Summary:

- Franklin Templeton Canada unveils the Franklin Core Equity suite with three new ETFs.

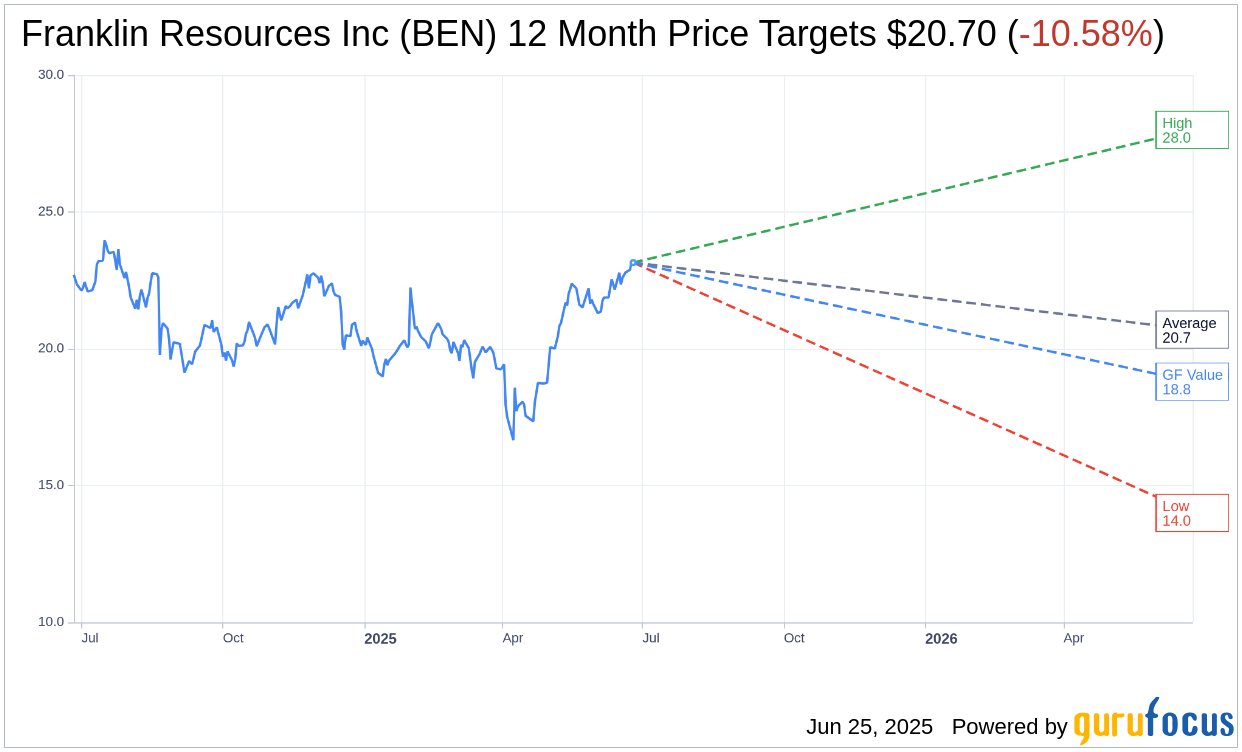

- The average analyst target for Franklin Resources Inc. (BEN, Financial) is $20.70, suggesting a potential downside.

- GuruFocus estimates indicate a lower fair value for BEN, suggesting caution for investors.

Franklin Templeton Canada, a division of Franklin Resources (NYSE: BEN), has recently launched an exciting addition to its investment offerings: the Franklin Core Equity suite. This suite comprises three innovative exchange-traded funds (ETFs): Franklin Canadian Core Equity Fund (FCRC), Franklin U.S. Core Equity Fund (FCRU), and Franklin International Core Equity Fund (FCRI). Investors can now access these funds as they are actively trading on the Toronto Stock Exchange.

Wall Street Analysts Forecast

As investors analyze the potential of Franklin Resources Inc. (BEN, Financial), insights from Wall Street are crucial. According to the one-year price targets provided by ten analysts, the average target price stands at $20.70. This projection encompasses a high estimate of $28.00 and a low forecast of $14.00. Compared to the current price of $23.15, the average target suggests a downside potential of 10.58%. For more comprehensive estimations, visit the Franklin Resources Inc (BEN) Forecast page.

The consensus from twelve brokerage firms places Franklin Resources Inc.'s (BEN, Financial) average brokerage recommendation at 3.3, indicating a "Hold" status. This rating is part of a scale from 1 to 5, where 1 signifies a Strong Buy and 5 denotes a Sell recommendation.

Analyzing stocks through the lens of GuruFocus metrics provides additional insight. The estimated GF Value for Franklin Resources Inc. (BEN, Financial) in one year is $18.80. This estimate reflects a potential downside of 18.79% from the current trading price of $23.15. GF Value represents GuruFocus' projection of fair market value, calculated by examining historical trading multiples, past business growth, and anticipated future performance. For more detailed financial data and analysis, explore the Franklin Resources Inc (BEN) Summary page.