Key Takeaways:

- Wells Fargo maintains an Overweight rating on Microsoft, with an increased price target.

- Microsoft's AI drive is projected to boost revenues significantly by 2029.

- Analysts forecast consistent growth, rating Microsoft as an "Outperform" investment.

Wells Fargo's Optimistic Outlook on Microsoft

Wells Fargo has reaffirmed its Overweight rating for Microsoft (MSFT, Financial), raising its price target from $565 to $585. The bank's confidence is anchored in Microsoft's expansive AI ambitions, predicting that AI revenue could surpass $100 billion by the fiscal year 2029. At present, Microsoft's AI operations contribute $13 billion in annual recurring revenue, showcasing its leadership in the tech sector.

Wall Street Analysts' Projections

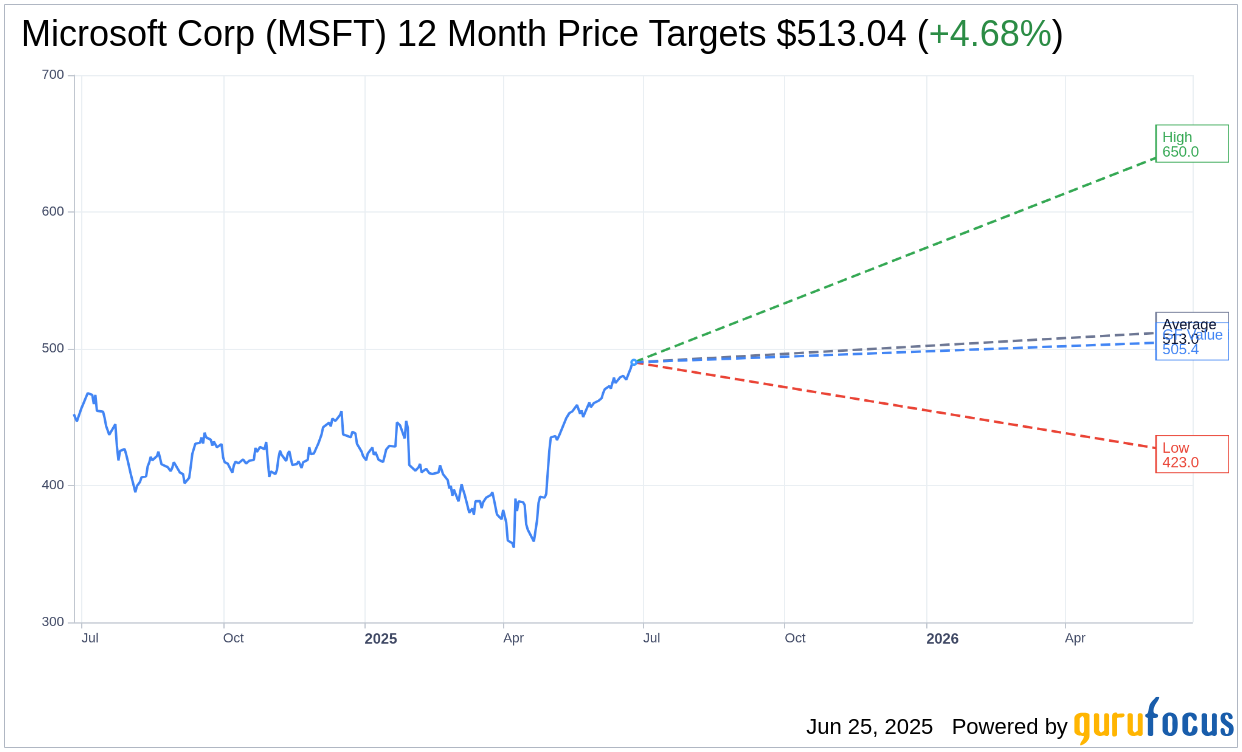

Across 49 analysts, the average one-year price target for Microsoft Corp (MSFT, Financial) stands at $513.04. Projections range widely, with a high of $650.00 and a low of $423.00. This average target implies a potential upside of 4.68% from the current stock price of $490.11. For more in-depth analysis, visit the Microsoft Corp (MSFT) Forecast page.

Analyst Recommendations and GF Value

The consensus from 62 brokerage firms categorizes Microsoft Corp's (MSFT, Financial) average brokerage recommendation at 1.8, signifying an "Outperform" rating. This rating hints at positive expectations, with the scale ranging from 1 (Strong Buy) to 5 (Sell).

GuruFocus provides a GF Value estimate for Microsoft Corp (MSFT, Financial) at $505.39 in one year, suggesting a potential upside of 3.12% from the current price. The GF Value metric represents the fair value of the stock, calculated based on historical trading multiples, past business growth, and anticipated future performance. For more details, explore the Microsoft Corp (MSFT) Summary page.