- Paychex (PAYX, Financial) strategically issues $4.2 billion in senior notes to fuel growth initiatives.

- Wall Street analysts project a potential upside of 6.90% based on current price targets.

- Paychex holds a "Hold" status with an average brokerage recommendation of 3.1.

Paychex (PAYX) has recently made a significant move by successfully pricing $4.2 billion in senior notes. This strategic fundraising is poised to bolster various corporate initiatives, including potential operational expansions and acquisitions. Investors are closely watching to see how this financial maneuver will impact the company's growth trajectory and market positioning.

Wall Street Analysts Forecast

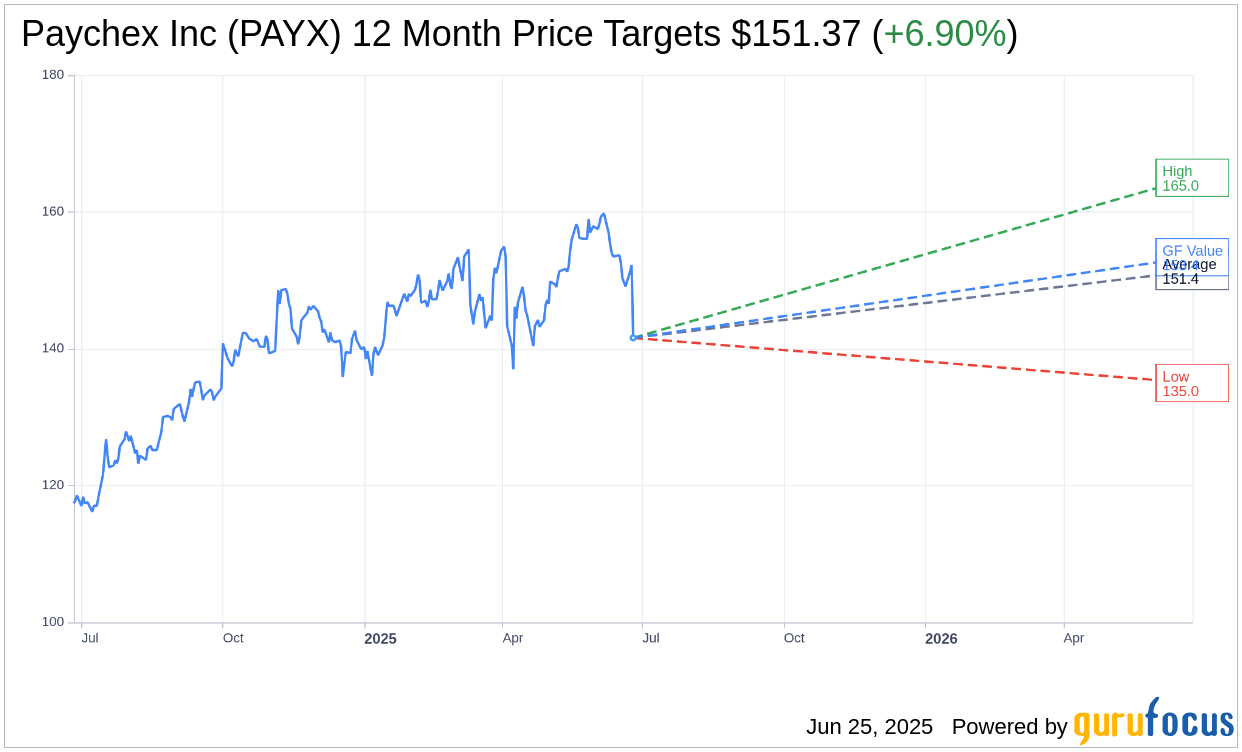

According to one-year price targets provided by 12 analysts, the average target price for Paychex Inc (PAYX, Financial) is $151.37. Projections show a high estimate of $165.00 and a low of $135.00, implying a potential upside of 6.90% from the current price of $141.59. For deeper insights into these forecasts, visit the Paychex Inc (PAYX) Forecast page.

Brokerage Recommendations

In terms of broker recommendations, Paychex Inc (PAYX, Financial) has an average recommendation of 3.1, which indicates a "Hold" status among the 17 brokerage firms surveyed. This rating is based on a scale from 1 to 5, where 1 means Strong Buy and 5 means Sell.

GuruFocus Value Estimation

According to GuruFocus calculations, the estimated GF Value for Paychex Inc (PAYX, Financial) over the next year is $153.39. This suggests a potential upside of 8.33% from the current trading price of $141.59. The GF Value is a fair value estimate derived from historical stock multiples, previous growth patterns, and projected business performance. For more extensive details, the Paychex Inc (PAYX) Summary page offers a comprehensive overview.