Key Takeaways

- Concentrix (CNXC, Financial) expects a 2.2% year-over-year EPS growth for Q2, with stable revenue projections.

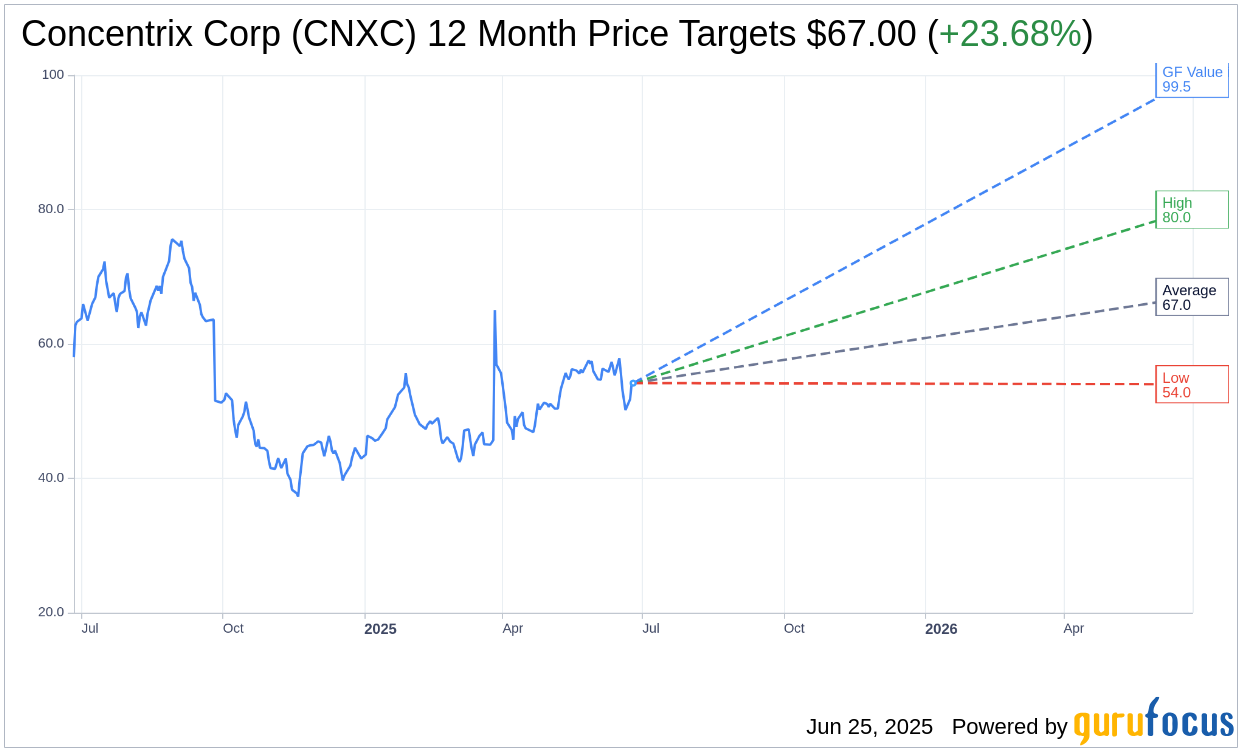

- Analysts project a 23.68% upside potential from the company's current stock price.

- The GF Value forecast suggests a possible 83.61% upside, reflecting significant growth potential.

Concentrix (CNXC) Q2 Financial Outlook

Concentrix (CNXC) is gearing up to announce its second quarter financial results on June 26th. The market anticipates an earnings per share (EPS) of $2.75, which marks a 2.2% increase compared to the previous year. Revenues are expected to remain steady at $2.38 billion. Notably, the past few months have witnessed two upward revisions in EPS forecasts, which indicate a rising investor confidence in the company's performance.

Wall Street Analysts' Projections

According to six analysts offering one-year price targets for Concentrix Corp (CNXC, Financial), the average target price stands at $67.00. The highest and lowest price estimates are $80.00 and $54.00, respectively. This average target indicates a potential upside of 23.68% from the current stock price of $54.17. For more detailed estimates, visit the Concentrix Corp (CNXC) Forecast page.

Analyst Ratings and Recommendations

The consensus from six brokerage firms gives Concentrix Corp (CNXC, Financial) an average broker recommendation of 2.0, which signifies an "Outperform" rating. The rating scale ranges from 1 to 5, with 1 indicating a Strong Buy and 5 suggesting a Sell.

Valuation and Growth Prospects

GuruFocus estimates a GF Value of $99.46 for Concentrix Corp (CNXC, Financial) in one year, implying a substantial upside of 83.61% from the current price of $54.17. The GF Value represents GuruFocus' assessment of the stock's fair trading value, derived from historical multiples, past business growth, and projected future performance. For a more comprehensive analysis, visit the Concentrix Corp (CNXC) Summary page.