- Rogers Communications (RCI, Financial) sees a notable stock price increase after TD Cowen names it a top pick.

- Analysts forecast a significant upside potential, with an average price target of $38.45.

- GuruFocus estimates suggest a 61.38% upside, highlighting RCI's potential growth and fair value.

Rogers Communications Inc. (RCI) is capturing investor attention as its stock surges, propelled by optimistic market evaluations. Recently, TD Cowen highlighted Rogers as a top pick, resulting in a 4.2% rise in its U.S. stock value. This boost reflects growing investor confidence, buoyed by strategic developments with Blackstone and BCE, which TD Cowen identified as key growth drivers. Moreover, TD Cowen has increased its price target for RCI to C$60, reflecting their positive outlook.

Wall Street Analysts Forecast

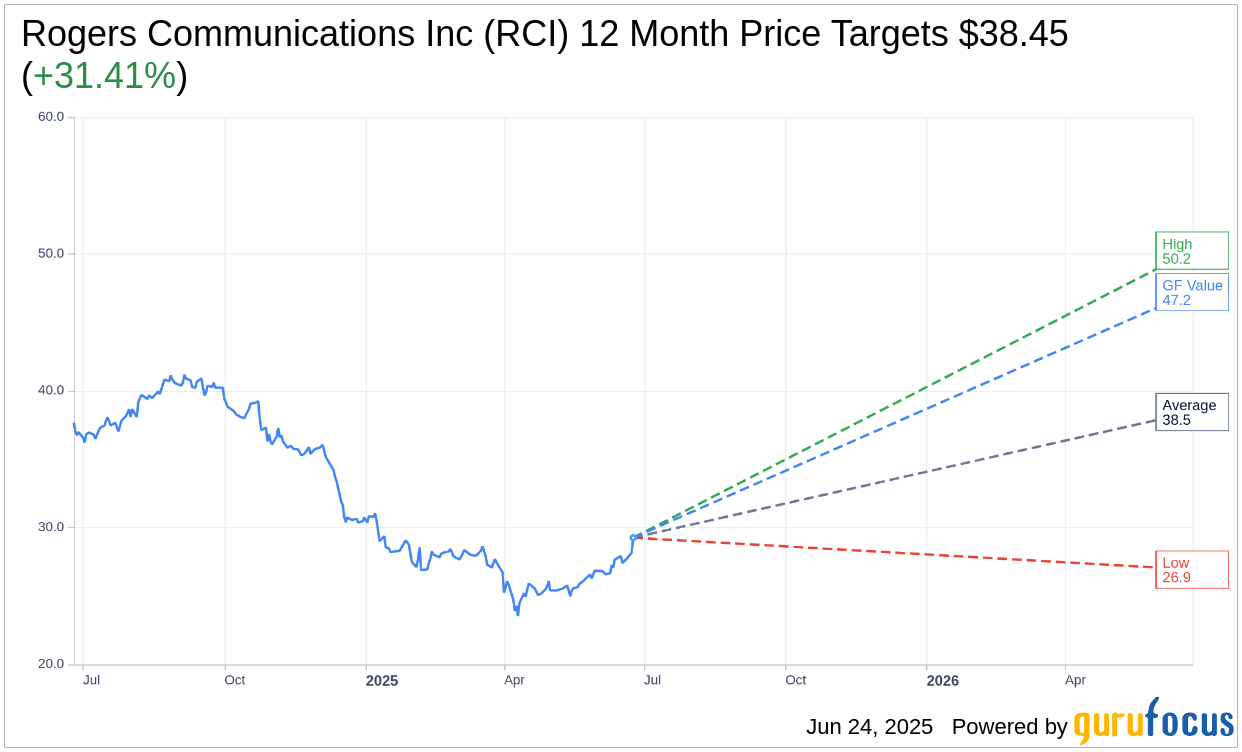

Eleven analysts provided one-year price targets for Rogers Communications Inc. (RCI, Financial), with an average target of $38.45. Projections range from a high of $50.25 to a low of $26.93, suggesting a substantial upside of 31.41% from the current stock price of $29.26. For a deeper dive into these forecasts, visit the Rogers Communications Inc (RCI) Forecast page.

Regarding brokerage recommendations, Rogers Communications Inc. (RCI, Financial) holds an average rating of 2.3 from 12 brokerage firms, translating to an "Outperform" evaluation. The rating scale, where 1 indicates a Strong Buy and 5 suggests a Sell, reflects positive market sentiment around RCI.

According to GuruFocus estimates, the projected GF Value for Rogers Communications Inc. (RCI, Financial) in the coming year is $47.22. This indicates a potential upside of 61.38% from the current price of $29.26. The GF Value metric is a GuruFocus proprietary estimate of a stock's fair trading value, calculated from historical trading multiples and anticipated business growth. Investors can explore more detailed insights on the Rogers Communications Inc. (RCI) Summary page.