Array Technologies, Inc. (ARRY, Financial) has revealed plans to issue $250 million in convertible senior notes due in 2031. This offering will occur through a private placement directed at qualified institutional buyers, in accordance with Rule 144A of the Securities Act of 1933. Additionally, ARRY may grant initial purchasers an option to acquire up to an additional $37.5 million in notes within 13 days of the original issuance date. The notes will be senior unsecured obligations, accruing interest semiannually.

Conversions will be settled by ARRY through cash payments equal to the principal amount of the notes being converted. For any excess, ARRY can opt to pay in cash, issue shares of its common stock, or use a combination of both, based on the conversion rate applicable at the time. Key terms like interest rate and initial conversion rate will be established when the offering is priced.

Funds from this offering are designated for repaying $150 million of its existing term loan facility, covering costs associated with capped call transactions, and potentially other corporate purposes, such as further debt repayments or repurchases. Should the option for additional notes purchase be exercised, ARRY intends to use part of the proceeds for additional capped call transactions.

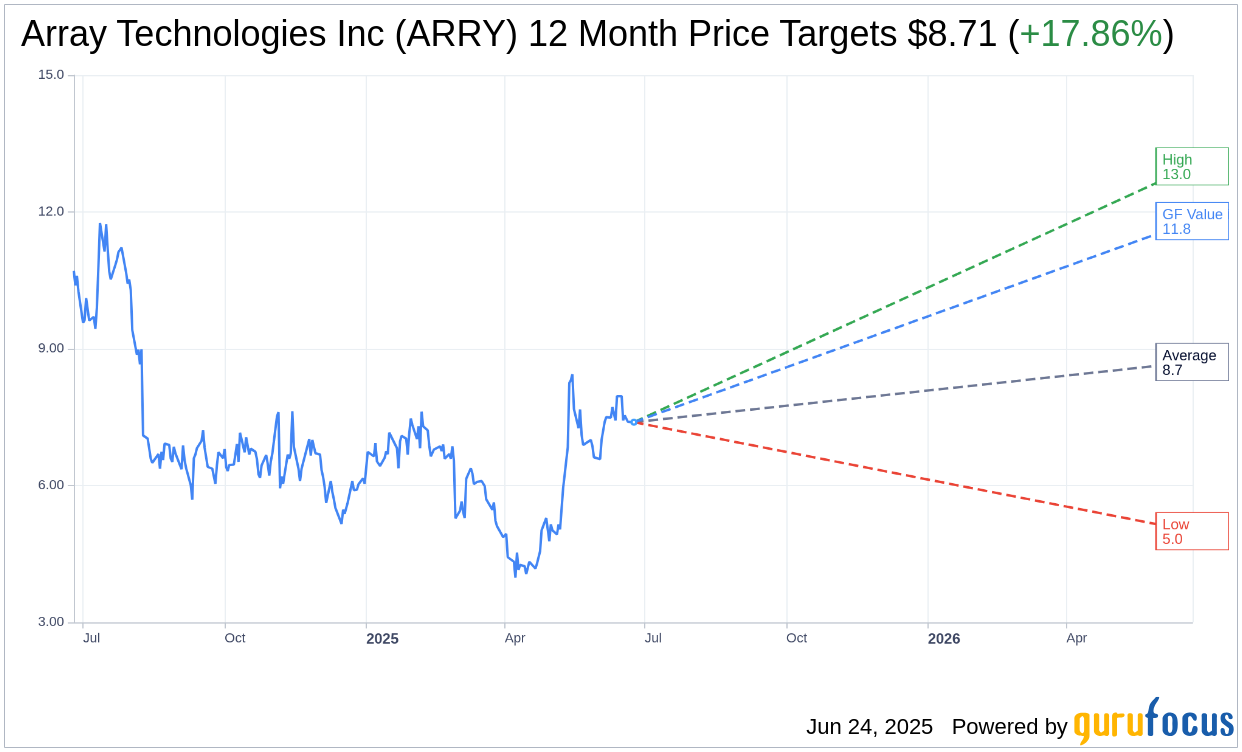

Wall Street Analysts Forecast

Based on the one-year price targets offered by 21 analysts, the average target price for Array Technologies Inc (ARRY, Financial) is $8.71 with a high estimate of $13.00 and a low estimate of $5.00. The average target implies an upside of 17.86% from the current price of $7.39. More detailed estimate data can be found on the Array Technologies Inc (ARRY) Forecast page.

Based on the consensus recommendation from 24 brokerage firms, Array Technologies Inc's (ARRY, Financial) average brokerage recommendation is currently 2.3, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Array Technologies Inc (ARRY, Financial) in one year is $11.80, suggesting a upside of 59.68% from the current price of $7.39. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Array Technologies Inc (ARRY) Summary page.

ARRY Key Business Developments

Release Date: May 06, 2025

- Revenue: $302.4 million, a 97% increase year-over-year and a 10% increase sequentially.

- Adjusted Gross Margin: 26.5%, reflecting expected compression due to legacy agreements and international projects.

- Cash Position: Ending cash balance of $348 million.

- Order Book: Maintained at $2 billion, with an 18% increase in contracting compared to the previous quarter.

- Adjusted EBITDA: $40.6 million, with a margin of 13.4%.

- Net Income: $2.3 million, compared to a net loss of $11.3 million in the prior year.

- Diluted Income Per Share: $0.02, compared to a loss of $0.07 in the prior year.

- Adjusted Net Income: $19.7 million, up from $9 million in the prior year.

- Free Cash Flow: A use of $15.4 million, compared to $45.1 million generated in the prior year.

- Leverage Ratio: Net debt leverage ratio of 1.8 times.

- Full-Year Revenue Guidance: Expected to be between $1.05 billion and $1.15 billion.

- Adjusted Gross Margin Guidance: Expected to be within the range of 29% to 30% for the full year.

- Adjusted EBITDA Guidance: Expected to range between $180 million and $200 million.

- Adjusted Diluted Earnings Per Share Guidance: Anticipated to be between $0.60 and $0.70.

- Free Cash Flow Guidance: Expected to be between $115 million and $130 million for 2025.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Array Technologies Inc (ARRY, Financial) reported a strong first quarter with a 97% increase in revenue year-over-year, reaching $302 million.

- The company achieved a 143% increase in volume growth over the prior year, marking the second largest quarter of volume shipped since Q2 of 2023.

- Array Technologies Inc (ARRY) maintained a robust order book valued at $2 billion, with an 18% increase in contracting compared to the previous quarter.

- The company has strengthened its management team with the addition of several solar industry veterans, enhancing leadership both domestically and internationally.

- Array Technologies Inc (ARRY) is seeing strong traction with its new product offerings, such as OmniTrack and SkyLink, which accounted for 15% of revenue in Q1 and 30% of new bookings.

Negative Points

- The company is facing near-term policy-related headwinds, including ongoing tariff negotiations and potential shifts in the Inflation Reduction Act.

- First quarter adjusted gross margin was compressed to 26.5% due to impacts from legacy volume commitment agreements and large international lower margin projects.

- Array Technologies Inc (ARRY) anticipates potential project delays due to current market uncertainties, including tariffs and commodity price increases.

- The devaluation of the Brazilian real and newly introduced tariffs on solar components have significantly slowed market growth in Brazil.

- The company is experiencing moderate commodity-related ASP declines in its legacy operations and slightly higher ASP declines internationally.