Insight Molecular Diagnostics (IMDX, Financial) has unveiled findings from a pivotal study comparing its GraftAssureIQ test kit to another established test in the market. The research demonstrated that both kits effectively measure donor-derived cell-free DNA, a crucial indicator of transplant rejection risk. This outcome bolsters IMDX's strategic focus on launching its inaugural clinical diagnostic test kit to tap into the lucrative $1 billion transplant rejection testing sector.

In 2025, IMDX is diligently advancing through the essential phases needed to move from product development towards commercial readiness. Conducted by University Hospital Heidelberg in Germany, the study marks the first direct analysis of two dd-cfDNA test kits utilizing single nucleotide polymorphisms. While one kit operates with next-generation sequencing technology, the GraftAssureIQ employs digital polymerase chain reaction (PCR), which accurately quantifies DNA targets rather than sequencing the DNA.

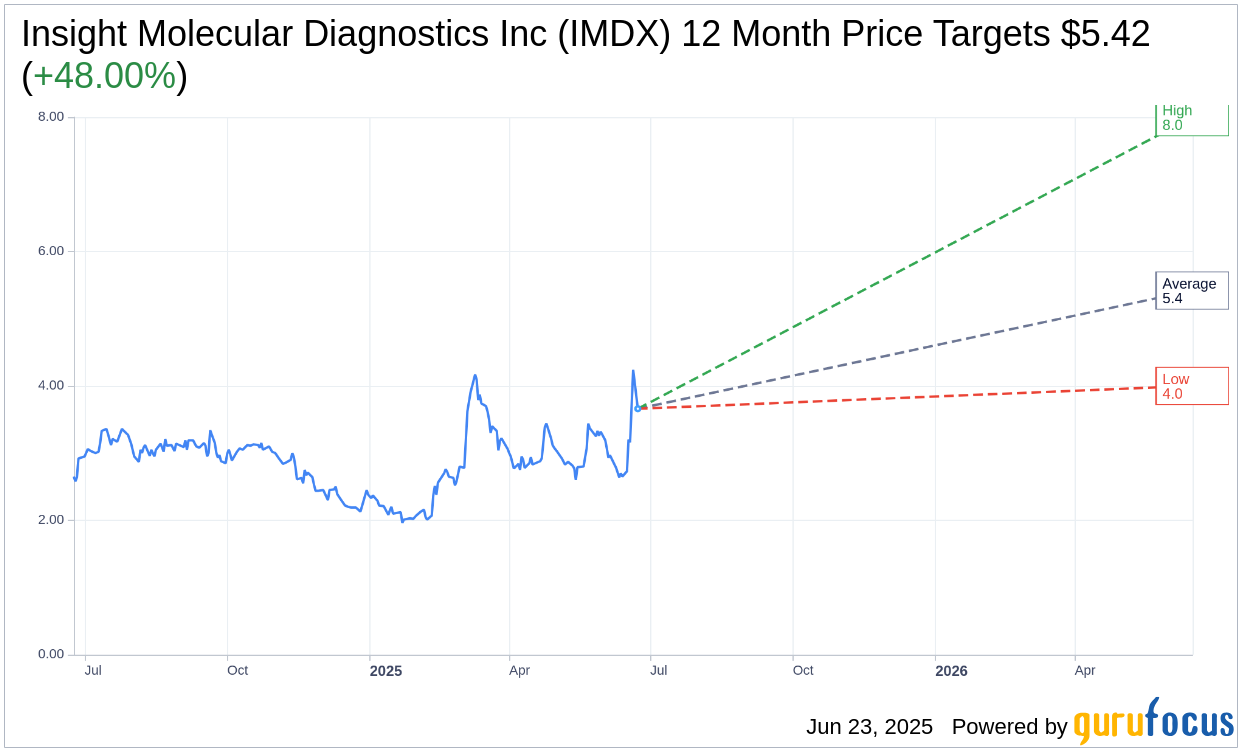

Wall Street Analysts Forecast

Based on the one-year price targets offered by 3 analysts, the average target price for Insight Molecular Diagnostics Inc (IMDX, Financial) is $5.42 with a high estimate of $8.00 and a low estimate of $4.00. The average target implies an upside of 48.00% from the current price of $3.66. More detailed estimate data can be found on the Insight Molecular Diagnostics Inc (IMDX) Forecast page.

Based on the consensus recommendation from 4 brokerage firms, Insight Molecular Diagnostics Inc's (IMDX, Financial) average brokerage recommendation is currently 2.5, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.