- ISS advises against re-electing Paramount Global's top executives due to corporate governance concerns.

- Analyst predictions for Paramount stock show mixed views with a predominant 'Hold' recommendation.

- GuruFocus evaluates Paramount's fair value to be slightly above its current trading price.

Proxy advisory firm ISS has issued a strong recommendation for stakeholders of Paramount Global (NASDAQ: PARA) to vote against the re-election of Shari Redstone along with three other board directors. This advice emerges amidst ongoing debates about the company's capital structure and executive compensation strategies. The timing coincides with Paramount's upcoming annual meeting, which is set against a backdrop of challenging corporate dynamics.

Wall Street Analysts' Insights

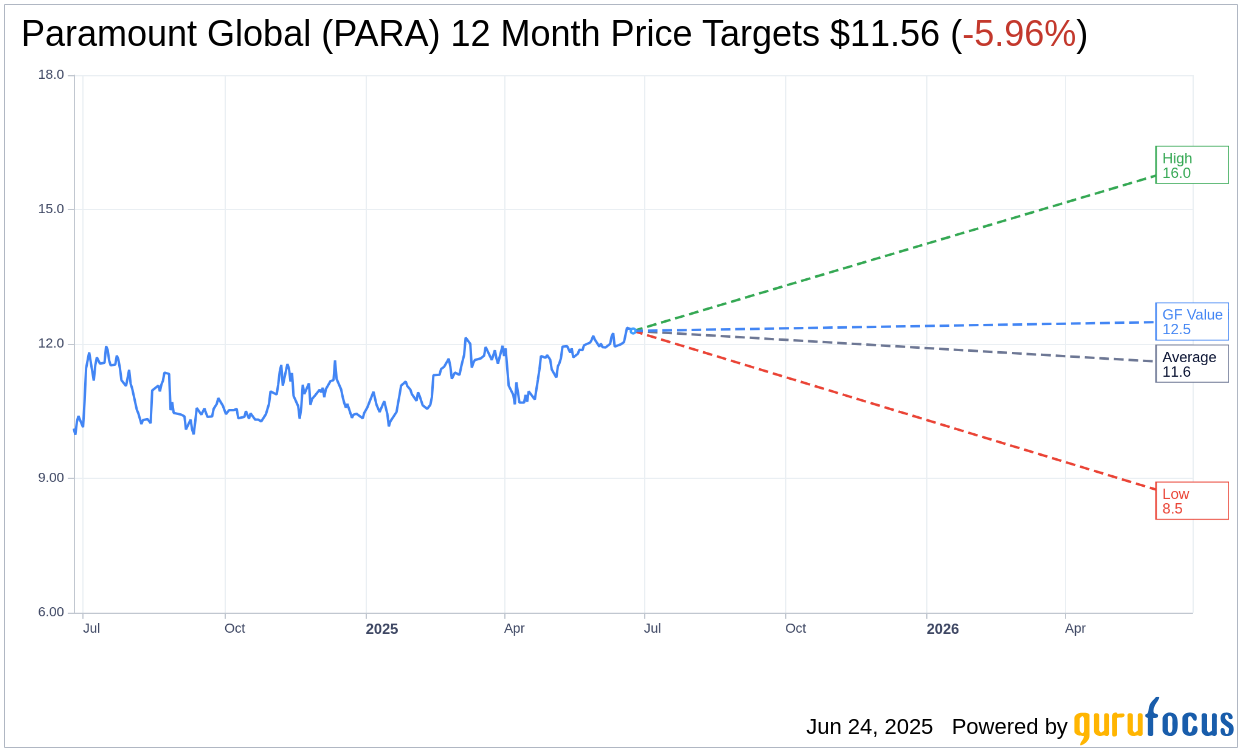

Paramount Global's stock (PARA, Financial) has been under the analytical microscope, with 19 prominent analysts providing one-year price projections. The average price target stands at $11.56, flanked by a high estimate of $16.00 and a low of $8.50. This average target reflects a potential downside of 5.96% from the recent trading price of $12.29. For more in-depth forecast data, visit the Paramount Global (PARA) Forecast page.

The consensus recommendation from 26 brokerage firms currently assigns Paramount Global (PARA, Financial) an average rating of 3.4, indicating a 'Hold' status. The rating system employs a scale from 1 (Strong Buy) to 5 (Sell), positioning Paramount in the middle ground of investment sentiment.

GuruFocus Valuation Metrics

According to GuruFocus estimates, the projected GF Value for Paramount Global's stock over the next year is $12.50. This suggests a modest upside of 1.71% from the current share price of $12.29. The GF Value metric is a proprietary assessment of what the stock should theoretically be worth, derived from historical trading multiples and the anticipated growth trajectory of the business. More comprehensive data can be accessed on the Paramount Global (PARA, Financial) Summary page.