Key Highlights:

- Sonim Technologies (SONM, Financial) announced a reverse takeover with a U.S. AI firm, boosting shares by 62.5% premarket.

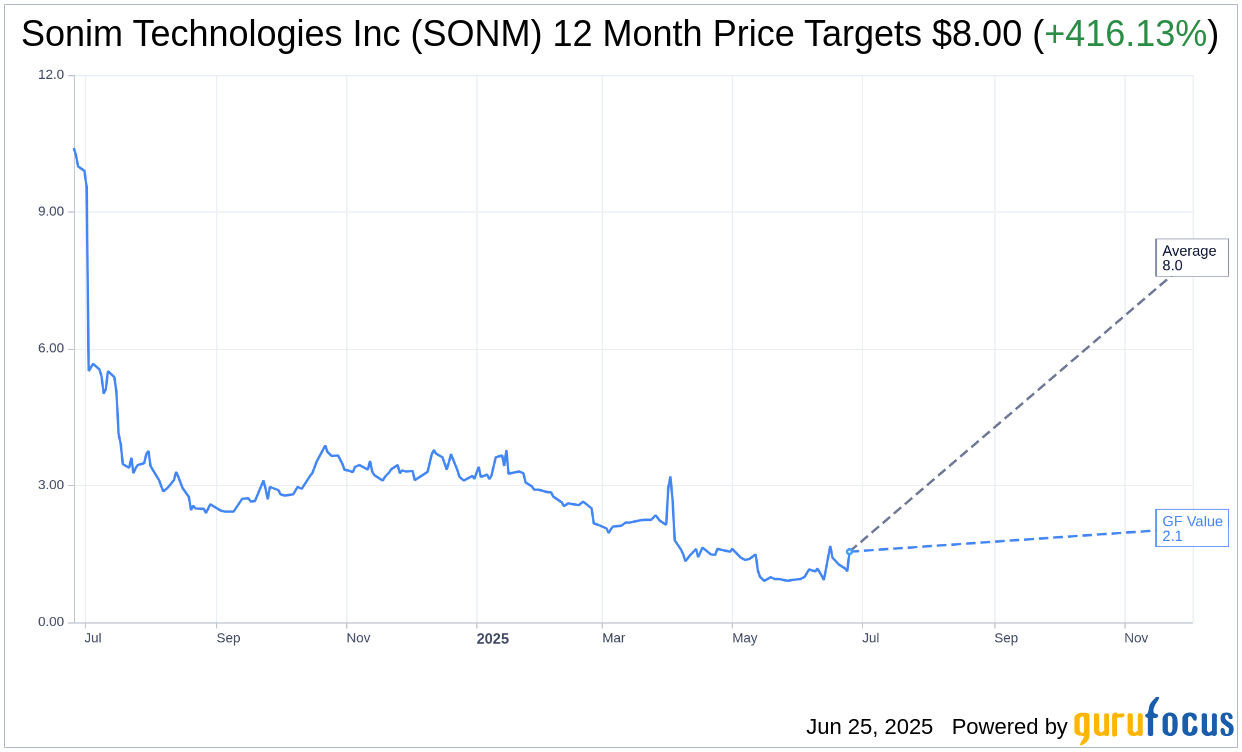

- Analyst price target suggests a 416.13% potential upside from the current stock price.

- GuruFocus GF Value estimates a 33.55% upside potential.

Sonim Technologies' Strategic Move

Sonim Technologies (SONM) has recently made headlines with a strategic play that has caught the attention of investors. The company has entered a non-binding agreement for a reverse takeover with a U.S.-based artificial intelligence firm. Valued at approximately $300 million, this AI company acquisition allows Sonim to retain $17.5 million in equity. This bold move has resulted in Sonim's shares skyrocketing by 62.5% in premarket trading, indicating strong market confidence in this decision.

Analyst Insights and Price Targets

The one-year price targets provided by analysts shed light on the potential trajectory for Sonim Technologies Inc (SONM, Financial). Currently, the average target price stands at $8.00, with both the high and low estimates aligning at the same value. This suggests a considerable upside of 416.13% from the current price of $1.55. Investors seeking more in-depth estimates can explore further details on the Sonim Technologies Inc (SONM) Forecast page.

Brokerage Recommendations

Interestingly, there is a lack of consensus from brokerage firms regarding Sonim Technologies Inc's (SONM, Financial) current standing. The average brokerage recommendation remains at 0.0, reflecting a "No opinions" status. This rating operates on a scale from 1 to 5, where a rating of 1 signifies a Strong Buy and 5 indicates a Sell recommendation. This lack of consensus could present both a risk and an opportunity for potential investors.

Valuation and Future Prospects

According to GuruFocus estimates, the projected GF Value for Sonim Technologies Inc (SONM, Financial) within a year is $2.07, which implies a 33.55% upside from the current price of $1.55. This GF Value is a calculated estimate of the fair market value at which the stock should be trading. It takes into account historical trading multiples, prior business growth, and anticipated future performance. For more comprehensive data, the Sonim Technologies Inc (SONM) Summary page offers extensive insights.

In conclusion, Sonim Technologies Inc (SONM, Financial) is at a pivotal moment in its corporate journey. With the recent announcement of a reverse takeover and the potential upsides indicated by price targets and GF Value estimates, it remains an intriguing option for investors willing to navigate the uncertainties of the market.