Key Takeaways:

- Taiwan Semiconductor Manufacturing Co. (TSM, Financial) announces a strategic $10 billion stock issuance via Taiwan Semiconductor Global to manage USD volatility.

- Average analyst price target for TSM is $222.69, closely aligning with its current market price of $222.74.

- TSM holds an "Outperform" analyst rating, with a GF Value estimation indicating a minor downside potential.

Taiwan Semiconductor's Strategic Financial Move

Taiwan Semiconductor Manufacturing Co. (TSM) is poised to bolster its financial structure through the issuance of $10 billion in new stock via its overseas branch, Taiwan Semiconductor Global. This initiative is a tactical response to mitigate the unpredictable fluctuations of the U.S. dollar while curtailing foreign exchange hedging costs. The capital raised will be primarily allocated into secure bank deposits and bonds, ensuring financial stability and risk management for the company.

Wall Street Analysts' Predictions and Ratings

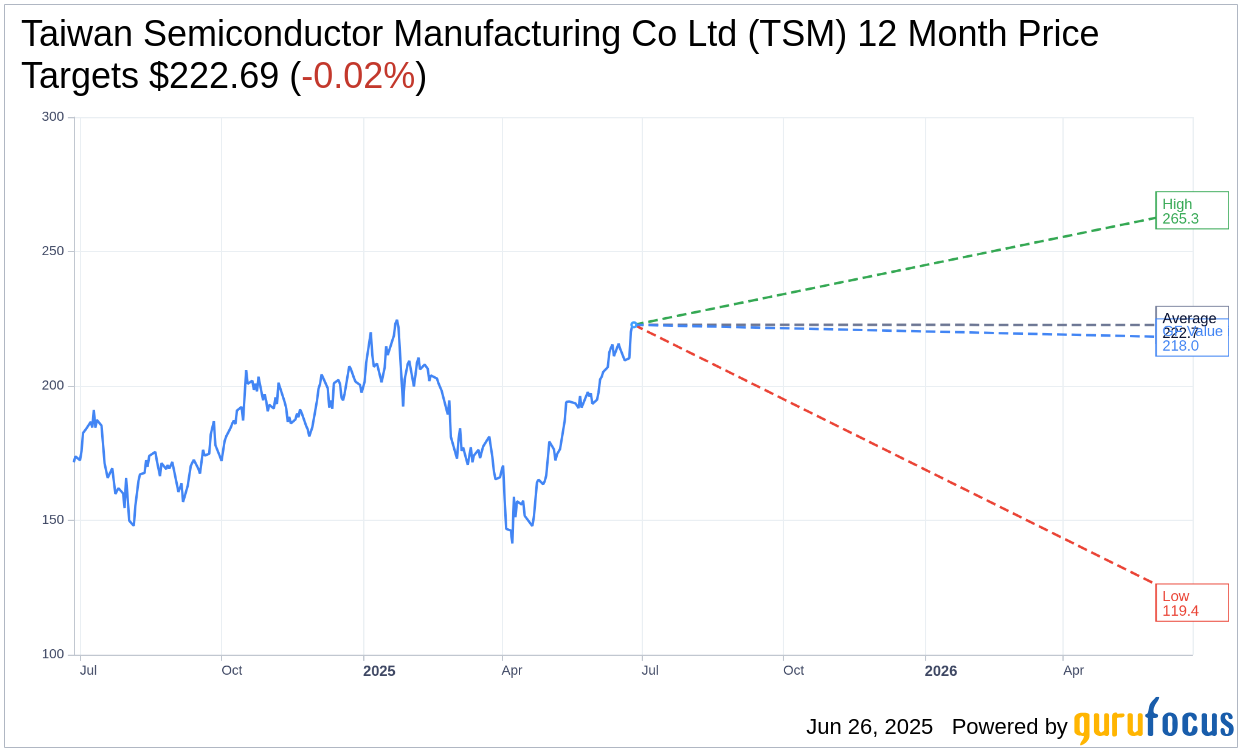

According to predictions from 17 top analysts, Taiwan Semiconductor Manufacturing Co. Ltd (TSM, Financial) has an average price target of $222.69, with an upper estimate reaching $265.34 and a lower forecast of $119.37. This average target suggests a negligible downside of 0.02% from the current stock price of $222.74. To explore detailed projections, visit the Taiwan Semiconductor Manufacturing Co Ltd (TSM) Forecast page.

The consensus among 19 brokerage firms positions Taiwan Semiconductor Manufacturing Co. Ltd (TSM, Financial) with an average recommendation score of 1.6, classifying it as an "Outperform" stock. The rating scale spans from 1 to 5, where 1 indicates a Strong Buy and 5 signifies a Sell.

Evaluating the GF Value of TSM

GuruFocus estimates the one-year GF Value for Taiwan Semiconductor Manufacturing Co. Ltd (TSM, Financial) to be $218.01, implying a slight downside of 2.12% from the current trading price of $222.74. GF Value represents GuruFocus' fair value estimation, determined by evaluating historical trading multiples, past business growth, and anticipated future performance metrics. For a comprehensive analysis, dive into the Taiwan Semiconductor Manufacturing Co Ltd (TSM) Summary page.