Lucky Strike Entertainment Corp. is an operator of location-based entertainment venues across North America. Formerly known as Bowlero Corp., the company manages over 360 locations and is the world's largest operator of ten-pin bowling centers, with well-known brands like Lucky Strike, Bowlero, and AMF. These venues range from upscale, lounge-style bowling centers with enhanced food and beverage options to more traditional bowling experiences. Beyond bowling, Lucky Strike Entertainment has expanded its offerings to include amusements, water parks such as Raging Waves, family entertainment centers, and attractions like Octane Raceway (Go-Karts). The company also owns the Professional Bowlers Association (PBA), making it a player in sports media. In late 2024, the company rebranded from Bowlero Corp. to Lucky Strike Entertainment to reflect its broader commitment to experiential entertainment. With more than 13,000 bowling lanes, over 12,000 employees, and more than 40 million guests annually, Lucky Strike Entertainment Corp. stands as a force in the North American entertainment industry.

Lucky Strike/ Bowlero has a roll-up business strategy. The roll-up business strategy is a consolidation approach designed to create a larger, more efficient, and competitive company by acquiring and integrating multiple smaller businesses within the same industry.

Business Model

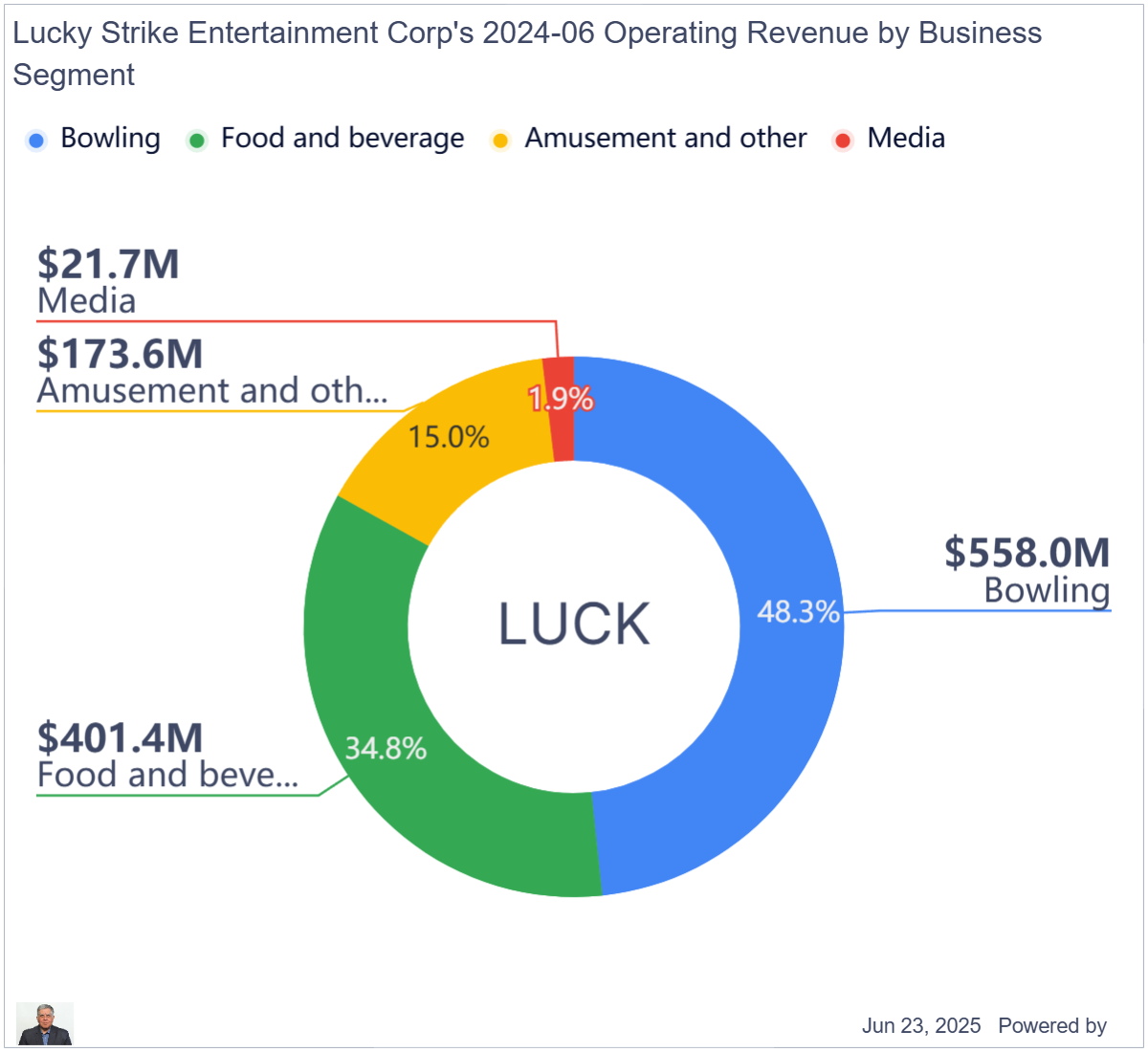

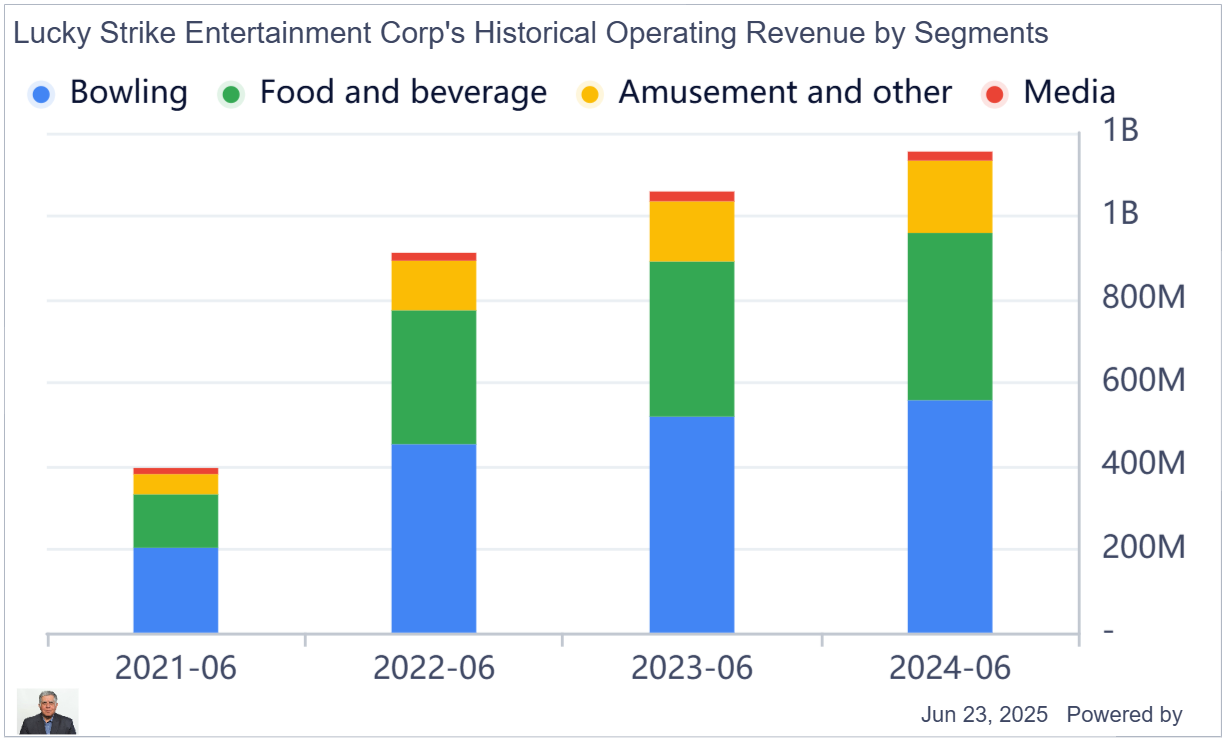

Lucky Strike Entertainment's business model centers on providing a comprehensive entertainment experience by combining bowling, amusements, dining, and events within its diverse portfolio of venues, including brands like Lucky Strike, Bowlero, AMF, and Boomers. The company generates revenue through admissions, food and beverage sales, and event hosting across its upscale and traditional entertainment centers. Growth is driven by strategic acquisitions of underperforming or complementary assets, which are then optimized operationally and often financed through sale-leaseback transactions to maintain capital flexibility. Additionally, Lucky Strike leverages its ownership of the Professional Bowlers Association (PBA) to generate media and sponsorship revenues, further diversifying its income streams. By investing in technology and gamification, the company enhances customer engagement and encourages repeat visits, positioning itself as a leader in the location-based entertainment industry with a focus on experiential offerings and operational excellence.

The following chart shows Lucky Strike's revenue segments.

Total addressable market

Lucky Strike Entertainment identifies its total addressable market (TAM) as exceeding $100 billion for out-of-home entertainment. This figure encompasses the broader location-based entertainment industry, including not only bowling but also amusements, water parks, family entertainment centers, and related experiential venues. The company positions itself as the industry leader within this expansive market, leveraging acquisitions and operational improvements to capture a growing share of this $100 billion+ opportunity

Funding Model

Lucky Strike Entertainment's funding model is built around a combination of acquisition-driven growth and creative capital management. The company primarily finances its expansion through a self-funding strategy that leverages sale-leaseback transactions: it acquires entertainment venues—often those with valuable real estate—improves their operational performance, and then sells the property while leasing it back, using the proceeds to fund additional acquisitions and investments. This approach allows Lucky Strike to continuously expand its portfolio while maintaining capital flexibility.

In addition to sale-leasebacks, Lucky Strike secures financing through a mix of credit facilities, term loans, and private investments. Recent examples include a $150 million incremental term loan secured in December 2024 for general corporate purposes and potential acquisitions5, as well as previous financing rounds involving revolving credit lines, subordinated notes, and equity investments from institutional lenders. This multi-pronged funding strategy enables Lucky Strike to refinance debt, support new location development, and pursue opportunistic growth across its entertainment brands.

Growth

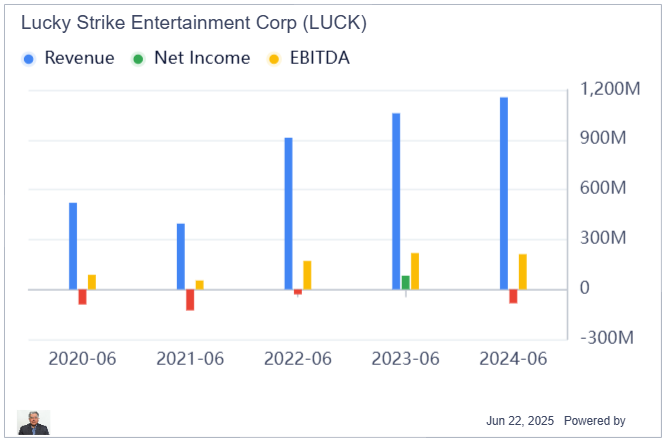

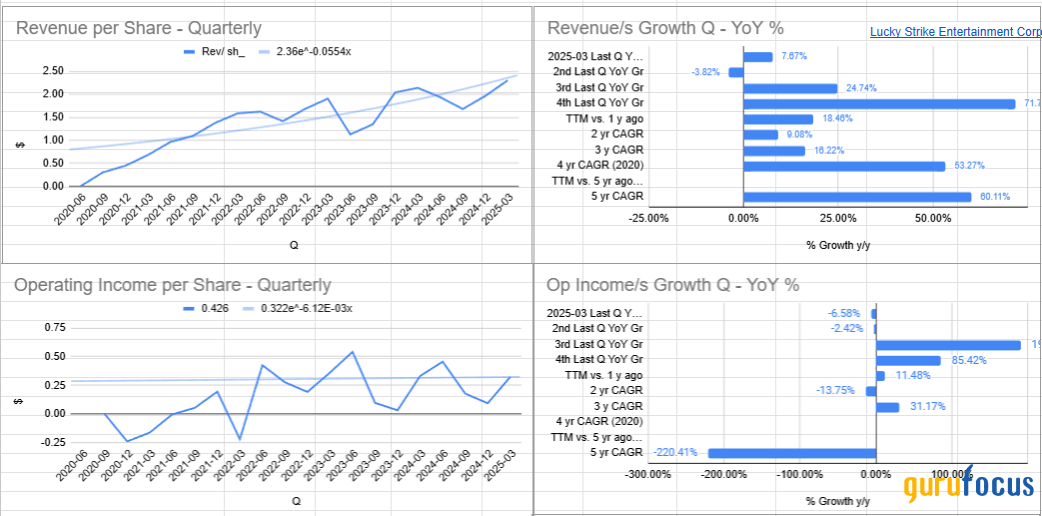

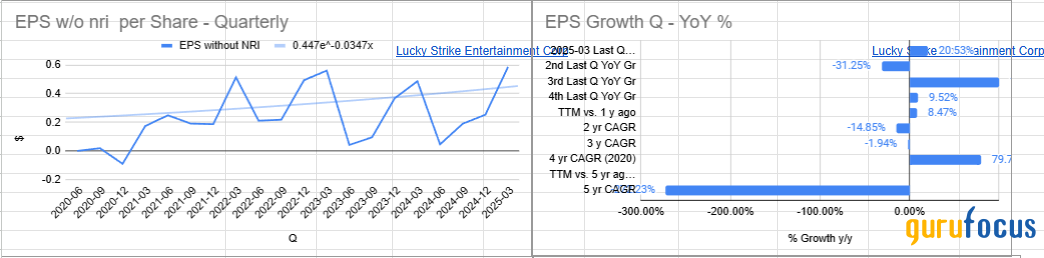

Revenue and EBITDA has grown rapidly as the company rolls up locations. Revenue has grown by a CAGR of 17.87%over the last 5 years and EBITDA per share by over 30% CAGR. Most of this is due to acquisitions. Same store sales growth has been between 4 to 5% annually. The location based entertainment industry is highly fragmented with mostly small business operators. This gives Lucky Strike a long growth runway as it consolidates a fragmented industry.

Recent Results

For the quarter ended March 30, 2025, net income was $13.3 million, down from $23.8 million in the prior year. For the nine months ended March 30, 2025, net income was $64.7 million, a significant improvement from a loss of $21.4 million in the prior period. Major adjustments included substantial interest expense ($49.4 million for the quarter; $146.9 million for nine months), high depreciation and amortization ($40.7 million for the quarter; $117.8 million for nine months), and share-based compensation, which increased year-over-year. The result also reflects the impact of changes in the value of earnouts, which were a large negative adjustment in 2025, reducing Adjusted EBITDA by $18.9 million for the quarter and $87.5 million for nine months, compared to positive adjustments in the prior year.

After accounting for all adjustments, Adjusted EBITDA—a key measure of operating performance—was $117.3 million for the quarter (down from $122.8 million in the prior year) and $279.0 million for the nine months (virtually flat year-over-year). This indicates that while net income fluctuated due to non-operational items, the company's underlying earnings power remained stable, with Adjusted EBITDA showing only a slight year-over-year decrease for the quarter and almost no change for the nine-month period.

The following charts shows the progression of Lucky Strike's revenue per share and Operating Income per share progression.

The company is also now profitable of a GAAP Earnings per share basis. PE (ttm) is 9, Forward PE is 32.

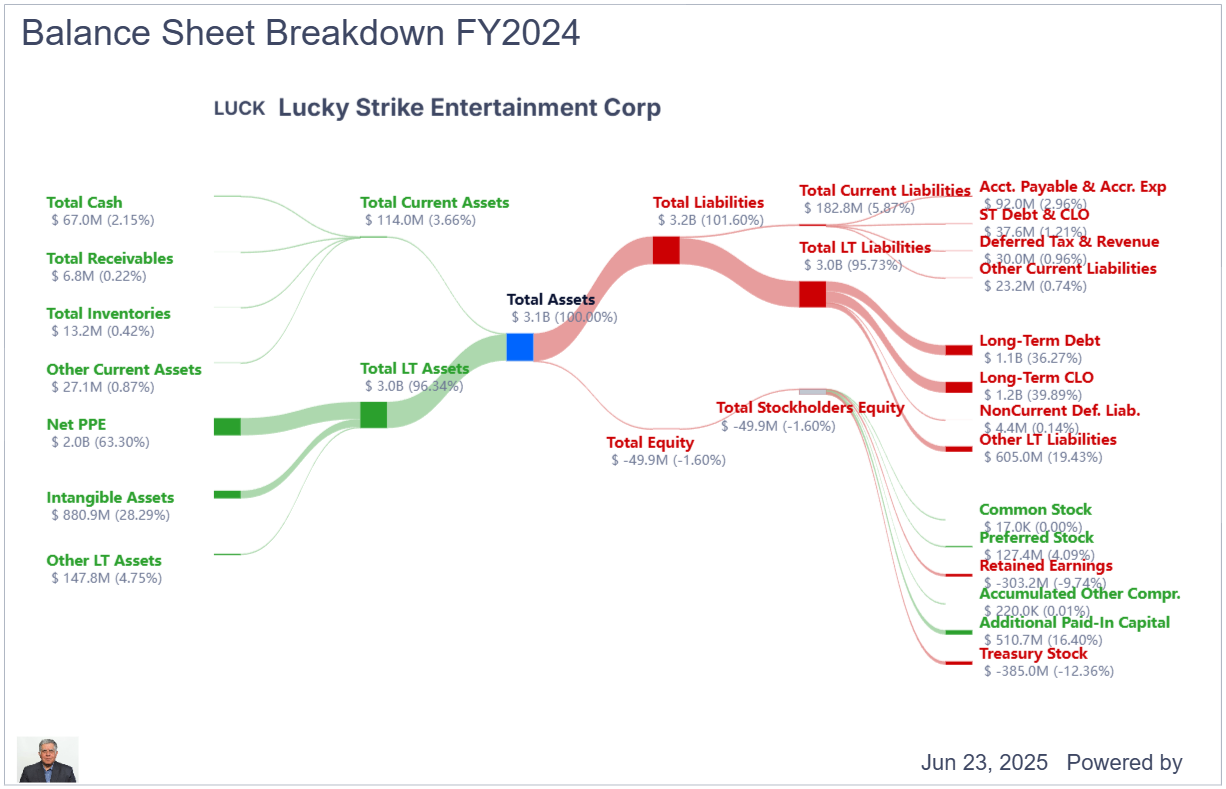

Debt

Lucky Strike carries a lot of debt but more than half the liabilities are operational leases.

Lucky Strike's Financial Position

- Total Long-Term Debt: $1.273 billion (net of unamortized financing costs and current maturities).

- Total Liabilities: $3.28 billion, including deferred taxes and operational obligations.

- Debt-to-Equity: Negative (-37.99) due to accumulated deficit, reflecting aggressive growth financing.

- Effective Interest Rate on Debt: 7.83% (ttm).

Lucky Strike Entertainment's debt structure is characterized by a mix of secured term loans, revolving credit facilities, and strategic interest rate hedges. Here's a breakdown of key components based on the latest financial data:

Core Debt Instruments

- First Lien Term Loan

- Principal: $1.282 billion (as of March 30, 2025)

- Maturity: February 8, 2028

- Interest Rate: Variable (Adjusted Term SOFR + 3.50%), currently 7.82%

- Repayment: Quarterly installments of $3.255 million

- Recent Amendment: A $150 million incremental term loan secured in December 2024, increasing quarterly payments from $2.875 million.

2. Revolving Credit Facility

- Commitment: $335 million (expanded by $50 million in August 2024)

- Maturity: December 15, 2026

- Utilization: Reduced by $22.4 million in standby letters of credit.

3. Other Equipment Loans

- Outstanding: $12.9 million (fixed rate of 6.24%, maturing August 2029)

Covenant Compliance:

- Leverage Ratio: Must not exceed 6.00:1.00 if Revolver utilization exceeds 35% of commitment.

Strategic Approach

Lucky Strike employs a self-reinforcing funding model:

- Sale-Leasebacks: Monetize real estate from acquired venues to fund new acquisitions.

- Refinancing Flexibility: Use amendments to optimize terms without triggering gains/losses.

- Hedging Focus: Collars minimize interest volatility while allowing upside if rates fall below floors.

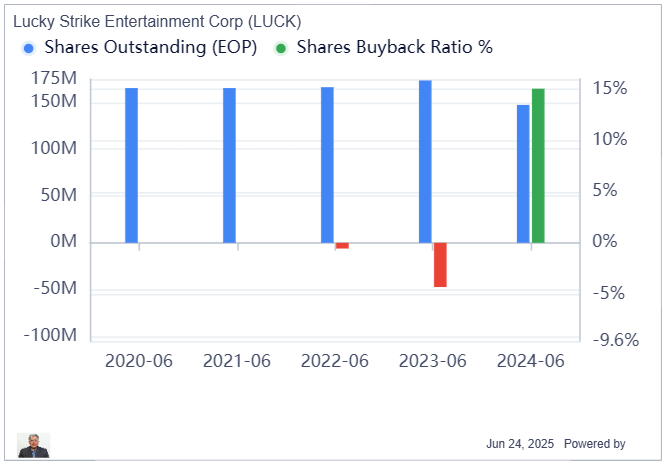

Insider Trading

Key insiders including the CFO and CEO have being buying the stock on weakness over the past few month. This indicates the stock is undervalued.

The company has also been buying back its stock.

Dividends.

Lucky Strike pays a divided with a current of yield 2.39%.

Conclusion

Lucky Strike's business strategy of rolling up a fragmented industry dominated by small players is interesting. It is using creative financial strategies to bring economies of scale to location based entertainment industry. This is noteworthy given the relative decline of movie theaters as go to places for family and friends. It is upgrading neighborhood bowling alleys to offer more upscale food and beverages as well attached video game arcades to keep the kids busy while Mom, Dad and friends bowl. Apart from bowling the company is now expanding into Waterparks and Go-Kart neighborhood destinations.

Lucky Strikes rapid growth and creative self funding model as well as its long growth runway gives investors a substantial opportunity for value creation.