Bernstein has begun coverage of Dyne Therapeutics (DYN, Financial), assigning the stock a Market Perform rating and setting a price target of $13. The firm identifies muscle therapies as one of the promising future areas for oligonucleotides, with Dyne being recognized as a leader due to its advanced antibody-conjugated delivery technology.

While acknowledging Dyne's potential, Bernstein favors Avidity Biosciences over Dyne, citing Avidity's broader risk management through multiple drugs undergoing pivotal trials, a cautious regulatory approach targeting the sizable myotonic dystrophy type 1 market, and a robust financial position with sufficient funds expected to last until 2027.

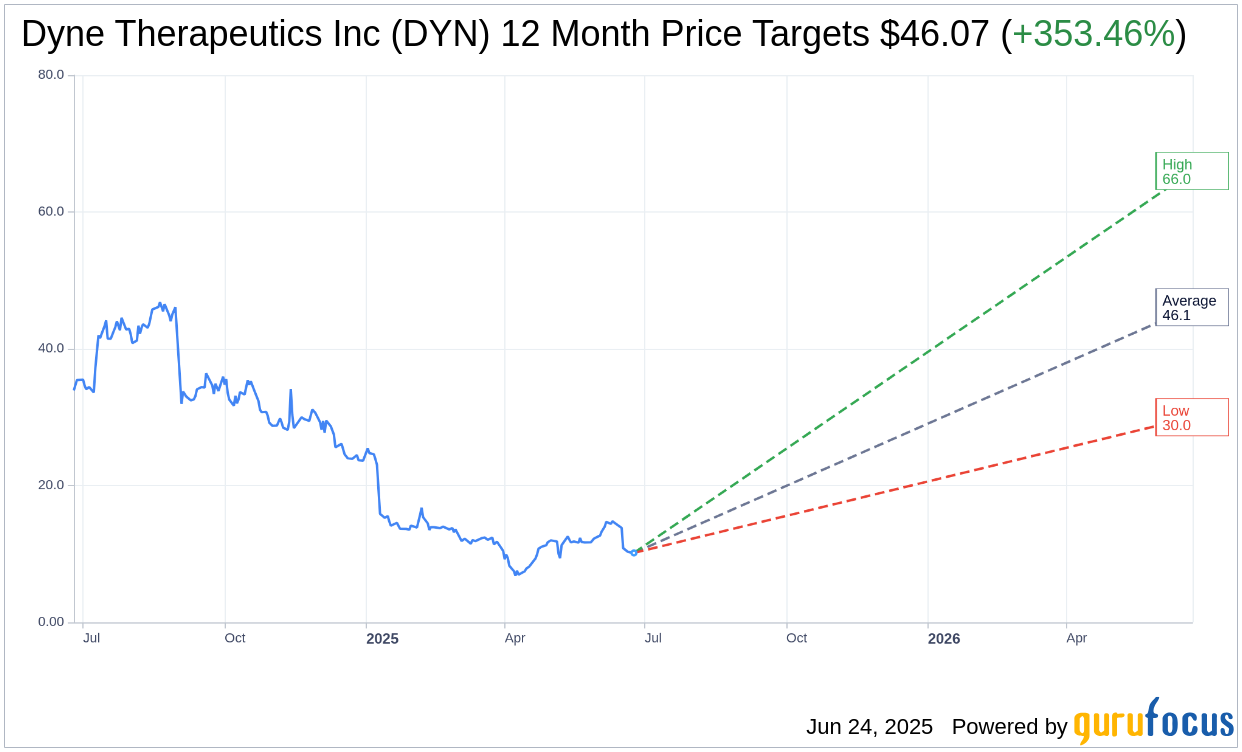

Wall Street Analysts Forecast

Based on the one-year price targets offered by 14 analysts, the average target price for Dyne Therapeutics Inc (DYN, Financial) is $46.07 with a high estimate of $66.00 and a low estimate of $30.00. The average target implies an upside of 353.46% from the current price of $10.16. More detailed estimate data can be found on the Dyne Therapeutics Inc (DYN) Forecast page.

Based on the consensus recommendation from 15 brokerage firms, Dyne Therapeutics Inc's (DYN, Financial) average brokerage recommendation is currently 1.7, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.