Unusually high option activity has been noted in Poet Technologies (POET, Financial), with a total of 14,698 call options trading, which is five times the anticipated volume. This increased activity has led to a significant rise in implied volatility, jumping over 16 points to reach 63.32%. The most traded options have been the August and January calls, specifically the Aug-25 4 calls and Jan-27 10 calls, accumulating a volume nearing 3,700 contracts. The Put/Call Ratio stands at a low 0.03, indicating a heavy tilt towards call options. Investors are also eyeing the company's upcoming earnings release, expected on August 14th.

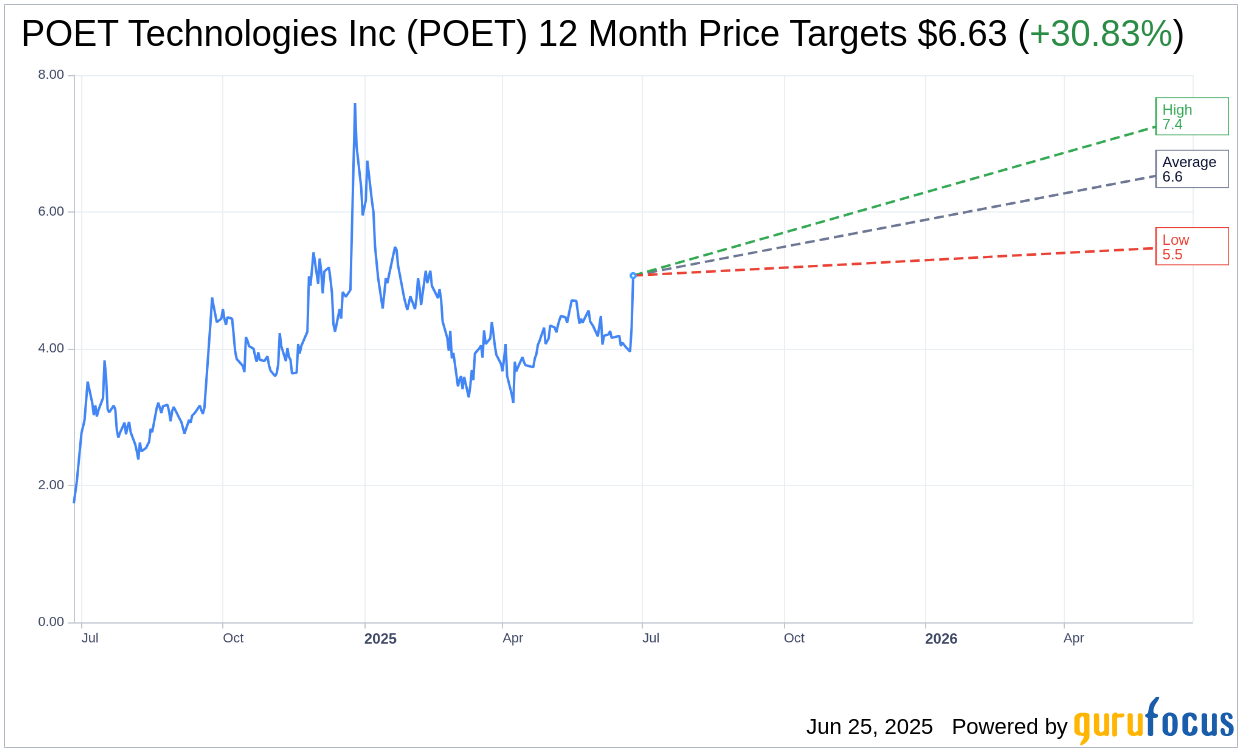

Wall Street Analysts Forecast

Based on the one-year price targets offered by 3 analysts, the average target price for POET Technologies Inc (POET, Financial) is $6.63 with a high estimate of $7.40 and a low estimate of $5.50. The average target implies an upside of 30.83% from the current price of $5.07. More detailed estimate data can be found on the POET Technologies Inc (POET) Forecast page.

Based on the consensus recommendation from 2 brokerage firms, POET Technologies Inc's (POET, Financial) average brokerage recommendation is currently 2.0, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for POET Technologies Inc (POET, Financial) in one year is $0.74, suggesting a downside of 85.4% from the current price of $5.07. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the POET Technologies Inc (POET) Summary page.