On June 24, 2025, Barclays analyst Luke Sergott announced the initiation of coverage on Medpace Holdings (MEDP, Financial), providing an "Equal-Weight" rating. The announcement follows Barclays' strategic assessment of the clinical contract research organization, which supports the pharmaceutical, biotechnology, and medical device sectors.

As part of this coverage, Barclays has set a price target of $300.00 USD for Medpace Holdings (MEDP, Financial). Analysts typically use price targets to project the future price levels of the stock, and Sergott’s price target reflects the expected performance of Medpace Holdings shares in the market.

The current price target from Barclays represents a new evaluation for Medpace Holdings as there was no prior price target to compare. The introduction of this coverage could potentially influence investor decisions surrounding Medpace Holdings (MEDP, Financial) as the insights from Barclays are often considered by the market stakeholders.

Medpace Holdings (MEDP, Financial) continues to be closely watched by investors and analysts alike, especially following Barclays' announcement, which marks a significant addition to the company's analytical coverage. This development is crucial for shareholders and market observers who rely on such insights for making informed investment choices.

Investors and market analysts are advised to monitor Medpace Holdings (MEDP, Financial) for potential market movements and further updates from analysts that might impact the company's stock performance in the coming months.

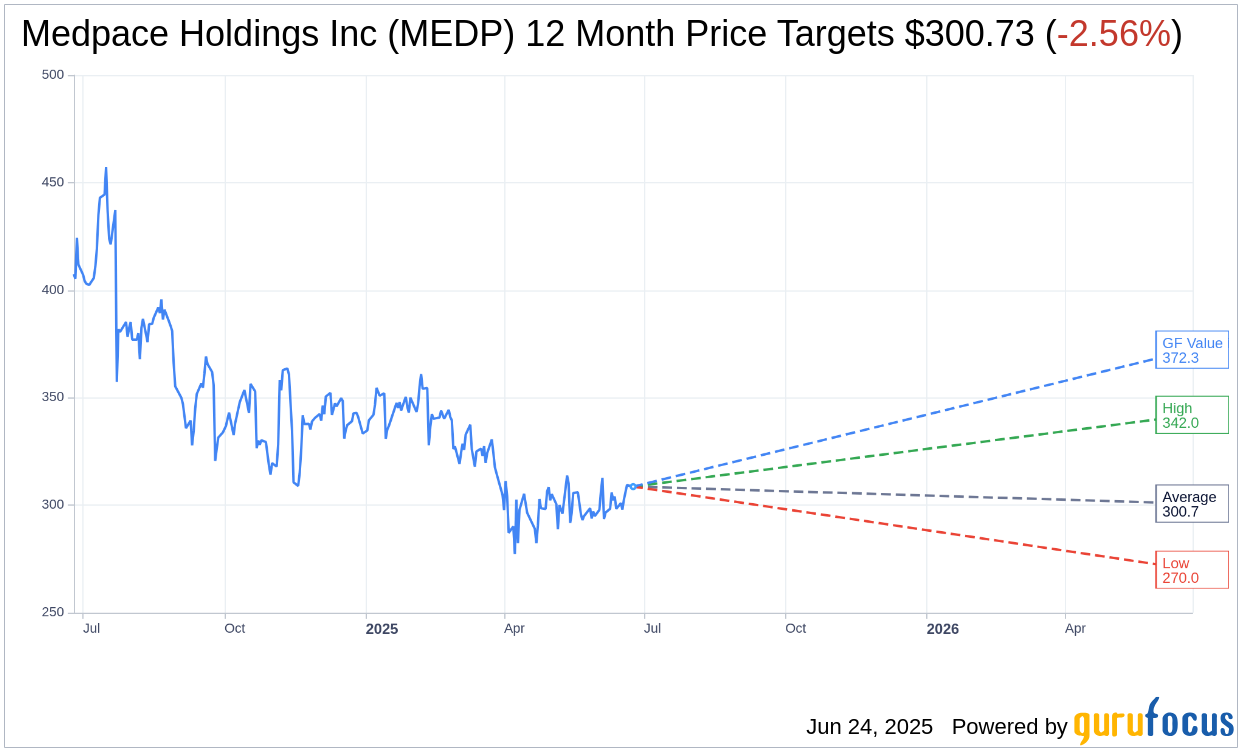

Wall Street Analysts Forecast

Based on the one-year price targets offered by 10 analysts, the average target price for Medpace Holdings Inc (MEDP, Financial) is $300.73 with a high estimate of $342.00 and a low estimate of $270.00. The average target implies an downside of 2.56% from the current price of $308.64. More detailed estimate data can be found on the Medpace Holdings Inc (MEDP) Forecast page.

Based on the consensus recommendation from 11 brokerage firms, Medpace Holdings Inc's (MEDP, Financial) average brokerage recommendation is currently 2.8, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Medpace Holdings Inc (MEDP, Financial) in one year is $372.34, suggesting a upside of 20.64% from the current price of $308.64. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Medpace Holdings Inc (MEDP) Summary page.