Citi has adjusted its price target for FedEx (FDX, Financial), lowering it from $267 to $259 while maintaining a Buy rating. This decision follows the company's fiscal Q4 report, where despite achieving satisfactory results, ongoing tariff issues have clouded future guidance. FedEx management has highlighted potential growth and improved performance upon the resolution of these tariff challenges and better macroeconomic conditions. However, investors appear hesitant to rely on these projections, given the company's inconsistent past results.

Wall Street Analysts Forecast

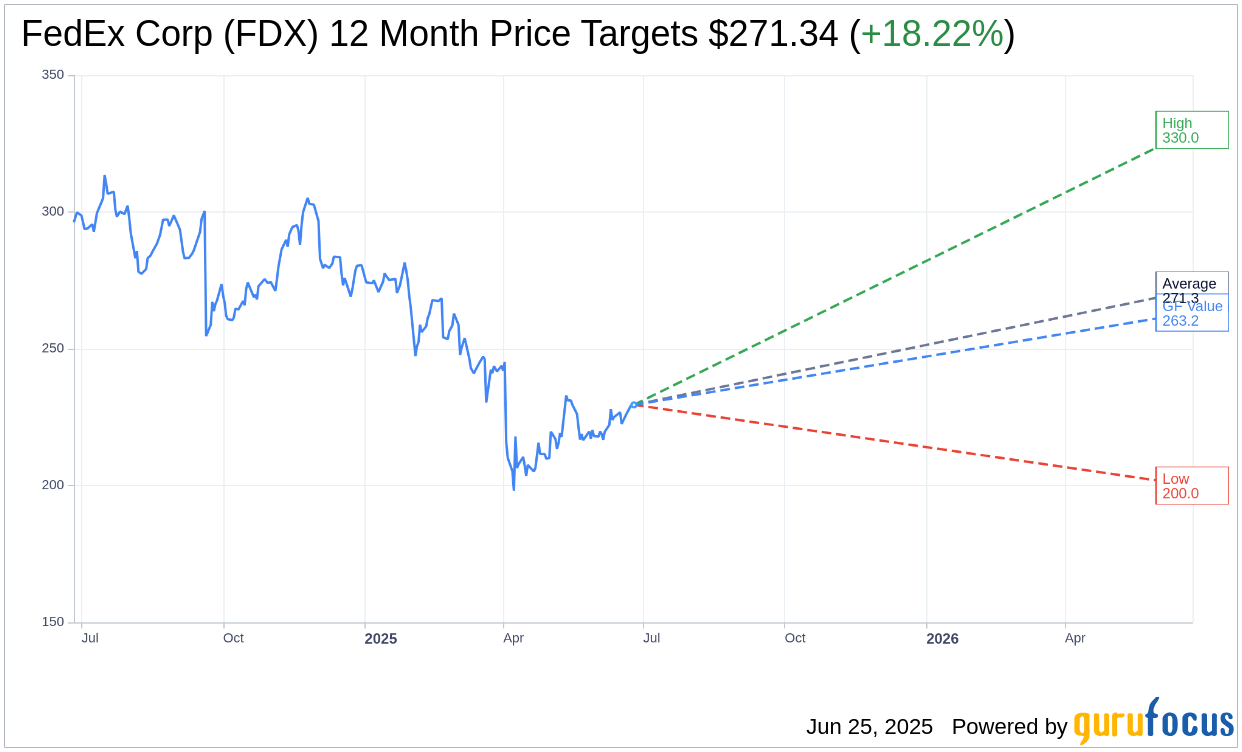

Based on the one-year price targets offered by 27 analysts, the average target price for FedEx Corp (FDX, Financial) is $268.41 with a high estimate of $330.00 and a low estimate of $200.00. The average target implies an upside of 16.95% from the current price of $229.51. More detailed estimate data can be found on the FedEx Corp (FDX) Forecast page.

Based on the consensus recommendation from 32 brokerage firms, FedEx Corp's (FDX, Financial) average brokerage recommendation is currently 2.2, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for FedEx Corp (FDX, Financial) in one year is $263.24, suggesting a upside of 14.7% from the current price of $229.51. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the FedEx Corp (FDX) Summary page.

FDX Key Business Developments

Release Date: June 24, 2025

- Revenue: Up 1% year over year in Q4.

- Adjusted Operating Income: Increased by 8% in Q4.

- Adjusted Operating Margin: Expanded by 60 basis points in Q4.

- Cash Returned to Stockholders: $4.3 billion in FY25.

- Adjusted Earnings Per Share (EPS): $18.19 for FY25.

- Capital Expenditure (CapEx): Reduced to $4.1 billion in FY25, lowest in over 10 years.

- Freight Operating Margin: 20.8% in Q4.

- Transformation-Related Savings: $1 billion expected in FY26.

- International Export Package Yield: Declined 1% in Q4.

- US Domestic Package Yield: Slight increase in Q4.

- Freight Average Daily Shipments: Up 8.3% sequentially in Q4.

- Share Repurchases: $3 billion in FY25.

- Dividend Increase: 5% in FY26.

- Adjusted Free Cash Flow Conversion: Nearly 90% in FY25.

- Debt Maturing in FY26: $1.3 billion.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- FedEx Corp (FDX, Financial) achieved a solid finish to FY25 with adjusted operating income growth and margin expansion despite a challenging demand environment.

- The company delivered on its $2.2 billion DRIVE structural cost reduction commitment, achieving a two-year $4 billion DRIVE target.

- FedEx Corp (FDX) returned $4.3 billion in cash to stockholders and reduced capital intensity significantly.

- The company successfully flexed its network to match demand, reducing capacity on the Asia-to-Americas lane by more than 35% in May.

- FedEx Corp (FDX) is well-positioned to support customers amid evolving global trade policies, leveraging its presence in over 220 countries and territories.

Negative Points

- FedEx Corp (FDX) faced major headwinds, including the expiration of the US Postal Service contract and volatility related to global trade policy.

- Higher-margin B2B volumes remain pressured, affecting both FedEx Express and Freight results.

- The company experienced a material headwind on its Asia-to-US lane due to escalating trade barriers, particularly from China.

- FedEx Freight's operating income declined due to prolonged weakness in the industrial economy.

- The global demand environment remains volatile, with uncertainties in trade policies impacting revenue projections.