Carnival PLC (LSE:CCL, Financial) released its 8-K filing on June 24, 2025, reporting a robust financial performance for the second quarter of 2025. As the largest global cruise company, Carnival operates over 90 ships and serves 14 million guests annually through its diverse portfolio of brands, including Carnival Cruise Lines, Holland America, and Princess Cruises, among others.

Record-Breaking Financial Results

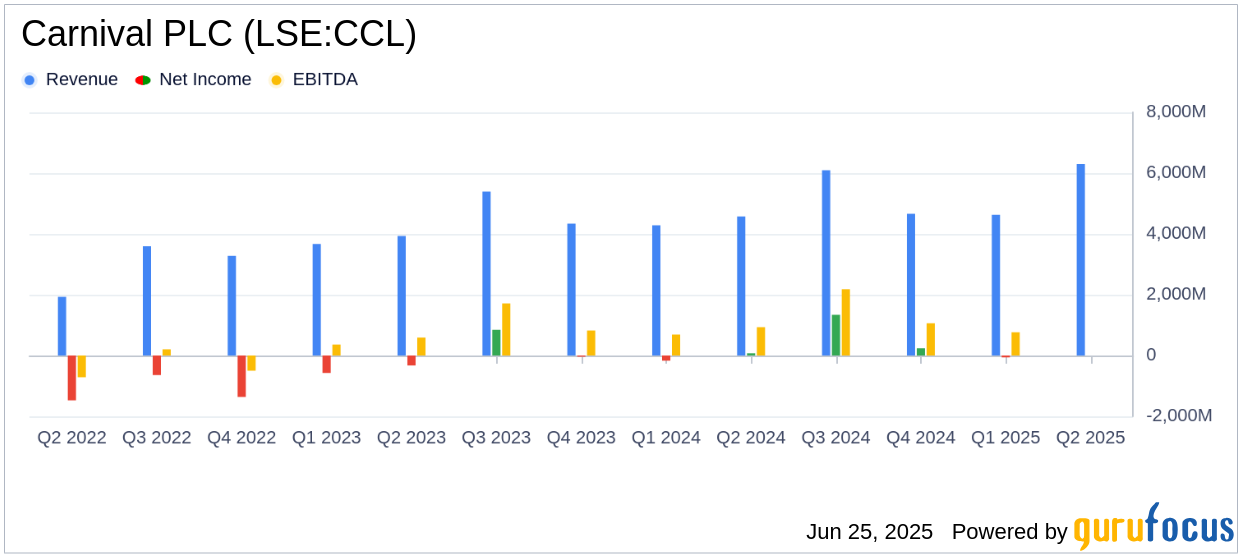

Carnival PLC achieved its highest-ever second-quarter operating results, with net income reaching $565 million, or $0.42 diluted EPS. This marks an improvement of nearly $475 million compared to the previous year. The adjusted net income of $470 million, or $0.35 adjusted EPS, exceeded March guidance by $185 million, driven by higher ticket prices and onboard spending.

The company reported record revenues of $6.3 billion, surpassing the prior year's figures by nearly $550 million. Operating income also reached a record $934 million, while adjusted EBITDA stood at $1.5 billion, a 26% increase from 2024. These achievements underscore Carnival's ability to capitalize on strong demand and optimize its revenue streams.

Strategic Financial Management

Carnival PLC's financial strategy has been pivotal in its success. The company extended and upsized its revolving credit facility to $4.5 billion, enhancing its liquidity and financial flexibility. This strategic move, coupled with refinancing efforts, has positioned Carnival to reduce interest expenses and manage debt maturities effectively.

Chief Financial Officer David Bernstein highlighted the company's progress, stating,

We continued rebuilding an investment grade balance sheet, working aggressively to reduce interest expense, simplify our capital structure and manage our future debt maturities."

Operational Metrics and Future Outlook

Key operational metrics indicate a positive trajectory for Carnival PLC. Net yields in constant currency increased by 6.4% compared to 2024, significantly outperforming March guidance. Cruise costs per available lower berth day (ALBD) decreased by 0.3%, while fuel consumption per ALBD improved by 6.3% due to enhanced energy efficiency measures.

Looking ahead, Carnival expects net yields for the full year 2025 to be approximately 5.0% higher than 2024 levels. The company also anticipates adjusted net income to rise over 40% compared to the previous year, reflecting its strong market position and strategic initiatives.

Challenges and Strategic Initiatives

Despite its strong performance, Carnival PLC faces challenges such as geopolitical uncertainties and fluctuating fuel prices. However, the company's proactive measures, including its commitment to reducing carbon intensity and enhancing customer experiences, position it well for future growth.

Carnival's CEO Josh Weinstein emphasized the company's strategic focus, stating,

Our strong results, booked position and outlook are a testament to the success of our ongoing strategy to deliver same-ship, high-margin revenue growth."

Conclusion

Carnival PLC's second-quarter results demonstrate its resilience and strategic acumen in navigating a complex market environment. With record revenues, improved profitability, and strategic financial management, the company is well-positioned to capitalize on future opportunities in the travel and leisure industry. Investors and stakeholders will be keenly watching Carnival's continued progress as it aims to achieve its long-term financial targets.

Explore the complete 8-K earnings release (here) from Carnival PLC for further details.