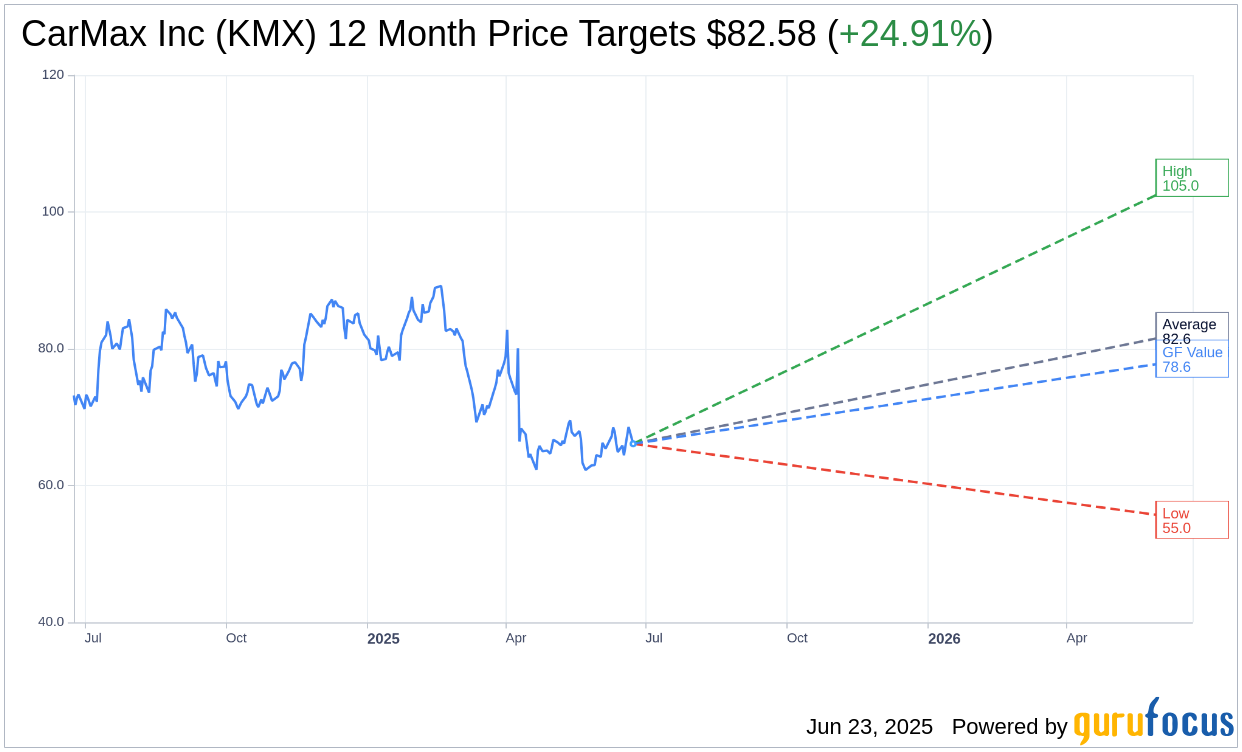

Based on the one-year price targets offered by 14 analysts, the average target price for CarMax Inc (KMX, Financial) is $82.58 with a high estimate of $105.00 and a low estimate of $55.00. The average target implies an upside of 24.91% from the current price of $66.11. More detailed estimate data can be found on the CarMax Inc (KMX) Forecast page.

Based on the consensus recommendation from 19 brokerage firms, CarMax Inc's (KMX, Financial) average brokerage recommendation is currently 2.2, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for CarMax Inc (KMX, Financial) in one year is $78.56, suggesting a upside of 18.83% from the current price of $66.11. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the CarMax Inc (KMX) Summary page.

KMX Key Business Developments

Release Date: June 20, 2025

- Total Sales: $7.5 billion, up 6% year-over-year.

- Retail Unit Sales: Increased 9% with used unit comps up 8.1%.

- Average Retail Selling Price: $26,100, a decrease of approximately $400 per unit year-over-year.

- Wholesale Unit Sales: Up 1.2% year-over-year.

- Average Wholesale Selling Price: $8,000, a decline of approximately $150 per unit.

- Net Earnings Per Diluted Share: $1.38, up 42% year-over-year.

- Total Gross Profit: $894 million, up 13% year-over-year.

- Retail Gross Profit Per Used Unit: $2,407, up $60 year-over-year, a record high.

- Wholesale Gross Profit Per Unit: $1,047, historically strong but slightly down from last year.

- SG&A Expenses: $660 million, up 3% year-over-year.

- SG&A to Gross Profit: Leveraged by 680 basis points to 74%.

- CarMax Auto Finance Originations: Over $2.3 billion with a sales penetration of 41.8%.

- Net Interest Margin: 6.5%, up over 30 basis points year-over-year.

- Loan Loss Provision: $102 million, with a total reserve balance of $474 million.

- Share Repurchases: Approximately 3 million shares for $200 million.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- CarMax Inc (KMX, Financial) achieved a 42% growth in earnings per share, marking the fourth consecutive quarter of positive retail unit comps and double-digit EPS growth.

- The company reported total sales of $7.5 billion, a 6% increase from the previous year, driven by higher volume despite lower prices.

- Retail gross profit per used unit reached an all-time high, supported by strong demand and operational efficiencies in logistics and reconditioning.

- CarMax Inc (KMX) successfully leveraged SG&A expenses, achieving a 680 basis point improvement as a percentage of gross profit.

- The company doubled its share repurchase pace, buying back approximately 3 million shares for $200 million, with $1.74 billion of repurchase authorization remaining.

Negative Points

- CarMax Auto Finance's sales penetration decreased by 150 basis points year-over-year, primarily due to an influx of self-funded higher credit purchasers.

- The average retail selling price decreased by approximately $400 per unit year-over-year, reflecting pricing pressures.

- Wholesale gross profit per unit, while historically strong, was slightly down from the previous year.

- The loan loss provision increased to $102 million, influenced by higher sales and lower credit quality, as well as uncertain economic outlooks.

- The company's digital sales, while significant, saw a slight decline in the percentage of total sales compared to the previous quarter.