- DexCom stock surges as the U.S. promotes wearable health technology.

- Analysts project an average price target of $99.82, indicating potential growth.

- GuruFocus estimates suggest a possible 91.62% upside based on GF Value.

DexCom Inc. (DXCM) is experiencing a notable rise in its stock price following the U.S. Department of Health and Human Services' announcement of a significant initiative advocating for wearable devices. This campaign is set to enhance health management across the nation, spotlighting the effectiveness of devices like DexCom's glucose monitors as affordable health management solutions.

Wall Street Analysts Forecast

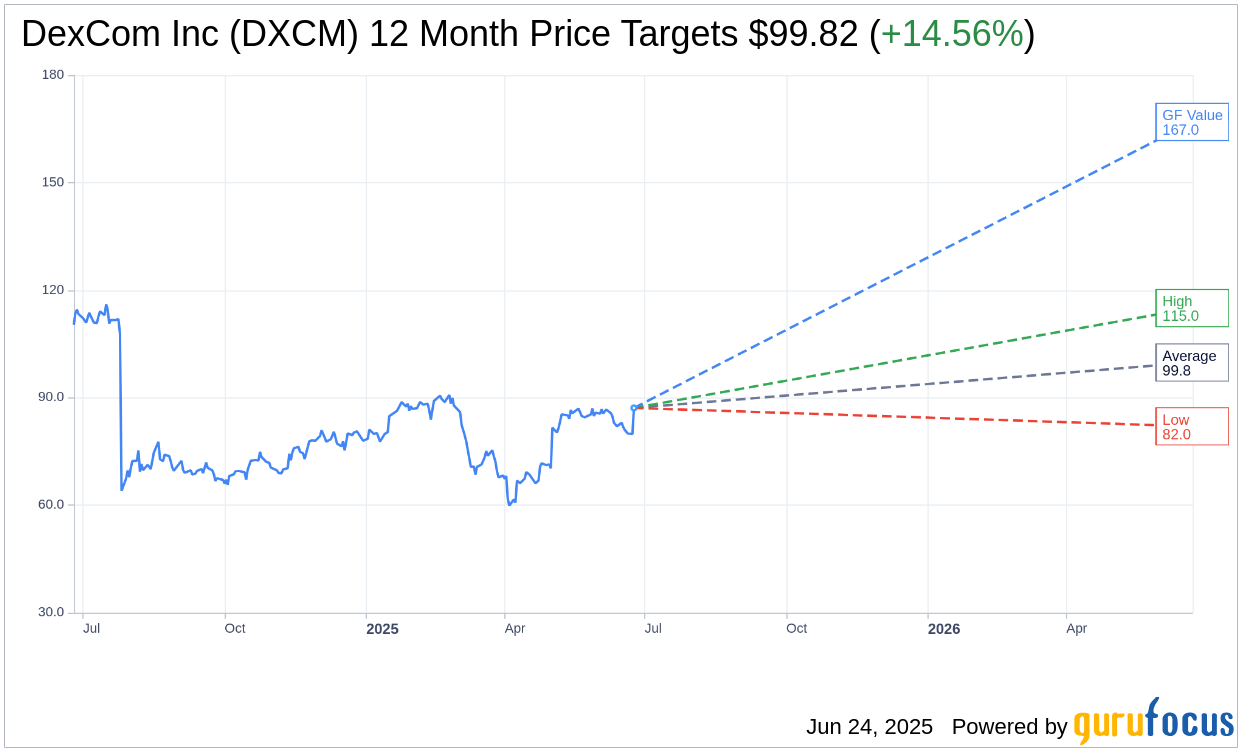

In the upcoming year, 26 analysts have set price targets for DexCom Inc. (DXCM). The average target is $99.82, with projections varying from a high of $115.00 to a low of $82.00. This average target indicates a potential upside of 14.56% compared to the current stock price of $87.13. Investors interested in more detailed forecasts can access the full data on the DexCom Inc (DXCM, Financial) Forecast page.

Moreover, consensus from 28 brokerage firms places DexCom Inc.'s (DXCM) average brokerage rating at 1.7, categorizing it as "Outperform." The scale used ranges from 1 to 5, with 1 representing a Strong Buy and 5 a Sell.

GuruFocus GF Value Estimates

According to GuruFocus, the estimated GF Value for DexCom Inc. (DXCM) over the next year is projected at $166.96. This suggests a substantial upside of 91.62% from the current price of $87.13. The GF Value is GuruFocus's evaluation of the stock's fair trading value, derived from historical trading multiples, past business growth, and anticipated future performance metrics. Further insights and detailed metrics are available on the DexCom Inc (DXCM, Financial) Summary page.