- MetLife anticipates variable investment income to range from $175 million to $225 million for the quarter ending June 30.

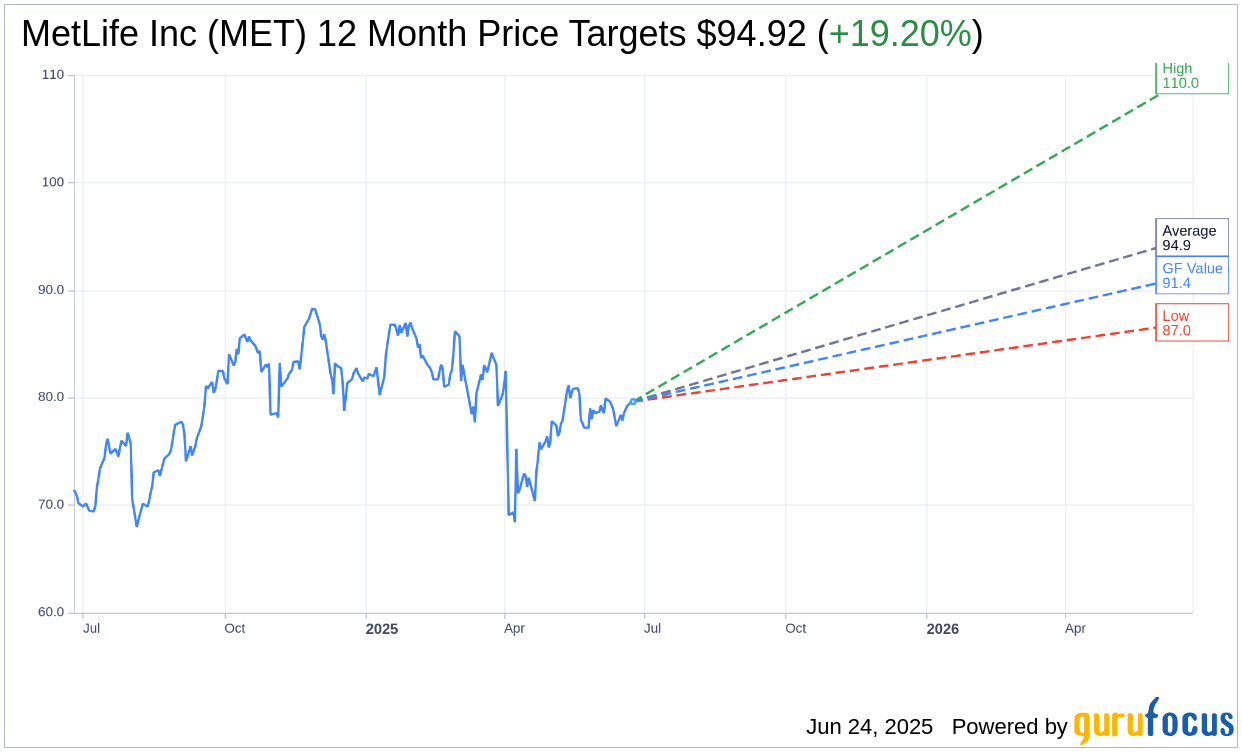

- Analysts set a one-year price target average for MetLife at $94.92, marking a 19.20% potential upside.

- GuruFocus estimates MetLife’s GF Value to suggest a 14.77% upside, forecasting a fair value price of $91.39.

MetLife (MET, Financial) is projecting a variable investment income for the quarter ending June 30 to fall between $175 million and $225 million, before tax considerations. This projection includes income from private equity, real estate investments, and other diversified funds.

Analyst Price Targets for MetLife

According to projections from 12 Wall Street analysts, MetLife Inc (MET, Financial) has an average one-year target price of $94.92. The forecasts range from a low of $87.00 to a high of $110.00. This average target suggests a potential upside of 19.20% from its current trading price of $79.63. Investors can find more detailed projections on the MetLife Inc (MET) Forecast page.

Broker Firm Recommendations

Consensus recommendations from 17 brokerage firms classify MetLife Inc (MET, Financial) with an average rating of 2.1, indicating it is seen as "Outperform". This rating system spans from 1, meaning Strong Buy, to 5, indicating a Sell position.

GuruFocus GF Value Analysis

GuruFocus measures suggest the GF Value for MetLife Inc (MET, Financial) over the next year is projected at $91.39, offering a 14.77% upside from the current price of $79.63. The GF Value represents what the stock should rationally trade at, using historical multiples, past business growth, and future business performance estimates. For further insights, visit the MetLife Inc (MET) Summary page.