KeyBanc has begun coverage of Dell Technologies (DELL, Financial), assigning it a Sector Weight rating. The firm acknowledges Dell's effective execution, noting a solid revenue growth trajectory and efficient operations which contribute to a robust free cash flow and capital return profile. However, KeyBanc highlights that this revenue growth is largely fueled by lower-margin AI servers, predicting ongoing pressure on gross margins. Additionally, the firm expresses caution regarding the extent of a potential PC refresh cycle. Overall, KeyBanc views Dell as "fairly valued" at its current market price.

Wall Street Analysts Forecast

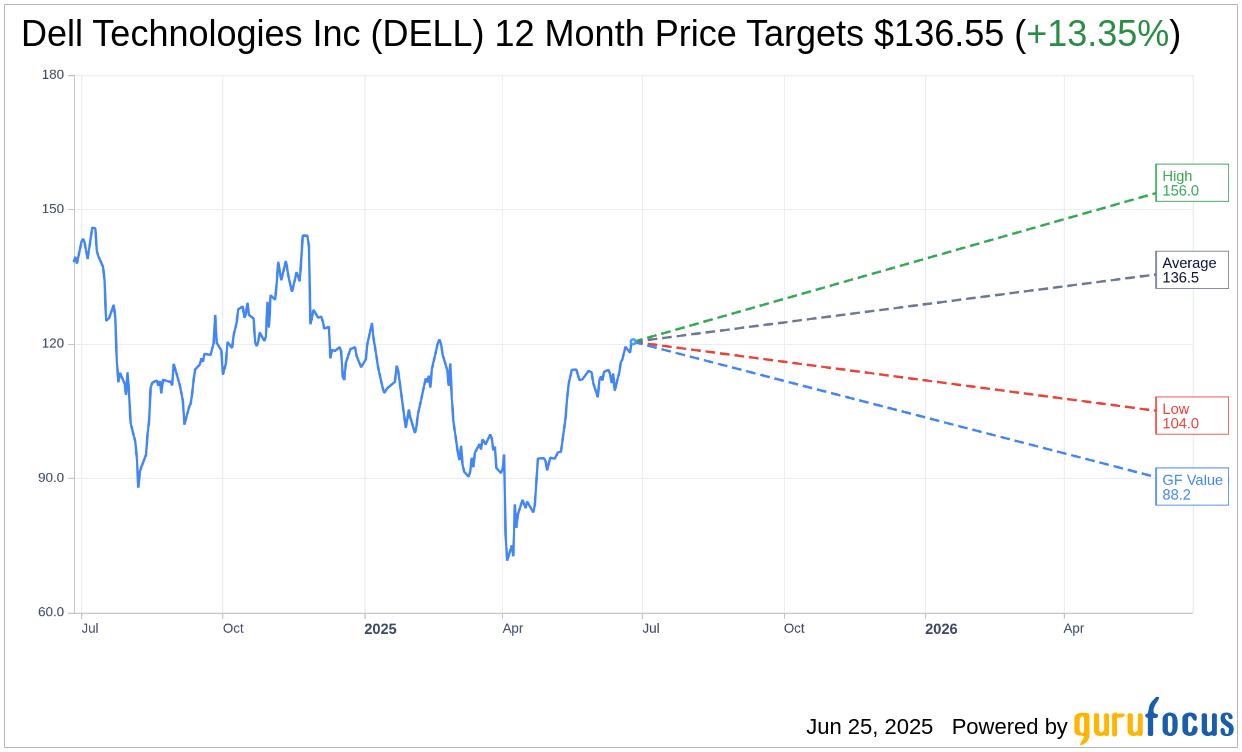

Based on the one-year price targets offered by 21 analysts, the average target price for Dell Technologies Inc (DELL, Financial) is $136.55 with a high estimate of $156.00 and a low estimate of $104.00. The average target implies an upside of 13.35% from the current price of $120.46. More detailed estimate data can be found on the Dell Technologies Inc (DELL) Forecast page.

Based on the consensus recommendation from 25 brokerage firms, Dell Technologies Inc's (DELL, Financial) average brokerage recommendation is currently 1.9, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Dell Technologies Inc (DELL, Financial) in one year is $88.16, suggesting a downside of 26.81% from the current price of $120.46. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Dell Technologies Inc (DELL) Summary page.

DELL Key Business Developments

Release Date: May 29, 2025

- Revenue: $23.4 billion, up 5% year-over-year.

- Earnings Per Share (EPS): $1.55, up 17% year-over-year.

- Gross Margin: $5.1 billion, or 21.6% of revenue, down 80 basis points.

- Operating Income: $1.7 billion, up 10%, or 7.1% of revenue.

- Net Income: $1.1 billion, up 13% year-over-year.

- Cash Flow from Operations: Record $2.8 billion for Q1.

- ISG Revenue: $10.3 billion, up 12% year-over-year.

- CSG Revenue: $12.5 billion, up 5% year-over-year.

- Commercial Revenue: $11.0 billion, up 9% year-over-year.

- Consumer Revenue: $1.5 billion, down 19% year-over-year.

- AI Server Orders: $12.1 billion in Q1, with $1.8 billion shipped.

- Storage Revenue: $4.0 billion, up 6% year-over-year.

- Shareholder Returns: $2.4 billion returned, including 22.1 million shares repurchased.

- Q2 Revenue Guidance: $28.5 billion to $29.5 billion, up 16% at midpoint.

- Full-Year Revenue Guidance: $101 billion to $103 billion, up 8% at midpoint.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Dell Technologies Inc (DELL, Financial) reported a 5% increase in revenue, reaching $23.4 billion, driven by growth across all core markets.

- Earnings per share increased by 17% to $1.55, growing three times faster than revenue.

- The company experienced unprecedented demand for AI-optimized servers, with $12.1 billion in orders booked in the first quarter.

- Dell Technologies Inc (DELL) achieved record cash generation for the first quarter, with cash flow from operations reaching $2.8 billion.

- The company is leading in AI innovation, with significant advancements in AI infrastructure and partnerships with key industry players like NVIDIA and Google.

Negative Points

- Consumer revenue declined by 19%, indicating challenges in the consumer market.

- Gross margin decreased by 80 basis points due to a competitive pricing environment, particularly in the CSG segment.

- The demand environment for traditional servers moderated compared to the previous quarter, with a lower mix of higher-margin North American sales.

- Operating income rate improvements were partially offset by a more competitive environment and geographical mix challenges.

- The company faces variability in timing and choices around technology, leading to a non-linear nature of demand and associated shipments.