Eyenovia (EYEN, Financial) has unveiled a co-branded Hyperliquid validator in partnership with Kinetiq, a prominent player in liquid staking protocols tailored for the Hyperliquid ecosystem. This initiative represents a pivotal moment in Eyenovia's strategy to enhance onchain engagement. By leveraging their recent acquisition of 1,040,584.5 HYPE, the company aims to directly bolster network stability and security.

The operational backbone of the validator is supported by Pier Two, a reputable provider of institutional staking services. They bring to the table a robust infrastructure that combines high-performance hybrid cloud and bare metal systems, alongside SOC 2 Type I and Type II certifications to ensure reliability and security.

This collaboration aligns with Eyenovia's strategic objective of fostering a secure and integrated approach to liquid staking within the Hyperliquid platform. As part of their broader vision, this partnership with Kinetiq and Pier Two is seen as a crucial step toward achieving greater composability and security in the blockchain domain.

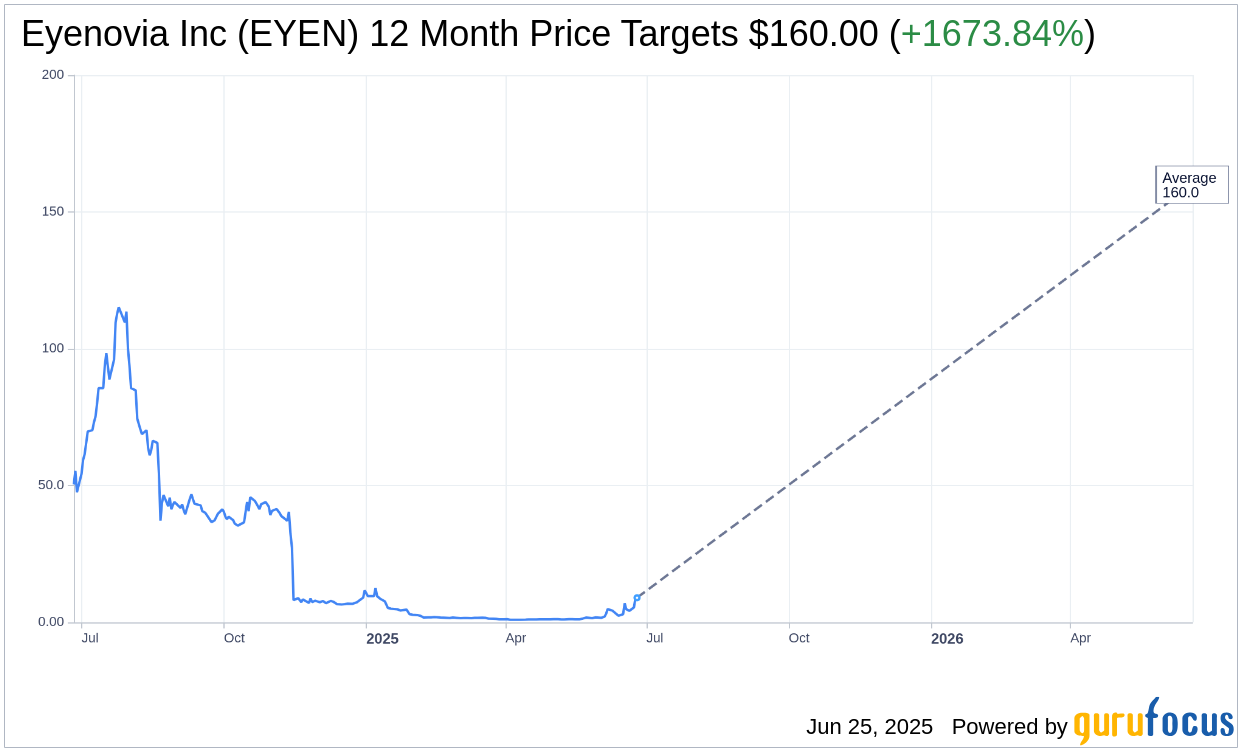

Wall Street Analysts Forecast

Based on the one-year price targets offered by 1 analysts, the average target price for Eyenovia Inc (EYEN, Financial) is $160.00 with a high estimate of $160.00 and a low estimate of $160.00. The average target implies an upside of 1,673.84% from the current price of $9.02. More detailed estimate data can be found on the Eyenovia Inc (EYEN) Forecast page.

Based on the consensus recommendation from 3 brokerage firms, Eyenovia Inc's (EYEN, Financial) average brokerage recommendation is currently 3.0, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.