Key Insights:

- NuScale Power's stock recently faced a 1.8% drop, influenced by Citi's Neutral rating initiation.

- Analysts suggest a significant downside from current prices, emphasizing potential execution challenges.

- Despite uncertainties, the company shows promise with its cutting-edge modular reactor technology.

NuScale Power's Market Potential and Current Evaluations

NuScale Power (SMR, Financial), a leader in the modular reactor technology sphere, recently experienced a 1.8% decline in stock value, triggered by Citi's initiation of coverage with a Neutral rating and a $46 target. Although the company is at the forefront of innovative reactor technology and maintains strategic partnerships, Citi highlights potential execution risks, with current share prices already factoring in extensive installations projected by 2040. However, securing a new contract might serve as a catalyst for a short-term stock uplift.

Wall Street Analysts Forecast

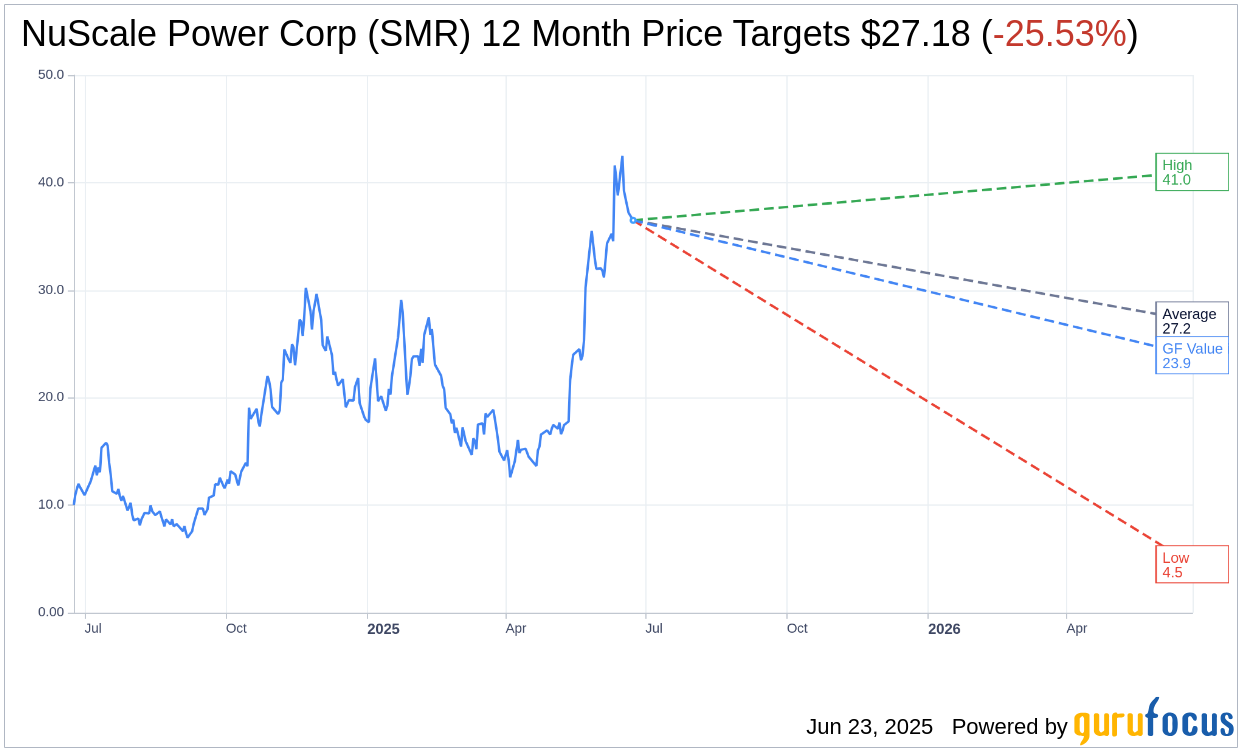

According to projections from 10 analysts for the forthcoming year, the average target price for NuScale Power Corp (SMR, Financial) is estimated at $27.18, with forecasts spanning a high of $41.00 and a low of $4.50. This indicates a potential downside of 25.53% from the current trading price of $36.50. For further detailed estimates, investors can refer to the NuScale Power Corp (SMR) Forecast page.

Brokerage Recommendations and GF Value Analysis

The consensus among 11 brokerage firms places NuScale Power Corp (SMR, Financial) at an average recommendation of 2.4, suggesting an "Outperform" status. This recommendation level falls within a scale where 1 signals a Strong Buy and 5 indicates a Sell.

Utilizing GuruFocus estimates, the projected GF Value for NuScale Power Corp (SMR, Financial) in one year is $23.95, pointing to a potential downside of 34.38% from its current market price of $36.5. The GF Value represents GuruFocus' fair value estimate, derived from the stock's historical trading multiples, its past business growth, and anticipated future performance. For a more comprehensive data analysis, please visit the NuScale Power Corp (SMR) Summary page.