- DuPont maintains its quarterly dividend, offering a consistent yield for investors.

- Analysts project a 24.71% upside potential for DuPont's stock price.

- With a favorable "Outperform" status, DuPont's future market performance looks promising.

DuPont (DD, Financial) continues to reward its shareholders with a stable dividend, announcing a payout of $0.41 per share. This dividend, in line with previous disbursements, corresponds to a forward yield of 2.41%. Shareholders eligible for this dividend will receive their payments on September 15, provided they are on record by August 29. The ex-dividend date, which signifies when new buyers are not entitled to the dividend, is also set for August 29.

Wall Street Analysts' Forecast

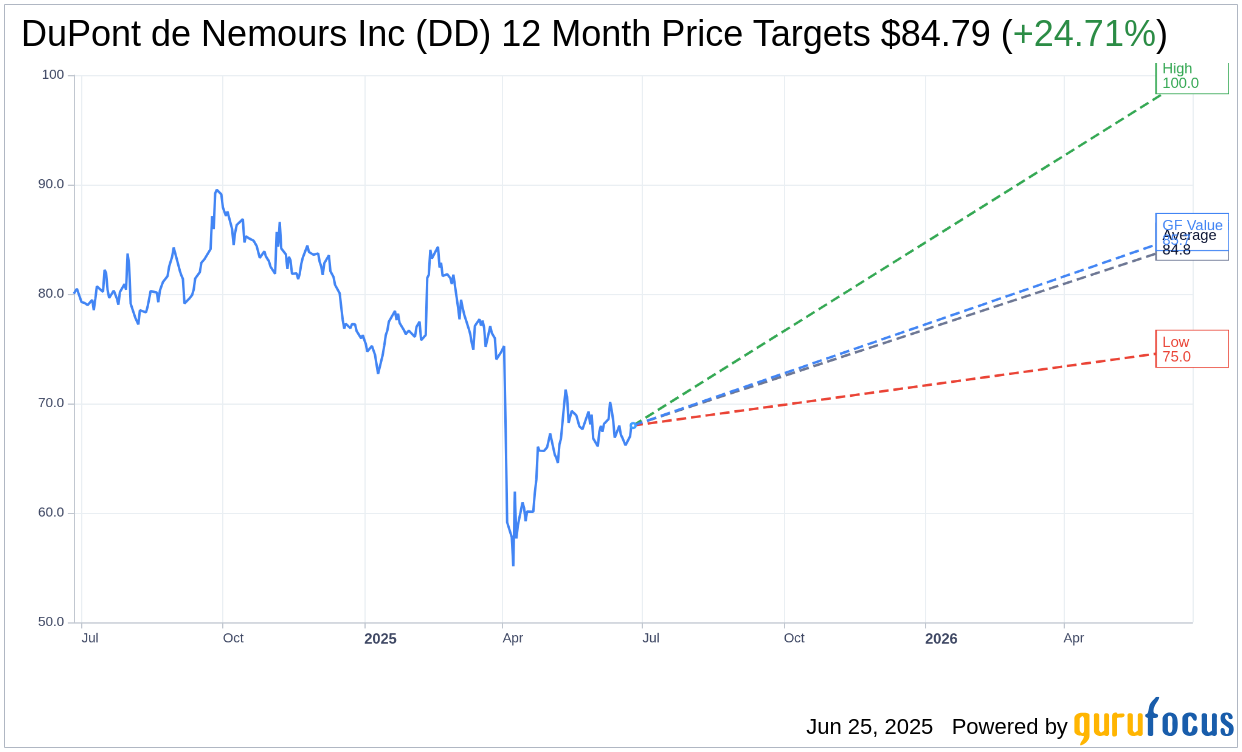

According to insights from 14 analysts, DuPont de Nemours Inc (DD, Financial) exhibits considerable upside potential, with an average price target of $84.79. These projections range from a high of $100.00 to a low of $75.00, suggesting a notable 24.71% increase from the current stock price of $67.99. For more in-depth analysis, visit the DuPont de Nemours Inc (DD) Forecast page.

When considering recommendations from 18 brokerage firms, DuPont de Nemours Inc (DD, Financial) currently holds an "Outperform" status, with an average brokerage recommendation score of 2.0. This rating, on a scale where 1 indicates a Strong Buy and 5 suggests a Sell, underscores positive expectations for the stock's future performance.

Further, GuruFocus estimates suggest that the GF Value of DuPont de Nemours Inc (DD, Financial) over the next year is $85.67. This valuation highlights a potential 26% increase from the current price of $67.99. The GF Value represents an educated estimate of the stock's fair trading value, determined by historical trading multiples and projections of business performance. For a comprehensive overview, visit the DuPont de Nemours Inc (DD) Summary page.