FedEx Corp. (FDX, Financial) anticipates permanent cost savings amounting to $1 billion through its DRIVE and Network 2.0 transformation efforts. This expectation is based on the company's strategic focus on cost management, reducing capital expenditure, and enhancing earnings, which are aimed at boosting shareholder value. John Dietrich, the executive vice president and chief financial officer, emphasized the company's commitment to these goals, highlighting their impact on the recent fiscal performance. Moving into fiscal year 2026, FedEx plans to continue its network transformation while adhering to a disciplined capital investment strategy and prioritizing shareholder returns.

Wall Street Analysts Forecast

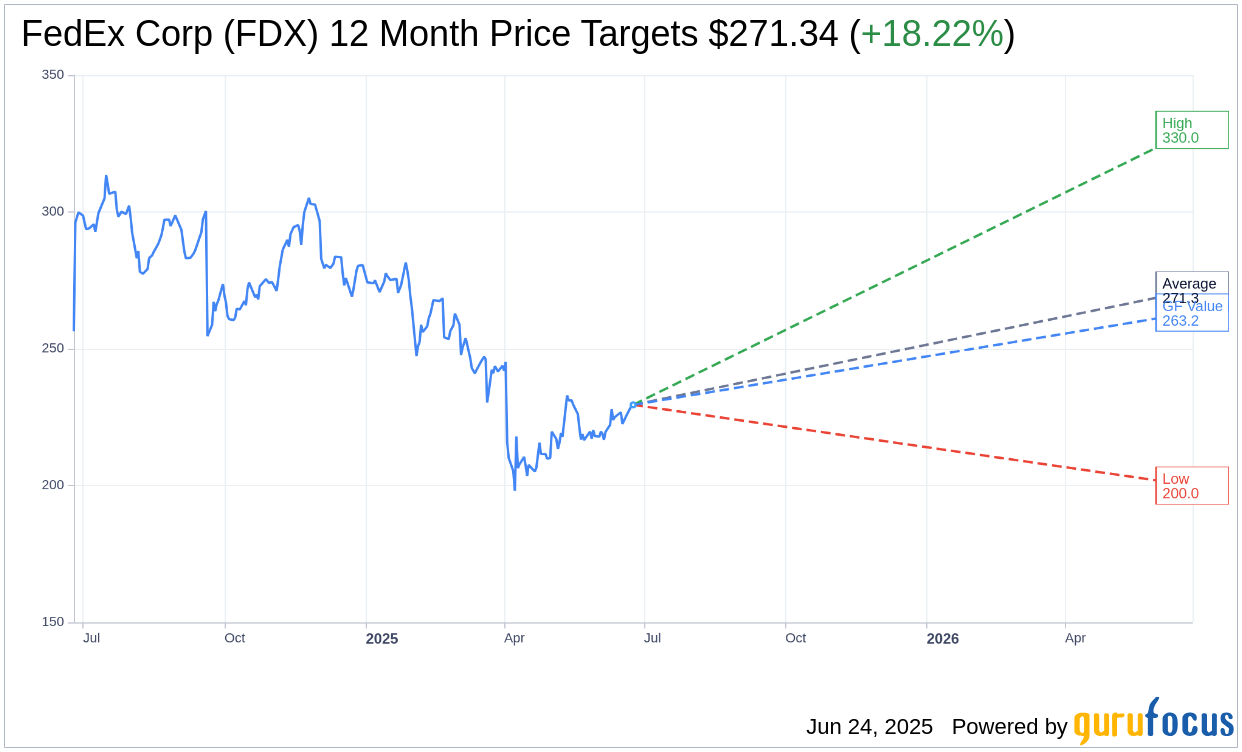

Based on the one-year price targets offered by 27 analysts, the average target price for FedEx Corp (FDX, Financial) is $271.34 with a high estimate of $330.00 and a low estimate of $200.00. The average target implies an upside of 18.22% from the current price of $229.51. More detailed estimate data can be found on the FedEx Corp (FDX) Forecast page.

Based on the consensus recommendation from 32 brokerage firms, FedEx Corp's (FDX, Financial) average brokerage recommendation is currently 2.2, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for FedEx Corp (FDX, Financial) in one year is $263.24, suggesting a upside of 14.7% from the current price of $229.51. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the FedEx Corp (FDX) Summary page.