Summary:

- Frontline's (FRO, Financial) shares fell nearly 6% following geopolitical developments, stabilizing tanker traffic through the Strait of Hormuz.

- Analysts predict a potential 27.41% upside for Frontline PLC with a target price of $22.50.

- Current brokerage ratings position Frontline as an "Outperform" with a GF Value suggesting a 9.91% downside.

Frontline (FRO) experienced a significant stock drop, decreasing nearly 6% as tanker traffic through the Strait of Hormuz returned to typical levels. This development comes after a ceasefire agreement between Iran and Israel, leading to an increase in oil flows. Despite Iran maintaining its positions, the movement in tanker stock shares remains varied.

Wall Street Analysts Forecast

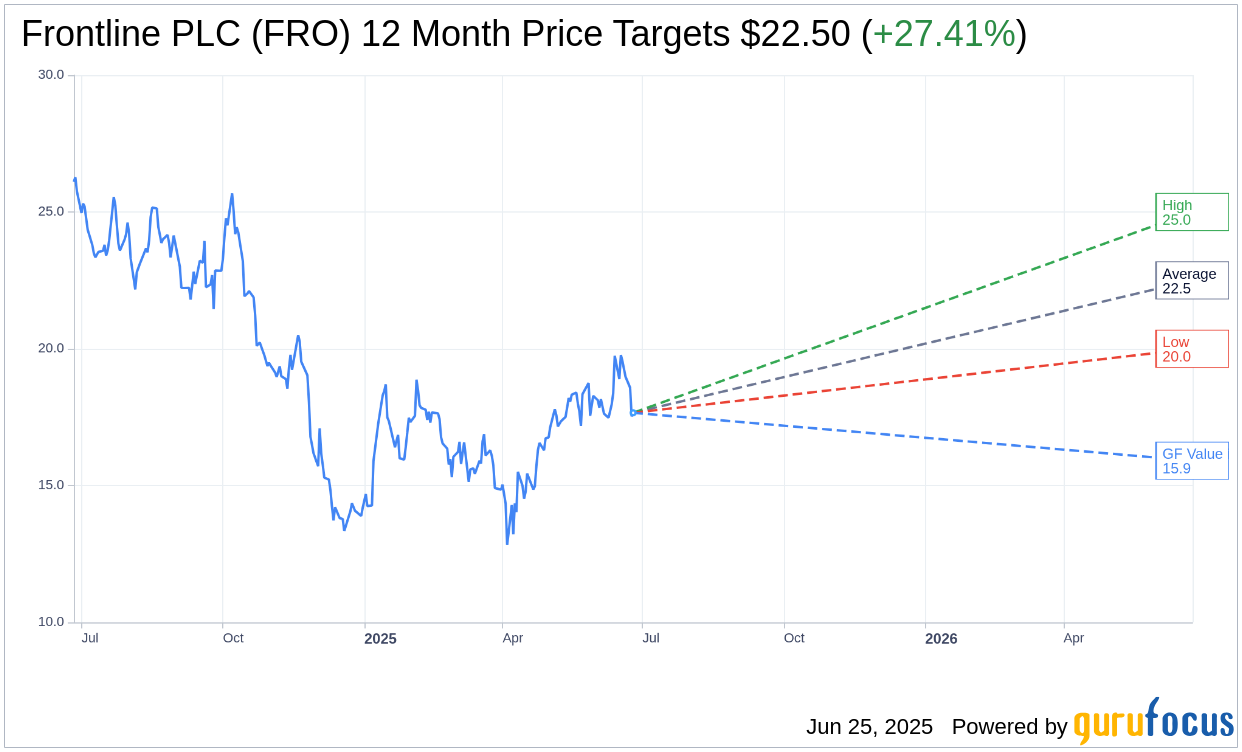

Analysts have provided one-year price targets for Frontline PLC (FRO, Financial), forecasting an average target price of $22.50. The projections range from a high estimate of $25.00 to a low of $20.00, implying a potential upside of 27.41% from the current stock price of $17.66. Investors interested in detailed projections can visit the Frontline PLC (FRO) Forecast page for more information.

With an average brokerage recommendation of 1.7 from three firms, Frontline PLC (FRO, Financial) is rated as "Outperform." This rating is on a scale where 1 indicates a Strong Buy and 5 a Sell. Such a positioning suggests optimism among analysts regarding the stock's potential performance.

On the other hand, according to GuruFocus estimates, the anticipated GF Value for Frontline PLC (FRO, Financial) in the upcoming year is $15.91. This suggests a potential downside of 9.91% from the current price of $17.66. The GF Value, calculated based on historical trading multiples, past business growth, and future performance estimates, serves as GuruFocus' estimation of the stock's fair value. For additional insights, investors can explore the Frontline PLC (FRO) Summary page.